Short Version

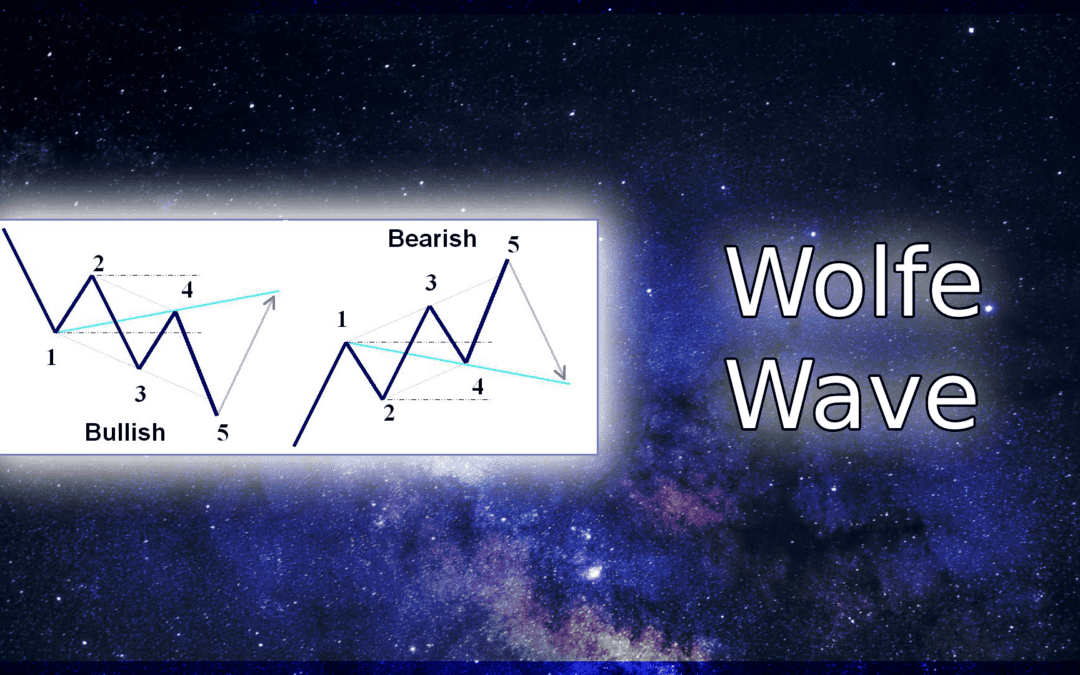

Wolfe Wave is a trading pattern named after its creator, Bill Wolfe. It is a powerful technical analysis tool used by traders to identify potential trend reversals and price targets in the financial markets. The pattern consists of a series of five waves labeled as 1, 2, 3, 4, and 5, forming a channel or an expanding triangle on a price chart. Traders look for specific wave formations and use trendlines to confirm the pattern’s validity. The Wolfe Wave pattern is valued for its ability to provide early signals of potential price reversals, allowing traders to enter trades with favorable risk-reward ratios. By understanding and effectively trading the Wolfe Wave pattern, traders aim to capitalize on market opportunities and boost their trading profits.

