Short Version

CME gaps, also known as Chicago Mercantile Exchange gaps, refer to price discrepancies that occur when the trading activity between the closing price of an asset and the opening price of the subsequent trading session creates a gap on a price chart. These gaps typically occur during periods of non-trading hours, such as weekends or holidays, when market participants cannot trade.

CME gaps are significant because they represent areas on a price chart where no trading activity has taken place, resulting in a gap between the previous closing price and the next opening price. These gaps can act as support or resistance levels and have the potential to influence future price movements.

Traders and investors often pay attention to CME gaps because they may provide valuable insights into market sentiment and potential trading opportunities. Strategies for trading CME gaps vary, including gap-fill strategies, where traders aim to profit from price corrections to fill the gap, and breakout strategies, where traders interpret gaps as potential indicators of trend continuation.

Understanding CME gaps and learning how to analyze and leverage them effectively can help traders make informed decisions and potentially capitalize on market discrepancies for financial gain.

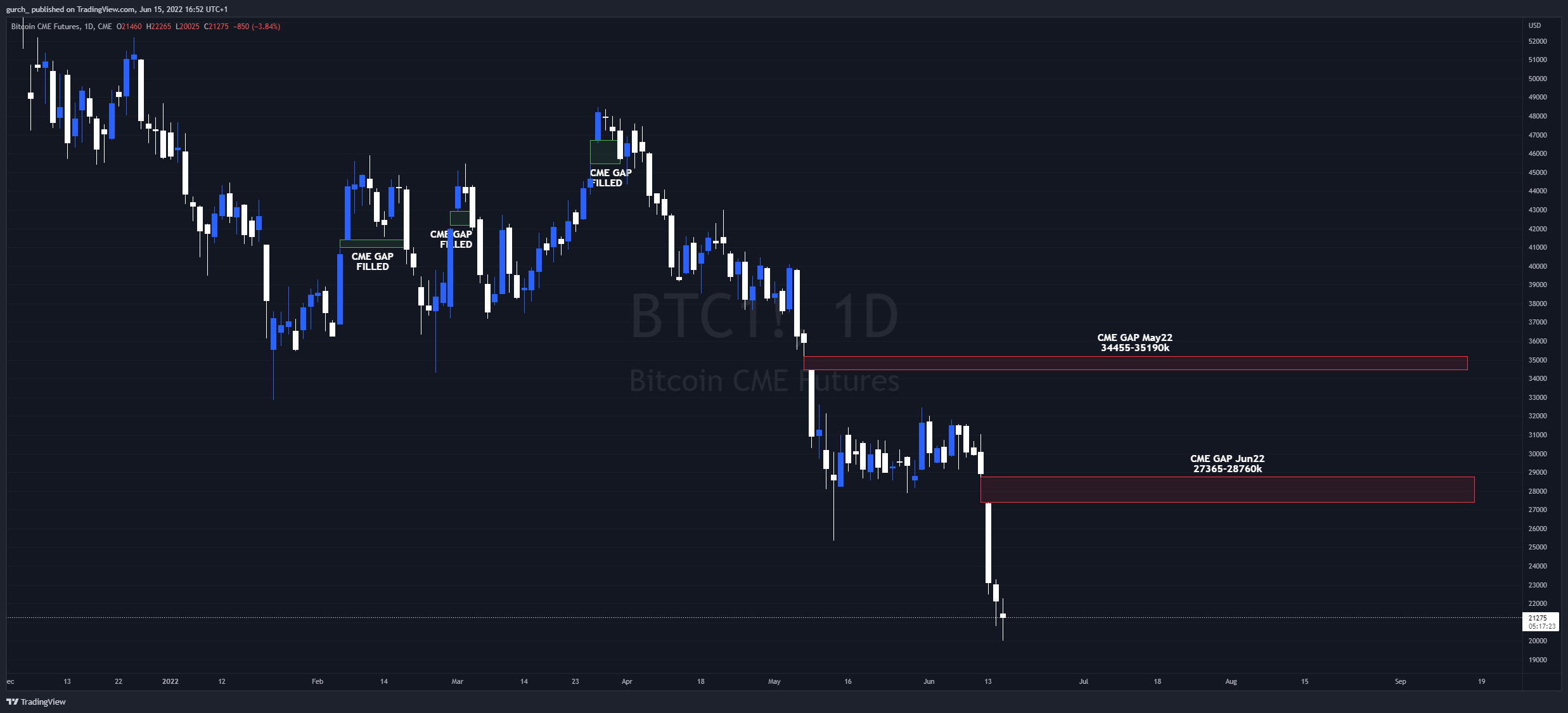

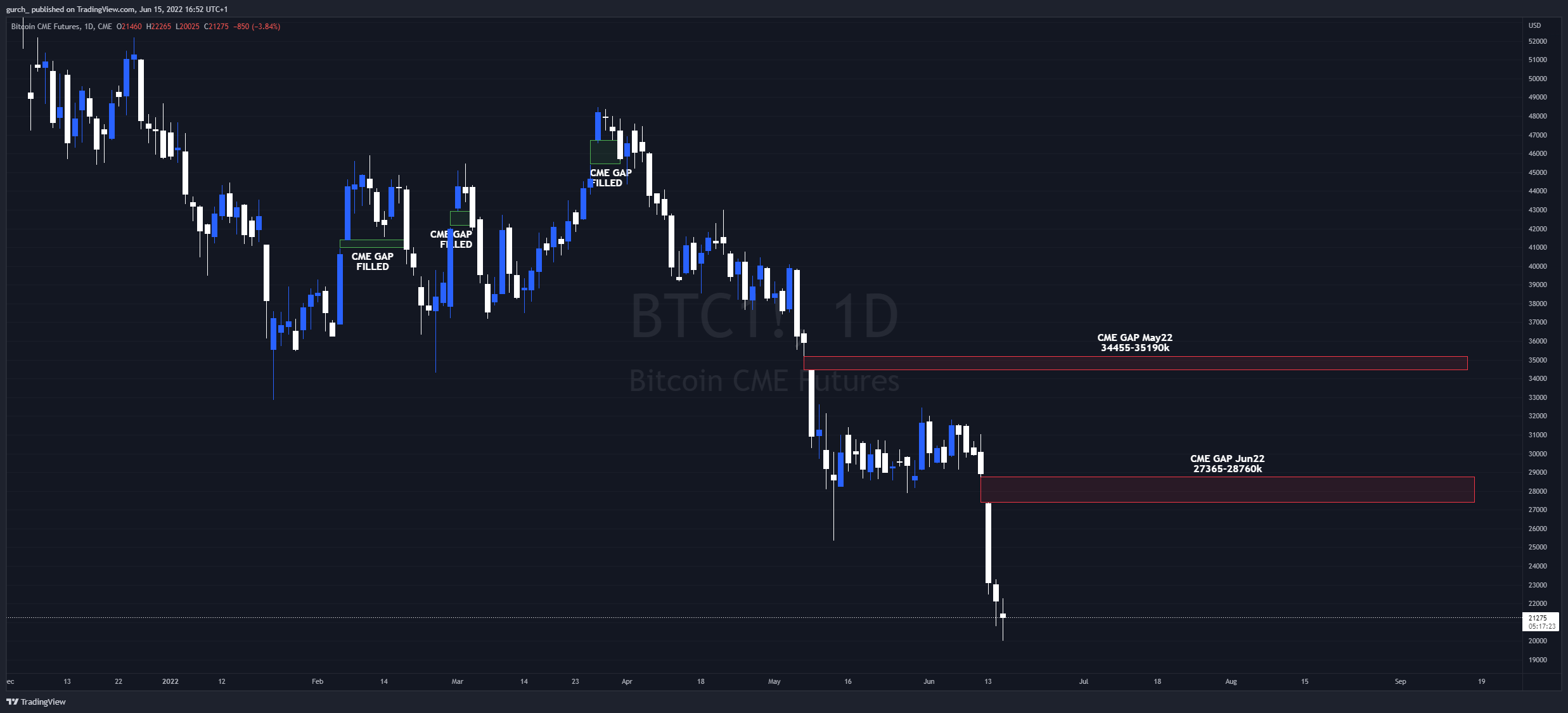

Examples of BTC CME Gaps

You can find more examples of CME Gaps in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

Long Version

Introduction

Understanding CME Gaps: A Gateway to Trading Success

Are you ready to take your trading skills to the next level? Look no further than CME gaps, the secret weapon of successful traders. In this blog post, we’ll demystify the concept of CME gaps and show you how they can unlock a world of trading opportunities.

