Short Version

SEC filings refer to the formal documents submitted by public companies, mutual funds, and other entities to the U.S. Securities and Exchange Commission (SEC). These filings provide important financial and operational information that enables investors and the public to make informed decisions. SEC filings include reports such as annual reports (Form 10-K), quarterly reports (Form 10-Q), and other disclosures like proxy statements (Form DEF 14A). They typically contain financial statements, management discussions, risk factors, and other relevant information that shed light on a company’s performance, strategies, and potential risks. SEC filings play a vital role in ensuring transparency, accountability, and regulatory compliance within the financial markets. Analyzing SEC filings can provide valuable insights for investors, financial analysts, and researchers seeking to understand the financial health and prospects of a company.

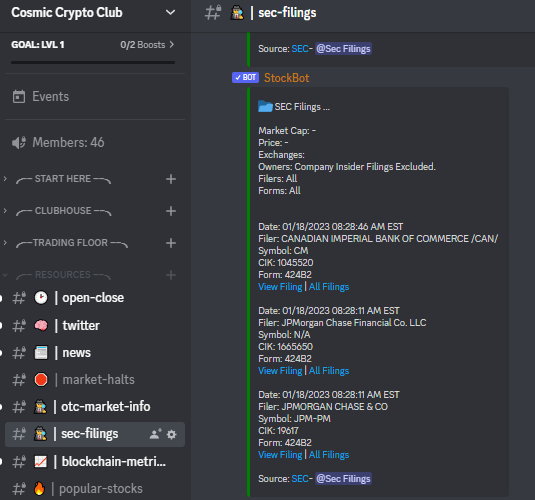

These alerts are fed into the 🛑|market-halts Discord channel which you can get to here. If you want to be alerted be sure to set your role

For more information about what data is being sent, read more here

Videos

Additional Resources

Long Version

Introduction

Unraveling the mysterious world of SEC filings

As an investor or someone interested in the financial markets, you may have come across the term “SEC filings.” But what exactly are they, and why are they crucial in the world of finance? In this blog post, we will demystify SEC filings and show you how to leverage them to gain valuable financial insights.

Understanding SEC filings is like having a secret decoder ring that opens the door to a wealth of information about a company’s financial health and operations. These filings are documents submitted to the U.S. Securities and Exchange Commission (SEC) by publicly traded companies. They are essential regulatory disclosures that offer transparency to investors and the general public.

The Importance of SEC Filings

When it comes to making informed investment decisions or conducting thorough financial analysis, SEC filings play a vital role. They provide a window into the inner workings of a company, offering a treasure trove of information that goes beyond what you might find in news headlines or press releases.

By digging into SEC filings, you can uncover crucial details such as a company’s financial statements, management discussions, risk factors, and much more. These insights can help you assess a company’s performance, evaluate its potential risks and opportunities, and make more informed investment choices.

In the following sections of this blog post, we will guide you through the basics of SEC filings, explain why they matter for financial insights, and provide actionable tips on how to leverage them effectively. But first, let’s dive deeper into what SEC filings are and why they are worth your attention.

Remember, this is an SEO-friendly and optimized Markdown format. You can use this section as a starting point for your blog post and continue with the rest of the outline.

Understanding the Basics of SEC Filings

Demystifying the regulatory documents that reveal financial secrets

To navigate the world of SEC filings and unlock their potential for financial insights, it’s essential to grasp the basics. In this section, we’ll delve into what SEC filings are, their regulatory purpose, and the valuable information they disclose.

What are SEC Filings?

SEC filings are documents submitted to the U.S. Securities and Exchange Commission (SEC) by publicly traded companies. These filings serve as a means of complying with regulatory requirements and providing transparency to investors and the general public.

Common Types of SEC Filings

Different types of SEC filings serve distinct purposes and provide varying levels of information. Some common types include:

- 10-K: The annual report filed by companies, offering comprehensive information about their financial performance, risks, and strategies.

- 10-Q: The quarterly report filed by companies, providing updates on financial results and material events.

