Short Version

Single Prints (SP) refer to specific price levels on a trading chart where trading activity has occurred only once. These levels represent areas where the market moved swiftly, leaving behind a footprint of limited activity. Single Prints (SP) are visually distinguishable as gaps or areas where price quickly moved through a level without revisiting it. They provide valuable insights into market psychology, supply-demand imbalances, and can act as significant support or resistance levels. Traders use Single Prints (SP) to enhance their understanding of price dynamics, identify key turning points, and make informed trading decisions.

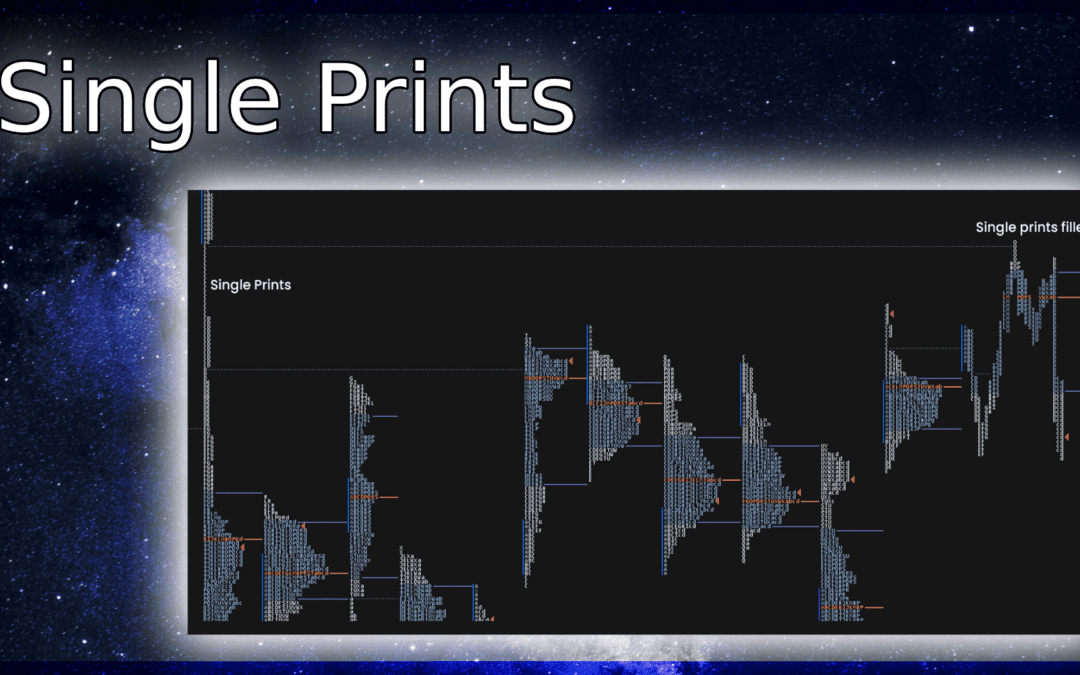

Examples of Single Prints

You can find more examples of Single Prints in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

Long Version

Introduction

Unleash the Power of Single Prints (SP) in Trading

Are you ready to take your trading game to the next level? Look no further than Single Prints (SP) – the secret weapon that can revolutionize your approach to analyzing price action. In this blog post, we’ll delve into the world of Single Prints (SP) and explore how they can be your ultimate ally in the trading arena.

Trading can sometimes feel like deciphering a complex puzzle. The market’s ups and downs, the endless array of technical indicators, and the constant influx of information can leave even the most seasoned traders scratching their heads. But fear not! Single Prints (SP) are here to simplify your trading journey and provide you with valuable insights.

Unveiling the Mystery of Single Prints (SP)

So, what exactly are Single Prints (SP)? In essence, Single Prints (SP) refer to specific price levels on a chart where trading activity has occurred only once. These price levels stand out from the rest and hold significant psychological and technical importance.

Picture Single Prints (SP) as rare gems hidden amidst the vast ocean of price data. They represent pockets of untapped potential, waiting to be discovered by astute traders like yourself. By paying attention to these unique price levels, you gain access to valuable clues about market sentiment, supply and demand imbalances, and potential turning points.

Why Single Prints (SP) Matter

Single Prints (SP) offer a multitude of benefits for traders. They act as visual cues that can guide your decision-making process and help you stay one step ahead of the market. Here are a few reasons why Single Prints (SP) matter:

-

Market Psychology: Single Prints (SP) provide insights into the collective psychology of market participants. They indicate areas where traders had significant conviction, leaving an indelible mark on the price chart.