Why CME Gaps Matter for Traders

CME gaps hold tremendous significance for traders looking to gain an edge in the market. By definition, CME gaps refer to price discrepancies between the closing and opening prices of trading sessions. These gaps can offer valuable insights into market sentiment and potential price movements, helping you make more informed trading decisions.

Unveiling the Potential of CME Gaps

Imagine CME gaps as hidden treasures waiting to be discovered. When you learn how to identify and interpret these gaps effectively, you position yourself for greater success. Whether you’re a seasoned trader seeking new strategies or a beginner looking for a solid foundation, understanding and leveraging CME gaps can be a game-changer in your trading journey.

Join us on an Exciting Journey

Get ready to explore the fundamentals of CME gaps, learn how to spot them, and discover effective trading strategies. We’ll also share inspiring success stories and debunk common myths surrounding CME gaps. This comprehensive guide will equip you with the knowledge and resources needed to make the most of CME gaps and enhance your trading prowess.

Let’s Dive In!

It’s time to unlock the secrets of CME gaps and unleash your trading potential. In the following sections, we’ll walk you through practical tips, real-life examples, and valuable resources to help you navigate the world of CME gaps successfully. Get ready for an exciting adventure that will revolutionize the way you approach trading.

What are CME Gaps

Understanding the Basics of CME Gaps

CME gaps, also known as Chicago Mercantile Exchange gaps, are price discrepancies that occur between the closing price of one trading session and the opening price of the next. These gaps can appear in various financial instruments, such as stocks, commodities, and currencies.

How CME Gaps Form

CME gaps form due to several factors, including overnight news events, economic data releases, market sentiment shifts, or other catalysts that impact trading activity. When a market opens with a price significantly different from the previous closing price, a CME gap is created.

Types of CME Gaps

There are three main types of CME gaps:

1. Common Gaps

Common gaps are the most frequent type of CME gaps and often occur within the range of normal market fluctuations. They tend to be quickly filled as the market adjusts.

2. Breakaway Gaps

Breakaway gaps signal a significant shift in market sentiment and usually occur at the beginning of a new trend. These gaps tend to be larger and take longer to fill, as they reflect a more substantial change in supply and demand dynamics.

3. Exhaustion Gaps

Exhaustion gaps appear near the end of a trend and indicate the last surge of buying or selling pressure before a reversal occurs. These gaps often mark important turning points in the market and can lead to significant price movements.

Interpreting CME Gaps

Interpreting CME gaps requires careful analysis and consideration of other market factors. While some traders view CME gaps as opportunities for price correction, others see them as potential areas of support or resistance.

The Significance of CME Gaps in Trading

CME gaps hold importance for traders and investors as they provide insights into market sentiment and potential price movements. Identifying and understanding CME gaps can help traders make informed decisions, develop effective strategies, and improve their overall trading success.

The Significance of CME Gaps in Trading

Gaining Insights into Market Sentiment

CME gaps provide valuable insights into market sentiment and the overall mood of traders. By analyzing the size, direction, and frequency of gaps, traders can gauge the level of bullishness or bearishness in the market. This information can help them make more informed decisions and align their trading strategies accordingly.

Identifying Potential Price Movements

CME gaps can act as potential indicators of future price movements. For example, breakaway gaps that occur at the beginning of a new trend may signal a strong momentum that could continue for some time. Exhaustion gaps, on the other hand, may indicate the end of a trend and a potential reversal in price direction. By understanding and interpreting these gaps, traders can anticipate potential price movements and position themselves accordingly.

Finding Areas of Support and Resistance

CME gaps can also act as areas of support or resistance in the market. When a gap is left unfilled, it can become a significant level that influences future price action. Traders often watch for these gaps to act as support or resistance levels, where price tends to bounce or stall. By identifying these levels, traders can make more informed decisions about their entry, exit, and stop-loss levels.

Uncovering Hidden Trading Opportunities

One of the most significant advantages of CME gaps is the potential for hidden trading opportunities. These gaps often present unique situations where price needs to catch up or fill the gap. Traders who can identify and capitalize on these opportunities may find themselves ahead of the curve and able to profit from the price discrepancies. It’s crucial to have a well-defined trading strategy and risk management plan in place to maximize the potential of these opportunities.