- 8-K: The report filed to disclose significant events or changes that occur between quarterly or annual filings.

- Proxy Statements: Documents submitted to shareholders prior to annual meetings, containing information about voting matters and corporate governance.

These are just a few examples among many other filing types. Each filing serves a specific purpose and provides valuable insights into a company’s operations, financial health, and future prospects.

Information Disclosed in SEC Filings

SEC filings go beyond surface-level information. They contain a wealth of data and analysis that can be instrumental in evaluating companies. Some key components of SEC filings include:

- Financial Statements: These statements reveal a company’s revenue, expenses, assets, liabilities, and equity, offering a comprehensive view of its financial performance.

- Management Discussions: Here, company executives provide insights into the business’s operations, challenges, growth strategies, and market outlook.

- Footnotes: Often overlooked, footnotes provide additional context, explanations, and important details about the financial statements.

- Risk Factors: Companies are required to disclose potential risks that could impact their business, such as market conditions, regulatory changes, or competition.

By understanding the types of filings and the information they contain, you’ll be better equipped to dive into SEC filings and extract valuable financial insights.

Why SEC Filings Matter for Financial Insights

Unveiling the hidden gems that impact investment decisions

SEC filings may seem like a sea of regulatory documents, but their significance in providing valuable financial insights cannot be overstated. In this section, we’ll explore why SEC filings matter and how they can impact investment decisions and financial analysis.

A Window into a Company’s Financial Health

When it comes to assessing the financial health of a company, SEC filings offer a panoramic view. These filings go beyond glossy annual reports or press releases, providing comprehensive and detailed information. By analyzing financial statements, management discussions, footnotes, and risk factors, you can gain a deep understanding of a company’s performance and prospects.

Uncovering Hidden Opportunities and Risks

SEC filings can be a goldmine for discovering hidden opportunities and risks that may not be immediately apparent. Through careful examination, you can identify emerging trends, potential market challenges, or significant events that impact a company’s operations. Such insights can be instrumental in making informed investment decisions and spotting potential risks before they materialize.

Influencing Investment Decisions

Financial analysts and investors rely on SEC filings to guide their investment decisions. By digging into the information disclosed in these filings, you can assess a company’s financial stability, growth potential, and competitive position. Whether you’re evaluating a potential investment or monitoring an existing one, SEC filings provide crucial data points that influence investment strategies.

Real-Life Examples of SEC Filings in Action

To truly grasp the impact of SEC filings, let’s consider some real-life examples. Companies’ disclosures in SEC filings have uncovered accounting irregularities, exposed fraudulent activities, or unveiled critical information that materially affected stock prices. These examples highlight the power of SEC filings in driving financial insights and shaping investment outcomes.

The Bottom Line

SEC filings are not just mundane paperwork; they are gateways to valuable financial insights. By analyzing the information contained in these filings, investors can make informed decisions, identify opportunities, and mitigate risks. In the following sections, we’ll share actionable tips on how to leverage SEC filings effectively and uncover the hidden gems that can impact your financial success.

Tips for Leveraging SEC Filings for Financial Insights

Unleashing the secrets hidden within SEC filings

To truly unlock the potential of SEC filings for valuable financial insights, it’s essential to employ effective strategies and techniques. In this section, we’ll share actionable tips to help you navigate SEC filings and extract meaningful information.

1. Go Beyond the Surface-Level Analysis

SEC filings can be dense and extensive, but don’t be discouraged. Look beyond the surface-level information and dig deeper into the details. Pay special attention to management discussions, footnotes, and risk factors. These sections often contain valuable insights that can reveal a company’s strategies, potential challenges, and future prospects.

2. Compare and Contrast Filings Over Time

Analyzing a single filing may provide some insights, but comparing filings over time can uncover valuable trends. By tracking changes in financial statements, management discussions, or risk factors across different periods, you can identify shifts in a company’s performance, goals, or risk profile. This comparative analysis can enhance your understanding of a company’s trajectory and aid in making informed decisions.