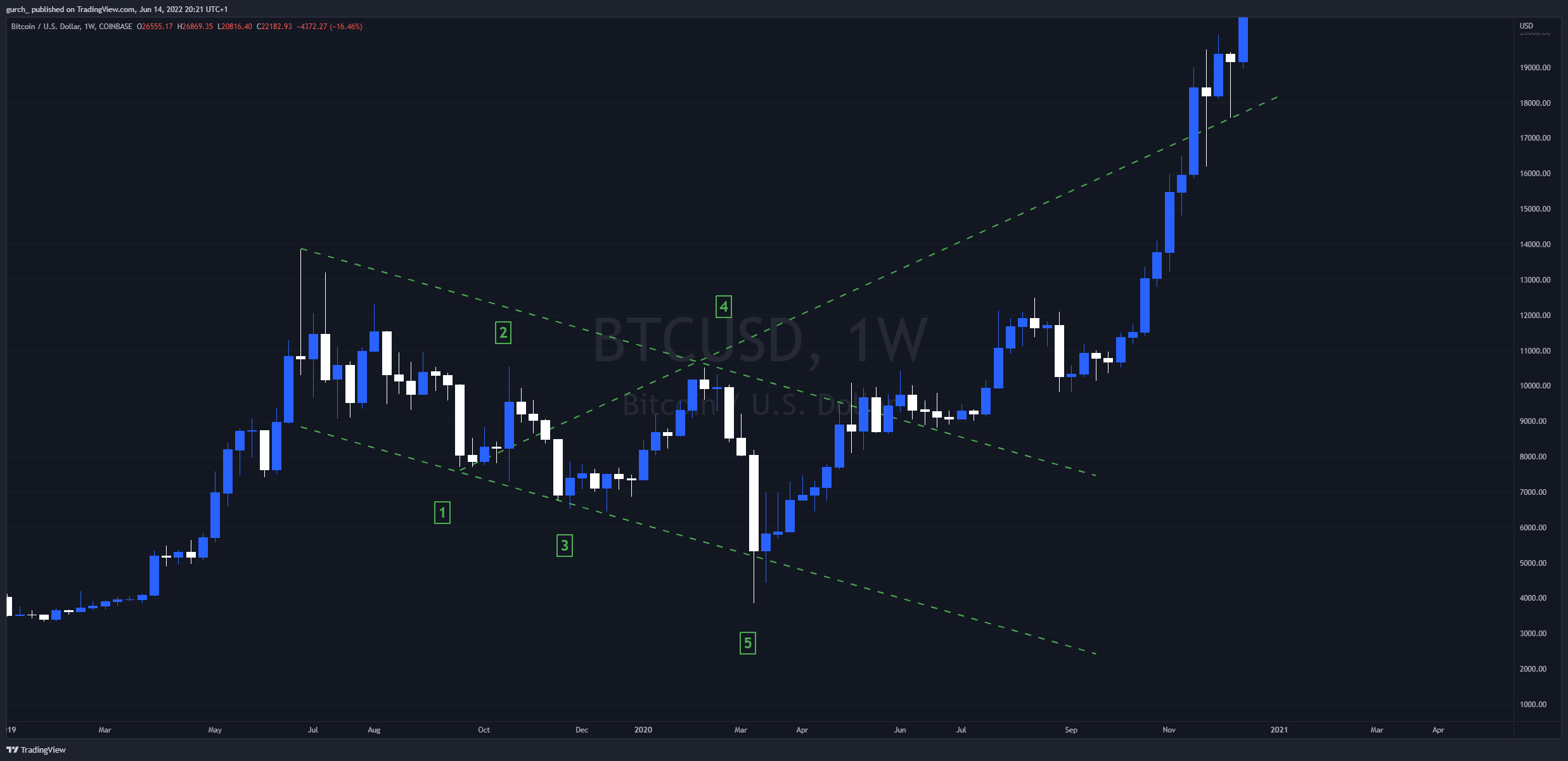

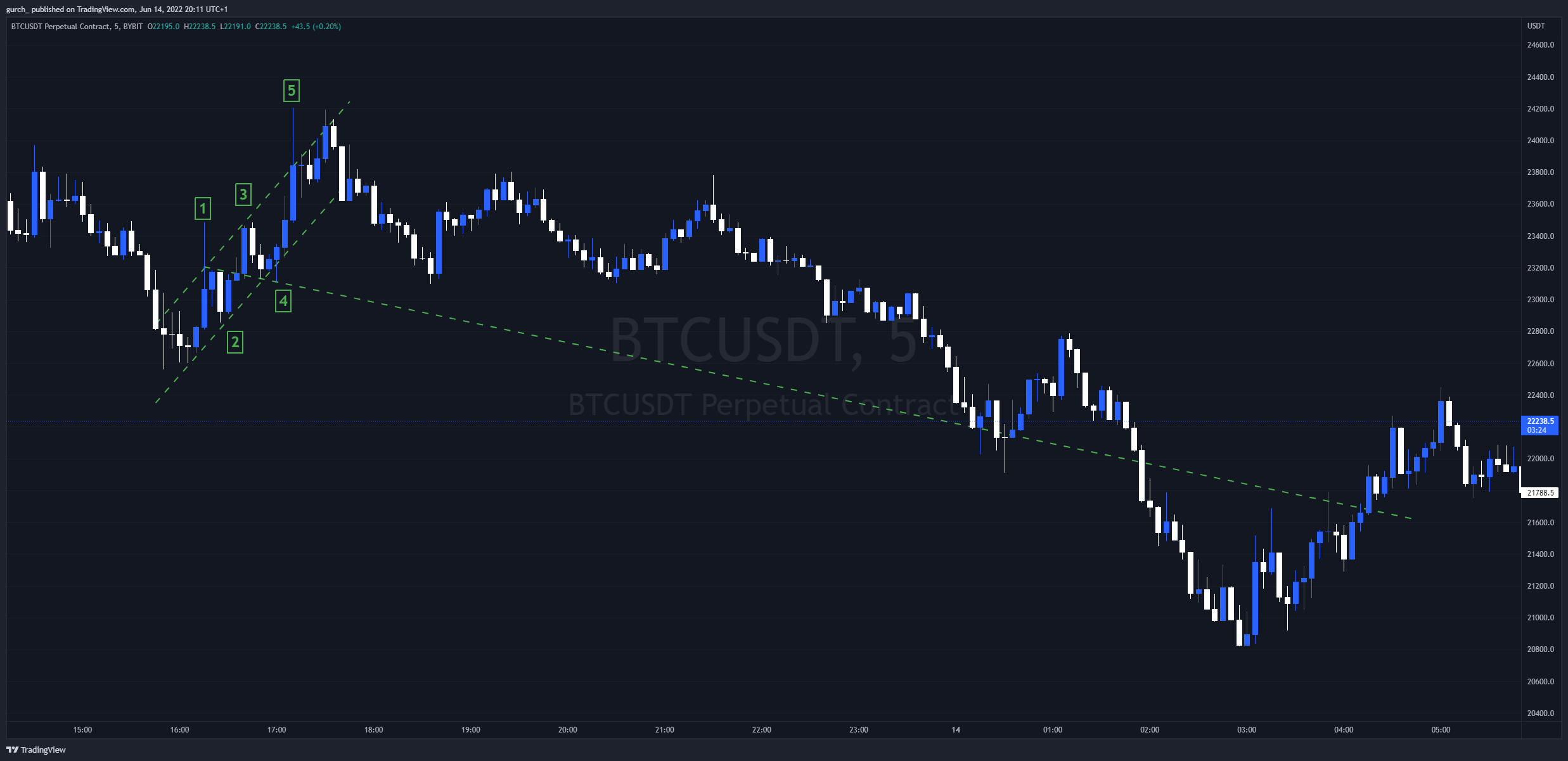

Examples of Wolf Waves

You can find more examples of Wolf Wave in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

Long Version

Introduction

Riding the Financial Waves: How to Spot and Trade the Wolfe Wave

Are you ready to ride the financial waves and make profitable trades? Look no further! In this blog post, we’ll guide you through the fascinating world of the Wolfe Wave pattern—a powerful trading technique that can help you identify potential opportunities in the market.

The Wolfe Wave pattern has gained significant popularity among traders due to its ability to forecast trend reversals and price targets. By understanding and effectively trading this pattern, you can boost your trading profits and gain a competitive edge.

In the sections ahead, we’ll delve deep into the Wolfe Wave, unraveling its key characteristics, teaching you how to spot it on price charts, and providing valuable insights into trading strategies. Whether you’re a seasoned trader or just starting out, this comprehensive guide will equip you with the knowledge and tools you need to navigate the financial markets like a pro.

So, fasten your seatbelt, grab your surfboard, and get ready to ride the waves of success with the Wolfe Wave pattern. Let’s dive in!

Understanding the Wolfe Wave

What is the Wolfe Wave Pattern?