Enhancing Trading Strategies with CME Gaps

Incorporating CME gaps into trading strategies can enhance their effectiveness. Traders can use gap analysis alongside other technical indicators and tools to validate signals and increase the probability of successful trades. By considering the significance of CME gaps, traders can fine-tune their strategies and improve their overall trading performance.

Identifying CME Gaps

Understanding the Characteristics of CME Gaps

Before you can identify CME gaps, it’s essential to familiarize yourself with their characteristics. CME gaps are typically characterized by a noticeable price jump or drop between the closing and opening prices of trading sessions. These gaps can appear on various timeframes, from daily to weekly or even intraday charts.

Utilizing Technical Analysis Tools

Technical analysis tools can be invaluable in identifying CME gaps. Key tools include:

1. Candlestick Charts

Candlestick charts display price movements and provide visual cues for identifying gaps. Look for gaps between the closing and opening prices, represented by the space between consecutive candlesticks.

2. Gap Scanners

Gap scanners are specialized tools that can help you quickly identify CME gaps across multiple financial instruments. These scanners allow you to set specific criteria, such as gap size or percentage, to filter and identify relevant gaps.

3. Moving Averages

Moving averages can be useful in identifying gaps by providing a baseline or reference point for price movements. Look for instances where the price gaps above or below the moving average, indicating a potential CME gap.

Key Indicators of CME Gaps

When analyzing price charts, keep an eye out for the following indicators of CME gaps:

1. Price Discontinuity

Look for instances where the current day’s opening price significantly deviates from the previous day’s closing price. These discontinuities in price indicate the presence of a CME gap.

2. Price Breakouts

CME gaps can lead to significant price breakouts, where the price moves beyond key levels of support or resistance. These breakouts often occur when the price gaps above or below these levels, indicating a shift in market sentiment.

3. Volume Spikes

Volume spikes accompanying a CME gap can provide additional confirmation. Higher trading volume during the gap indicates increased market activity and reinforces the significance of the gap.

Applying Multiple Timeframe Analysis

To increase the accuracy of identifying CME gaps, consider analyzing multiple timeframes. Gaps that occur on various timeframes can provide a more comprehensive view of market sentiment and confirm the significance of the gap.

Practicing Diligence and Due Diligence

While CME gaps can present lucrative opportunities, it’s essential to exercise caution and thorough research. Verify the authenticity of the gap and consider other market factors before making trading decisions. Additionally, be aware that not all gaps are tradable or offer favorable risk-to-reward ratios.

Strategies for Trading CME Gaps

Understanding the Potential of CME Gaps

Before diving into specific strategies, it’s crucial to understand the potential of CME gaps in trading. CME gaps can present unique opportunities for profit due to the price discrepancies they create. By applying appropriate strategies, traders can aim to capitalize on these gaps and maximize their trading success.

Strategy 1: Gap Fill Trading

One popular strategy is gap fill trading, which involves anticipating that the price will eventually move to fill the gap. Traders who believe that the market will correct the price imbalance may enter positions in the opposite direction of the gap and aim to profit as the price moves toward filling the gap.

Strategy 2: Breakaway Gap Trading

Breakaway gaps, which occur at the beginning of a new trend, can provide opportunities for trend-following traders. Traders utilizing this strategy may enter positions in the direction of the gap, expecting the trend to continue. Proper risk management techniques, such as using stop-loss orders, are crucial to mitigate potential losses if the gap does not play out as expected.

Strategy 3: Exhaustion Gap Reversals

Exhaustion gaps, appearing near the end of a trend, can signal potential reversals in price direction. Traders using this strategy may look for indications that the trend is losing steam, such as divergence on technical indicators or signs of price rejection near the exhaustion gap. They may then enter positions in the opposite direction, aiming to profit from the anticipated reversal.

Strategy 4: Gap and Go Trading

Gap and go trading is a strategy where traders aim to take advantage of the momentum created by a gap. Traders using this approach may enter positions in the direction of the gap and aim to ride the momentum for a quick profit. This strategy requires active monitoring and swift decision-making to capitalize on short-term price movements.