-

Support and Resistance: Single Prints (SP) often serve as reliable support or resistance levels. They can act as price magnets, attracting the market back to those levels in future price movements.

-

Breakout and Reversal Points: By identifying Single Prints (SP), you can anticipate potential breakouts or reversals. These price levels hold the potential for significant price movements, providing opportunities for profitable trades.

Now that we have a glimpse into the significance of Single Prints (SP), let’s dive deeper into understanding how they can be effectively utilized in analyzing price action and enhancing your trading strategies.

Understanding Single Prints (SP)

What Are Single Prints (SP)?

Single Prints (SP) are a fascinating concept in trading that can provide valuable insights into market dynamics. To truly harness the power of Single Prints (SP), it’s essential to grasp their definition and significance.

At its core, Single Prints (SP) refer to specific price levels on a chart where trading activity has occurred only once. These levels represent unique areas where the market moved swiftly, leaving behind a footprint of limited activity. These pockets of price action are visually distinguishable on a chart and hold crucial importance for traders.

The Role of Single Prints (SP) in Market Psychology

To understand the significance of Single Prints (SP), it’s important to delve into the realm of market psychology. These distinct price levels are a reflection of the collective sentiment and behavior of market participants. Let’s explore how Single Prints (SP) play a role in market psychology:

- Signs of Conviction: Single Prints (SP) indicate areas where traders exhibited strong conviction. Whether it was due to a significant news event, a change in market sentiment, or other factors, these price levels represent moments of heightened trading activity.

- Imbalances in Supply and Demand: Single Prints (SP) can reveal imbalances in supply and demand within the market. When price moves swiftly through a level without revisiting it, it suggests a temporary mismatch between buyers and sellers, creating an opportunity for future price reactions.

- Price Exploration and Acceptance: Single Prints (SP) often occur during price exploration phases. Traders test new levels, and if the market finds acceptance above or below a Single Print (SP), it can lead to further price movements in that direction.

Benefits of Using Single Prints (SP) in Trading

Now that we understand the nature of Single Prints (SP) and their role in market psychology, let’s explore the benefits they offer to traders:

-

Enhanced Market Understanding: By identifying Single Prints (SP), traders gain a deeper understanding of price dynamics and the psychology driving market participants. This insight helps in making informed trading decisions.

-

Key Support and Resistance Levels: Single Prints (SP) often act as significant support or resistance levels. Traders can utilize these levels to identify potential areas of price reversals or breakouts.

-

Identification of Market Turning Points: Single Prints (SP) can serve as early warning signs for potential market turning points. When the market approaches a Single Print (SP) level, it warrants careful observation for potential shifts in market direction.

As we continue our journey into the world of Single Prints (SP), we’ll explore how to identify and interpret these unique price levels, empowering you to make more effective trading decisions.

Analyzing Price Action with Single Prints (SP)

Identifying Single Prints (SP) on Price Charts

To effectively analyze price action using Single Prints (SP), it’s crucial to develop the skill of identifying them on price charts. Let’s explore how you can spot Single Prints (SP) and understand their visual representation:

-

Distinct Price Patterns: Single Prints (SP) appear as gaps or areas where price swiftly moved through a level without revisiting it. These gaps can take various forms, such as single bars or candlestick patterns, highlighting the unique nature of Single Prints (SP).

-

Volume Confirmation: When identifying Single Prints (SP), it’s essential to consider volume as well. Typically, Single Prints (SP) occur with low trading volume, indicating the swift nature of the price move.

Interpreting Single Prints (SP) for Trading Decisions

Once you’ve identified Single Prints (SP) on price charts, the next step is to interpret them and leverage their insights for making trading decisions. Let’s explore how Single Prints (SP) can be used in your analysis:

-

Support and Resistance Levels: Single Prints (SP) often act as key support or resistance levels in the market. These levels can be significant barriers that the price may find difficult to breach or reverse from.

-

Gauging Market Strength: By observing Single Prints (SP), you can assess the strength of market movements. Large Single Prints (SP) indicate strong and swift price moves, suggesting a higher probability of sustained trends.

-

Anticipating Breakouts and Reversals: Single Prints (SP) provide valuable clues about potential breakouts or reversals. When price approaches a Single Print (SP) level, it’s an opportunity to anticipate a significant price reaction, either as a breakout through the level or a reversal from it.