The Wolfe Wave is a powerful trading pattern that helps traders identify potential trend reversals and price targets. Named after its creator, Bill Wolfe, this pattern is based on specific wave formations and can be observed on various financial charts.

Key Characteristics of the Wolfe Wave

To effectively trade the Wolfe Wave, it’s important to understand its key characteristics:

1. Wave Structure

The Wolfe Wave consists of five waves, labeled as 1, 2, 3, 4, and 5. These waves form a pattern that resembles a channel or an expanding triangle.

2. Symmetry and Proportions

One distinctive feature of the Wolfe Wave is its symmetry. The waves tend to exhibit proportional relationships in terms of both time and price.

3. Channel Construction

The Wolfe Wave pattern is formed by connecting specific swing points on the price chart to create trendlines, which define the boundaries of the wave structure.

4. Point 5 Confirmation

For a valid Wolfe Wave pattern, point 5 acts as a confirmation point. It confirms that the pattern is complete and indicates a potential reversal in the price trend.

By understanding these key characteristics, you’ll be better equipped to identify and analyze the Wolfe Wave pattern on your price charts. In the next section, we’ll explore how to spot this pattern and unleash its trading potential.

Spotting the Wolfe Wave

Identifying Potential Wolfe Wave Patterns

Spotting the Wolfe Wave pattern on price charts can provide you with valuable trading opportunities. Here’s a step-by-step guide on how to identify potential Wolfe Wave patterns:

1. Determine the Initial Trend

Before identifying a Wolfe Wave, it’s crucial to determine the initial trend. Is the price in an uptrend or a downtrend? This will help you identify whether you should be looking for bullish or bearish Wolfe Wave patterns.

2. Identify Wave 1 and Wave 2

The first step in spotting a Wolfe Wave is identifying wave 1 and wave 2. Wave 1 is the initial price move in the direction of the trend, while wave 2 is the first retracement against the trend.

3. Draw Trendlines

Connect the highest point of wave 1 and the lowest point of wave 2 to form an upward-sloping trendline. This trendline acts as the baseline for the potential Wolfe Wave pattern.

4. Locate Wave 3

After drawing the trendline, locate wave 3. Wave 3 should be higher than the trendline and represents the second impulse move in the direction of the trend.

5. Confirm Wave 4 and Wave 5

The next step is to confirm the completion of wave 4 and wave 5. Wave 4 should retrace towards the trendline without breaking it, and wave 5 should surpass the trendline again.

By following these steps and analyzing the price chart, you can identify potential Wolfe Wave patterns and prepare for potential trading opportunities. In the next section, we’ll explore effective trading strategies that can be applied to the Wolfe Wave pattern.

Trading Strategies with the Wolfe Wave

Exploring Different Trading Approaches

Trading the Wolfe Wave pattern opens up various possibilities for profit. Let’s explore some effective trading strategies that can be applied to the Wolfe Wave:

1. Breakout Strategy

One popular approach is the breakout strategy. When the price breaks above the upper trendline of a bullish Wolfe Wave or below the lower trendline of a bearish Wolfe Wave, it signals a potential entry point. Traders can initiate a trade in the direction of the breakout, aiming to capture the continuation of the trend.

2. Fibonacci Retracement

Using Fibonacci retracement levels in conjunction with the Wolfe Wave pattern can enhance trading precision. Traders can measure the retracement levels from wave 1 to wave 2 and look for potential reversal points around the 50% or 61.8% Fibonacci levels. This strategy helps traders enter the market at favorable prices with a higher probability of price reversal.

3. Multiple Time Frame Analysis

Incorporating multiple time frame analysis can provide valuable insights into the Wolfe Wave pattern’s strength and reliability. Traders can use a higher time frame to identify the overall trend and a lower time frame to pinpoint potential entry and exit points. This approach helps to validate the Wolfe Wave pattern and increase trading accuracy.

4. Risk Management and Stop Loss

Implementing proper risk management techniques is vital when trading the Wolfe Wave. Set appropriate stop-loss orders to protect your capital in case the pattern fails. Consider using a trailing stop-loss strategy to lock in profits as the trade moves in your favor.