Strategy 5: Gap Fade Trading

Gap fade trading involves taking a contrarian approach by betting against the direction of the gap. Traders utilizing this strategy may enter positions in the opposite direction, expecting the price to revert to pre-gap levels. This strategy requires careful analysis of market conditions, as fading gaps can be riskier and may require tighter risk management.

Strategy 6: Combination and Custom Strategies

Experienced traders often develop their own combination or custom strategies based on their unique trading style and risk tolerance. This may involve incorporating elements of different gap trading strategies, combining technical indicators, or incorporating other factors specific to their trading approach. Custom strategies can provide a personalized approach that aligns with individual trading preferences.

Final Thoughts

When employing any trading strategy, it’s important to practice diligent risk management and conduct thorough analysis. Not all CME gaps will lead to profitable trades, and losses are a possibility. Traders should backtest and validate their chosen strategies, adapt as market conditions change, and continually refine their approach to trading CME gaps.

Case Studies and Success Stories

Real-Life Examples of CME Gap Trading Success

In this section, we’ll explore real-life case studies and success stories of traders who have utilized CME gaps to their advantage. These examples highlight the potential profitability and effectiveness of incorporating gap trading strategies in your trading approach.

Case Study 1: Profiting from a Breakaway Gap

In this case study, we’ll examine how Trader A identified a breakaway gap on a stock chart and successfully positioned themselves to profit from the subsequent trend. We’ll delve into the specific indicators used, entry and exit points, and the overall trading plan that led to a profitable outcome.

Case Study 2: Recognizing and Capitalizing on Exhaustion Gaps

Trader B’s success story revolves around their ability to recognize exhaustion gaps near key resistance levels. We’ll analyze their strategy, including the use of technical analysis tools, confirmation indicators, and risk management techniques that enabled them to enter trades at optimal levels and profit from the ensuing price reversals.

Case Study 3: Gap Fading the Opening Gap

In this case study, we’ll explore how Trader C employed a gap fading strategy to take advantage of opening gaps in the futures market. We’ll examine the specific rules and criteria used to determine trade entries, as well as the risk management strategies implemented to minimize losses in case of adverse price movements.

Lessons Learned from Successful Traders

Alongside these case studies, we’ll highlight common themes and lessons learned from successful traders who have consistently profited from CME gaps. These insights will provide you with valuable takeaways, trading tips, and best practices to enhance your own trading approach.

Applying Case Study Insights to Your Trading

While every trader’s journey is unique, there are valuable insights and strategies to glean from these case studies and success stories. We’ll discuss how you can incorporate these learnings into your own trading plan, adapt them to your preferred trading style, and refine your strategies to increase the likelihood of success.

Celebrating Success and Inspiring Growth

By showcasing these case studies and success stories, we aim to inspire and motivate traders who are exploring the potential of CME gaps. These stories serve as a reminder that with dedication, sound strategies, and proper risk management, it is indeed possible to achieve trading success in the realm of CME gaps.

Tools and Resources for Analyzing CME Gaps

The Importance of Using the Right Tools

When it comes to analyzing CME gaps, having the right tools at your disposal can make a significant difference in your trading success. Here, we’ll explore various tools and resources that can help you effectively analyze CME gaps and make informed trading decisions.

Candlestick Charting Tools

Candlestick charts are widely used for visualizing and analyzing price movements, including CME gaps. To optimize your analysis, consider utilizing the following candlestick charting tools:

1. Trading Platforms with Advanced Charting Features

Many trading platforms offer advanced charting features that allow you to customize your candlestick charts. Look for platforms that provide a wide range of indicators, drawing tools, and timeframe options to enhance your analysis of CME gaps.

2. Candlestick Pattern Recognition Software

Candlestick pattern recognition software can automatically identify specific candlestick patterns, including gap patterns. These tools can save you time by quickly scanning multiple charts and alerting you to potential gap opportunities or reversal signals.

Gap Scanners and Screeners

Gap scanners and screeners are valuable resources for identifying CME gaps across various markets and securities. Consider utilizing the following tools:

1. Stock Screeners

Stock screeners allow you to filter stocks based on specific criteria, including price gaps. Look for screeners that offer customizable filters for gap size, percentage change, and other relevant parameters to identify potential trading opportunities.