3. Leverage Search Keywords

To navigate the vast amount of information in SEC filings efficiently, employ targeted search techniques. Identify relevant keywords related to your research objectives, such as specific products, competitors, or industry trends. Use these keywords to search for specific information within the filings. This approach can help you pinpoint relevant sections and save time in your analysis.

4. Utilize Tools and Resources

Various tools and resources can assist in analyzing SEC filings. Explore online platforms and financial websites that provide streamlined access to SEC filings, offer search functionalities, or even provide pre-analyzed data. These tools can enhance your efficiency and provide additional insights through visualizations or comparisons.

5. Read Between the Lines

When it comes to SEC filings, reading between the lines is key. Companies may employ carefully crafted language or include subtle hints that offer insights beyond the explicit information. Pay attention to tone, language choices, or shifts in emphasis within the filings. These nuances can provide valuable clues about a company’s intentions, challenges, or future plans.

6. Stay Informed About Regulatory Changes

Regulatory requirements and filing guidelines can change over time. Stay up to date with any regulatory updates or amendments that may impact SEC filings. By understanding the latest regulatory landscape, you can ensure your analysis is accurate, relevant, and aligned with current standards.

Remember, these tips are designed to help you extract meaningful financial insights from SEC filings. By employing these strategies, you can delve deeper into the disclosures and uncover the secrets hidden within the filings.

Case Studies: Unveiling Financial Insights Through SEC Filings

Real-life examples that demonstrate the power of SEC filings

To understand the true impact of SEC filings on financial insights, let’s explore some compelling case studies. In this section, we’ll delve into real-life examples where SEC filings played a pivotal role in uncovering valuable financial information and shaping investment decisions.

Case Study 1: Detecting Revenue Manipulation

In one notable case, diligent analysis of a company’s SEC filings revealed revenue manipulation tactics. By closely examining the footnotes and comparing revenue recognition practices across multiple periods, astute investors noticed inconsistencies and anomalies. These findings raised red flags, prompting further investigation and ultimately exposing fraudulent activities. This case demonstrates how meticulous examination of SEC filings can unveil critical information hidden beneath the surface.

Case Study 2: Uncovering Emerging Market Trends

Another compelling case highlights the power of SEC filings in identifying emerging market trends. By analyzing filings from multiple companies within a specific industry, investors noticed recurring mentions of new technologies, partnerships, or market opportunities. These consistent threads across filings painted a picture of a burgeoning trend, offering early insights into potential investment opportunities. This case showcases how comprehensive analysis of SEC filings can uncover valuable market intelligence.

Case Study 3: Assessing Regulatory Risks

SEC filings also play a crucial role in assessing regulatory risks that may impact a company’s operations. In one instance, a careful review of a company’s filings revealed a significant regulatory change that could disrupt its core business model. The timely identification of this risk allowed investors to adjust their strategies, mitigating potential losses. This case emphasizes the importance of monitoring SEC filings for regulatory updates that may affect investment decisions.

Case Study 4: Evaluating Merger and Acquisition Opportunities

SEC filings provide invaluable insights when evaluating merger and acquisition opportunities. By scrutinizing filings related to proposed transactions, investors can gain a deeper understanding of the potential synergies, risks, and financial implications. In some cases, analysis of SEC filings has revealed undisclosed liabilities or contingent risks, influencing the decision to proceed or withdraw from a deal. This case illustrates how thorough examination of SEC filings can inform critical business decisions.

Case Study 5: Identifying Management’s Focus and Priorities

SEC filings offer glimpses into a company’s strategic direction and management’s focus. By analyzing management discussions, investors can identify key areas of emphasis, such as research and development, cost management, or geographic expansion. This understanding provides insights into a company’s priorities and helps assess its alignment with market trends and competitive dynamics. Case studies like this demonstrate how SEC filings can guide investment strategies based on management’s disclosed objectives.

These case studies underscore the importance of leveraging SEC filings for financial insights. By learning from real-life examples, investors can appreciate the impact of comprehensive analysis and unlock hidden gems within these regulatory disclosures.