Remember, each trading strategy carries its own set of risks and rewards. It’s essential to backtest and practice these strategies before applying them to live trading. In the next section, we’ll discuss common challenges faced when trading the Wolfe Wave and provide tips to overcome them.

Common Challenges and Tips

Overcoming Challenges in Trading the Wolfe Wave

While trading the Wolfe Wave can be rewarding, it also comes with its fair share of challenges. Here are some common hurdles traders may encounter when working with the Wolfe Wave pattern and tips to overcome them:

1. False Signals

One challenge in trading the Wolfe Wave is dealing with false signals. Not all potential Wolfe Wave patterns result in successful trades. To mitigate this challenge, consider waiting for additional confirmation signals such as candlestick patterns or technical indicators before entering a trade. This can help filter out false signals and increase the accuracy of your trades.

2. Patience and Discipline

Patience and discipline are key traits for successful trading with the Wolfe Wave. Waiting for the complete formation of the pattern and confirming its validity may require patience. Avoid the temptation to jump into trades prematurely or ignore the rules of the pattern. Stay disciplined in following your trading plan and executing trades based on the criteria of the Wolfe Wave pattern.

3. Market Conditions

The effectiveness of the Wolfe Wave pattern can vary based on market conditions. It may work better in certain market environments or instruments than others. Adaptability is crucial. Continuously monitor and assess market conditions to determine the suitability of the Wolfe Wave pattern. Consider using other technical analysis tools to validate the pattern and improve trading decisions.

4. Continuous Learning

Trading the Wolfe Wave is a skill that requires continuous learning and practice. Stay updated with market trends, news, and technical analysis concepts. Keep refining your understanding of the Wolfe Wave pattern through research, books, and educational resources. Additionally, practice on demo accounts or with small positions to gain experience before committing larger capital.

By addressing these common challenges and implementing the suggested tips, you can enhance your trading approach and increase the probability of success when working with the Wolfe Wave pattern. In the concluding section, we’ll recap the key points covered and encourage readers to take action in incorporating the Wolfe Wave into their trading strategies.

Conclusion

Riding the Waves of Success with the Wolfe Wave

Congratulations! You’ve now gained valuable insights into the Wolfe Wave pattern and how it can be a powerful tool in your trading arsenal. Let’s recap the key points covered in this blog post:

Understanding the Wolfe Wave

We explored the key characteristics of the Wolfe Wave pattern, including its wave structure, symmetry, channel construction, and the importance of point 5 confirmation. Understanding these characteristics is essential for accurate pattern identification.

Spotting the Wolfe Wave

By following a systematic approach, you can identify potential Wolfe Wave patterns on price charts. Determining the initial trend, identifying wave 1 and wave 2, drawing trendlines, and confirming wave 3, 4, and 5 are crucial steps in spotting the Wolfe Wave.

Trading Strategies with the Wolfe Wave

We discussed various trading strategies that can be applied to the Wolfe Wave, such as breakout strategies, Fibonacci retracement, multiple time frame analysis, and effective risk management techniques. These strategies can help you optimize your trading decisions and capitalize on the potential of the Wolfe Wave pattern.

Common Challenges and Tips

Trading the Wolfe Wave comes with its challenges, including false signals, the need for patience and discipline, market conditions, and continuous learning. By implementing the tips provided, you can overcome these challenges and enhance your trading approach.

Now it’s time for you to take action! Start incorporating the Wolfe Wave pattern into your trading strategy. Practice on demo accounts, backtest historical data, and gain experience to refine your skills. Remember, trading involves risks, so always exercise caution and manage your risk effectively.

Stay curious, continue learning, and adapt your strategies as you navigate the ever-changing financial markets. The Wolfe Wave pattern is just one tool in your trading toolbox, and with dedication and practice, you can ride the waves of success.

So, grab your charting software, analyze price movements, and spot those Wolfe Waves. Happy trading!

Now, go out there and make some profitable trades.