2. Market Scanners

Market scanners are designed to scan multiple markets, such as futures or forex, for gap opportunities. These scanners can help you identify gaps across a wide range of instruments, enabling you to diversify your trading strategies.

Technical Analysis Indicators

Technical analysis indicators can provide valuable insights when analyzing CME gaps. Consider incorporating the following indicators into your analysis:

1. Moving Averages

Moving averages can help identify trends, support, and resistance levels, and potential price targets. Use them in conjunction with gap analysis to validate potential trading opportunities.

2. Volume Indicators

Volume indicators, such as volume bars or the on-balance volume (OBV) indicator, can provide insights into the strength and validity of a gap. Higher trading volume accompanying a gap can add confirmation to its significance.

Educational Resources and Communities

Continual learning and staying connected with trading communities can enhance your understanding and analysis of CME gaps. Consider utilizing the following educational resources and communities:

1. Online Courses and Webinars

Online courses and webinars offer structured learning experiences and insights from experienced traders. Look for courses that specifically cover gap analysis and trading strategies to deepen your knowledge.

2. Trading Forums and Social Media Groups

Joining trading forums and social media groups focused on gap trading can provide opportunities for discussion, sharing insights, and learning from other traders’ experiences. Engage in conversations, ask questions, and stay up to date with the latest trends and strategies.

Conclusion

By leveraging the right tools and resources, you can enhance your analysis of CME gaps and make more informed trading decisions. Explore the various options available, experiment with different tools, and continue to expand your knowledge to optimize your gap trading strategies.

The Importance of Patience and Discipline

The Role of Patience in Gap Trading

Patience is a crucial virtue when it comes to successfully trading CME gaps. Consider the following aspects highlighting the importance of patience in your trading approach:

1. Waiting for High-Quality Setups

Rushing into trades without proper analysis and confirmation can lead to suboptimal results. Patience allows you to wait for high-quality gap setups that align with your trading plan and have a higher probability of success.

2. Allowing Gaps to Develop

Gaps may take time to develop fully, especially in the case of overnight or weekend gaps. Patience enables you to allow gaps to unfold, providing clearer insights into their potential direction and trading opportunities.

The Significance of Discipline in Gap Trading

Discipline is equally essential when it comes to trading CME gaps. Here’s why discipline plays a crucial role in your trading success:

1. Sticking to Your Trading Plan

A disciplined approach ensures that you adhere to your pre-defined trading plan, including entry and exit criteria, risk management strategies, and position sizing. This helps you avoid impulsive decisions and stay focused on your long-term trading goals.

2. Managing Emotions and Avoiding Overtrading

Discipline helps you control your emotions and avoid overtrading, which can lead to hasty and irrational decisions. By maintaining discipline, you can stay patient, wait for the right opportunities, and avoid excessive risk-taking.

The Power of Consistency in Gap Trading

Consistency is the key to long-term success in gap trading. Consider the following points that emphasize the power of consistency:

1. Building a Track Record

Consistently executing your trading plan allows you to build a track record of your performance. This track record can provide valuable insights into your strengths, weaknesses, and areas for improvement, ultimately helping you refine your gap trading strategies.

2. Emphasizing Risk Management

Consistent risk management practices are vital for preserving capital and avoiding substantial losses. By consistently applying risk management principles, such as setting stop-loss orders and managing position sizes, you can protect your trading account from significant drawdowns.

Developing Patience, Discipline, and Consistency

Developing patience, discipline, and consistency is an ongoing process. Consider the following tips to cultivate these essential qualities:

1. Set Realistic Expectations

Acknowledge that trading CME gaps requires time, effort, and a continuous learning mindset. Set realistic expectations, understanding that success may not come overnight, but rather through consistent effort and improvement.

2. Maintain a Trading Journal

Keeping a trading journal allows you to reflect on your trades, track your emotions, and identify areas for improvement. Regularly review your journal to identify patterns, refine your strategies, and reinforce your discipline.

3. Practice Mindfulness and Self-Awareness

Be mindful of your emotions, biases, and impulsive tendencies when trading. Cultivate self-awareness to recognize when you may be deviating from your plan or making decisions based on emotions rather than logic.