Pro Tips and Best Practices

Maximize the value of SEC filings with these expert recommendations

To make the most of SEC filings and extract valuable financial insights, it’s crucial to follow pro tips and best practices. In this section, we’ll share expert recommendations to enhance your analysis and optimize your utilization of SEC filings.

1. Develop a Systematic Approach

Approach SEC filings with a systematic and organized methodology. Create a structured framework to guide your analysis, focusing on key sections such as financial statements, management discussions, footnotes, and risk factors. Having a consistent approach will streamline your research process and enable you to compare filings across different companies efficiently.

2. Stay Current with Industry News

Stay updated with industry news and developments that may impact the companies you’re analyzing. By understanding the broader market landscape, you can contextualize the information in SEC filings and identify relevant trends or events that may influence financial performance. Incorporate external factors into your analysis to gain a comprehensive understanding of the company’s position within its industry.

3. Collaborate and Seek Expert Advice

Engage in discussions with fellow investors, financial professionals, or industry experts to gain different perspectives and insights. Collaboration can provide valuable insights and help validate your analysis. Don’t hesitate to seek expert advice when encountering complex or specialized areas within SEC filings. Their expertise can enhance your understanding and lead to more informed decision-making.

4. Keep Track of Filing Deadlines

Be mindful of filing deadlines to ensure you access the most up-to-date information. Companies typically adhere to specific deadlines for submitting SEC filings, and monitoring these deadlines allows you to access the latest information promptly. Utilize tools or platforms that provide alerts or notifications for filing updates, enabling you to stay informed and maintain a competitive edge.

5. Combine Quantitative and Qualitative Analysis

Integrate quantitative and qualitative analysis when interpreting SEC filings. While financial statements offer quantitative data, qualitative information in management discussions or risk factors can provide important context and insights. By combining both approaches, you can develop a comprehensive understanding of a company’s financial health and prospects.

6. Practice Critical Thinking and Skepticism

Approach SEC filings with a critical mindset and healthy skepticism. While filings provide essential information, they can also be subject to biases or omissions. Scrutinize the data and statements, cross-reference information from multiple sources, and seek additional verification when necessary. Practicing critical thinking ensures you make well-informed decisions based on reliable information.

Remember, these pro tips and best practices are designed to optimize your utilization of SEC filings for financial insights. By incorporating these recommendations into your analysis process, you can enhance the accuracy and depth of your research.

Conclusion

Unlock the power of SEC filings and make informed financial decisions

SEC filings are a treasure trove of financial information that can provide valuable insights for investors and financial analysts. By delving into these regulatory documents and employing effective analysis techniques, you can unlock hidden gems and make more informed investment decisions. Let’s recap the key takeaways from this blog post.

SEC Filings as a Source of Financial Insights

SEC filings offer a comprehensive and detailed view of a company’s financial health, performance, and prospects. Going beyond the surface-level analysis and exploring sections such as financial statements, management discussions, footnotes, and risk factors can provide a deeper understanding of a company’s operations.

Tips and Best Practices for Effective Analysis

To maximize the value of SEC filings, it’s important to follow expert recommendations. Develop a systematic approach to your analysis, stay current with industry news, collaborate with others, and track filing deadlines. Combining quantitative and qualitative analysis while maintaining a critical mindset will enhance the accuracy and depth of your research.

Real-Life Case Studies

Examining real-life case studies demonstrates the impact of SEC filings on financial insights. From detecting revenue manipulation to uncovering emerging market trends, these examples highlight the power of comprehensive analysis and showcase how SEC filings have influenced investment decisions and business strategies.

The Value of SEC Filings for Financial Success

Understanding the basics of SEC filings, recognizing their significance, and implementing pro tips and best practices can lead to financial success. By leveraging the information disclosed in SEC filings, investors can make informed decisions, identify opportunities, and mitigate risks.

As you continue your journey in the world of financial analysis, remember that SEC filings are not just mundane paperwork but gateways to valuable financial insights. Stay curious, stay diligent, and stay informed. By harnessing the power of SEC filings, you can navigate the complex landscape of investments and make choices that align with your financial goals.