Real-World Examples of Single Prints (SP) Analysis

To solidify your understanding of analyzing price action with Single Prints (SP), let’s explore some real-world examples:

-

Example 1: Identify a Single Print (SP) level on a chart and analyze how it acted as a strong resistance level, causing price reversals on multiple occasions.

-

Example 2: Spot a Single Print (SP) that served as a support level, with subsequent price movements bouncing off that level and providing profitable trading opportunities.

By studying these real-world examples and practicing the art of analyzing price action with Single Prints (SP), you’ll sharpen your skills and gain confidence in incorporating this powerful tool into your trading strategy.

In the next section, we’ll delve into specific strategies for effectively incorporating Single Prints (SP) into your trading approach, allowing you to capitalize on the insights they provide.

Strategies for Incorporating Single Prints (SP) into Your Trading

Scalping Opportunities with Single Prints (SP)

Scalping, a short-term trading strategy, can be enhanced by incorporating Single Prints (SP) into your analysis. Here’s how you can leverage Single Prints (SP) for scalping opportunities:

-

Identifying Breakout Points: Look for Single Prints (SP) that act as barriers to price movement. When price breaks out of a Single Print (SP) level, it can signal a potential acceleration in the direction of the breakout, providing opportunities for quick scalp trades.

-

Confirming Entry and Exit Points: Single Prints (SP) can serve as confirmation for entry and exit points in scalping trades. When price approaches a Single Print (SP) level, it allows you to assess the strength of the level and make decisions accordingly.

Swing Trading and Trend Following with Single Prints (SP)

Single Prints (SP) can be valuable tools for swing trading and trend following strategies. Consider the following approaches:

-

Identifying Trend Reversals: Single Prints (SP) that occur at key support or resistance levels can be indications of potential trend reversals. When price approaches these levels, closely monitor for signs of a reversal to capture trend changes.

-

Confirming Existing Trends: Single Prints (SP) can act as confirmations for existing trends. If a Single Print (SP) aligns with the direction of the trend, it provides additional evidence of market strength and can be used to reinforce your trading decisions.

Risk Management and Single Prints (SP)

While Single Prints (SP) provide valuable insights, it’s important to combine them with effective risk management techniques. Consider the following practices:

-

Multiple Confirmations: When utilizing Single Prints (SP), seek multiple confirmations from other technical indicators or analysis tools. Combining signals can help reduce the risk of false or unreliable trade setups.

-

Stop Loss Placement: Determine appropriate stop loss levels based on the analysis of Single Prints (SP) and other factors. Placing stop loss orders beyond significant Single Prints (SP) levels can help protect your capital in case of unexpected price movements.

Remember, incorporating Single Prints (SP) into your trading strategy requires practice and experience. As you become more familiar with their dynamics, you can refine your approaches and adapt them to your own trading style.

In the final section, we’ll summarize the key points discussed and emphasize the potential of Single Prints (SP) in enhancing your trading outcomes.

Conclusion

Unleash the Power of Single Prints (SP) in Your Trading Journey

Congratulations! You’ve now unlocked the secret weapon of Single Prints (SP) and discovered their potential in analyzing price action and enhancing your trading outcomes. Let’s recap the key points we’ve explored:

-

Understanding Single Prints (SP): Single Prints (SP) are unique price levels on a chart where trading activity has occurred only once. They provide valuable insights into market psychology and supply-demand imbalances.

-

Analyzing Price Action: By identifying and interpreting Single Prints (SP), you can determine crucial support and resistance levels, gauge market strength, and anticipate potential breakouts or reversals.

-

Incorporating Single Prints (SP) into Your Trading: Whether you’re a scalper, swing trader, or trend follower, Single Prints (SP) offer opportunities to optimize your trading strategies. They can help you identify scalping opportunities, confirm existing trends, and manage risk effectively.

As you continue your trading journey, remember to combine the insights from Single Prints (SP) with other technical analysis tools and risk management techniques. By doing so, you’ll further enhance your decision-making process and increase the probability of successful trades.

Now, armed with this newfound knowledge, it’s time to put it into practice. Explore different charts, observe Single Prints (SP), and study their behavior in various market conditions. Embrace the learning process, adapt your strategies, and refine your skills over time.

Remember, trading is not just about the tools you use, but also the discipline, patience, and continuous learning that you bring to the table. So, go forth with confidence and make Single Prints (SP) your ally in the ever-evolving world of trading.

If you have any questions or need further assistance, feel free to reach out. Happy trading!