Conclusion

Patience, discipline, and consistency are integral to achieving long-term success in gap trading. By emphasizing these qualities in your trading approach, you can enhance your decision-making, manage risk effectively, and increase your chances of profitable trading outcomes.

Common Myths and Misconceptions about CME Gaps

Debunking the Myths

When it comes to CME gaps, there are several common myths and misconceptions that can mislead traders. Let’s debunk some of these myths and provide a clearer understanding of CME gaps:

Myth 1: All Gaps Must Be Filled

One prevailing myth is that all gaps must be filled, meaning that price will eventually return to the level of the gap and close it. In reality, not all gaps get filled, and gaps can act as support or resistance levels. Understanding the context and characteristics of each gap is crucial for accurate analysis.

Myth 2: Gaps Always Indicate a Trading Opportunity

While gaps can present trading opportunities, it’s a misconception that every gap is a signal to enter a trade. Gaps require thorough analysis, confirmation from other technical indicators, and alignment with your trading strategy. Blindly trading every gap can lead to losses and poor risk management.

Understanding the Realities

Now that we’ve debunked some myths, let’s explore the realities of CME gaps and gain a clearer perspective:

Reality 1: Gaps Reflect Market Imbalance

Gaps occur due to significant market imbalances, such as overnight news events, earnings reports, or economic data releases. Understanding the underlying factors causing the gap can help you better evaluate its significance and potential trading implications.

Reality 2: Gap Size Matters

Gap size is an essential factor to consider when analyzing CME gaps. Larger gaps tend to have more significant implications and higher trading potential, while smaller gaps may be less reliable as trading opportunities. Paying attention to gap size in conjunction with other technical factors can provide valuable insights.

Key Considerations for Gap Trading

To navigate CME gaps effectively, it’s important to keep the following considerations in mind:

Consideration 1: Context is Key

Analyzing CME gaps requires considering the broader market context, including prevailing trends, support and resistance levels, and overall market sentiment. Contextual analysis enhances your ability to assess the potential outcomes of a gap and make more informed trading decisions.

Consideration 2: Confirmation is Crucial

Relying solely on gaps for trading decisions may lead to unreliable outcomes. It’s vital to seek confirmation from other technical indicators, such as volume, trend lines, or chart patterns, to validate the trading opportunity presented by a gap. Confirmation adds a layer of reliability to your analysis.

Conclusion

By debunking common myths and understanding the realities of CME gaps, you can approach gap trading with a clearer mindset. Remember that thorough analysis, context evaluation, and confirmation from additional indicators are vital for successful gap trading. Continually educate yourself, refine your strategies, and approach gap trading with a well-informed perspective.

Conclusion

Embrace the Opportunities of CME Gaps

CME gaps present unique opportunities for traders to capitalize on market imbalances and potentially profit from significant price movements. By understanding the nature of CME gaps and employing effective gap trading strategies, you can increase your chances of success in this dynamic trading approach.

Key Takeaways

Here are the key takeaways to remember when it comes to trading CME gaps:

1. Thorough Analysis is Essential

Before entering a trade based on a CME gap, conduct thorough analysis. Consider the context, gap size, confirmation from other technical indicators, and overall market conditions to make well-informed trading decisions.

2. Patience and Discipline Pay Off

Patience and discipline are crucial virtues in gap trading. Wait for high-quality setups, stick to your trading plan, manage your emotions, and avoid impulsive trading decisions. Consistency in executing your strategy and adhering to risk management principles are key to long-term success.

3. Educate Yourself Continuously

Never stop learning. Stay updated with market trends, study successful trading strategies, and leverage educational resources and trading communities. Continually refine your skills, adapt to changing market conditions, and strive for improvement in your gap trading approach.

Start Your Gap Trading Journey

Now that you have a solid understanding of CME gaps, it’s time to put your knowledge into action. Start observing gaps, practice analyzing them, and implement your gap trading strategies in a disciplined manner. Remember, trading gaps involves risks, so always manage your risk wisely and trade with a well-defined plan.

Trade With Confidence

While gap trading can be challenging, it also offers exciting opportunities for traders. By combining your analytical skills, disciplined approach, and continuous learning, you can navigate the world of CME gaps with confidence. Stay focused, be patient, and seize the potential that CME gaps bring to your trading journey.