Short Version

Support and resistance are fundamental concepts in trading. Support refers to a price level where buying pressure is strong enough to prevent the price from falling further, acting as a floor for the price. Resistance, on the other hand, refers to a price level where selling pressure is significant enough to prevent the price from rising higher, acting as a ceiling for the price. Support and resistance levels are areas on a price chart where traders pay close attention as they indicate potential price reversals, consolidation, or breakout opportunities. Understanding support and resistance levels is crucial for traders to make informed decisions about entry and exit points, risk management, and overall trading strategies.

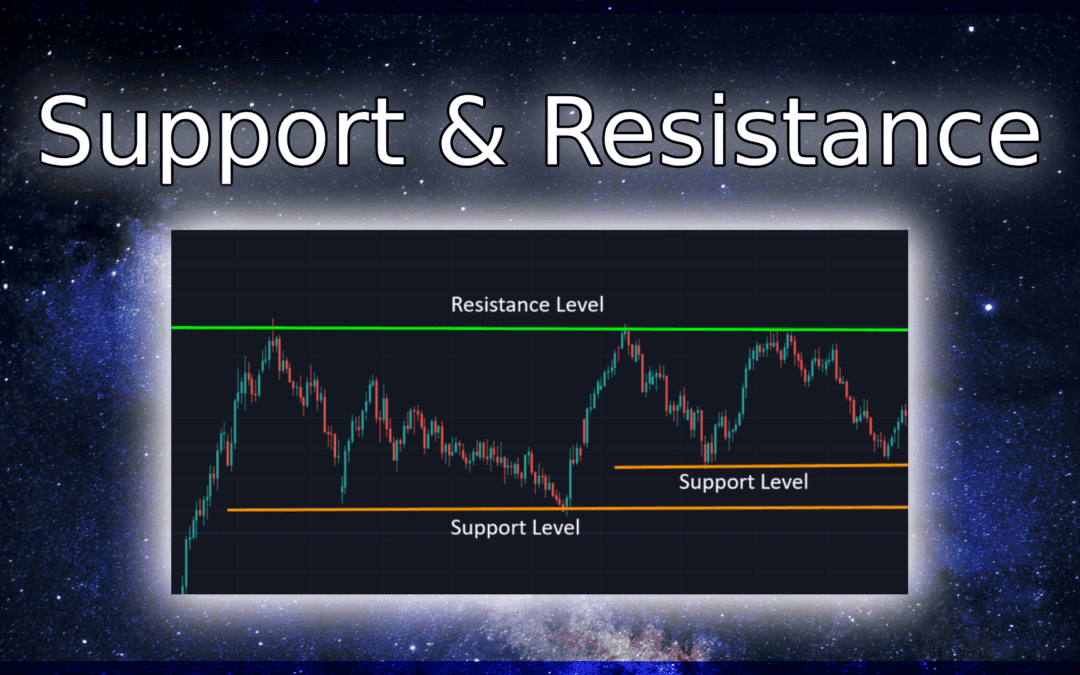

Examples of Support & Resistance

You can find more examples of Support & Resistance in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

https://www.investopedia.com/trading/support-and-resistance-basics/

https://www.babypips.com/learn/forex/support-and-resistance

https://school.stockcharts.com/doku.php?id=chart_analysis:support_and_resistance

https://www.ig.com/uk/trading-strategies/what-are-support-and-resistance-levels-in-forex-trading–221109

Long Version

Introduction

Unveiling the Power of Support and Resistance: Boost Your Trading Profits

Welcome to our blog post on the fascinating world of support and resistance in trading! If you’re a trader looking to enhance your profits and gain a competitive edge, understanding and harnessing the power of support and resistance levels is essential.

In this article, we’ll dive deep into the concept of support and resistance, exploring how these levels can significantly impact your trading outcomes. Whether you’re a seasoned trader or just starting out, learning to identify and leverage support and resistance can be a game-changer.

So, let’s embark on this exciting journey and uncover the hidden potential that support and resistance hold for boosting your trading profits. By the end of this article, you’ll have a solid foundation to incorporate these powerful concepts into your trading strategies.

Let’s get started!

Understanding Support and Resistance

What are Support and Resistance Levels?

Support and resistance levels are fundamental concepts in trading that every trader should grasp. These levels represent areas on a price chart where the buying or selling pressure is significant, causing the price to pause, reverse, or consolidate.

How are Support and Resistance Levels Formed?

Support levels are formed when the demand for an asset is strong enough to prevent the price from falling further. They act as a floor, providing a barrier against downward movement. On the other hand, resistance levels occur when the supply for an asset is robust enough to prevent the price from rising higher. Resistance levels act as a ceiling, hindering upward movement.

The Role of Supply and Demand in Support and Resistance

Support and resistance levels are determined by the underlying principles of supply and demand in the market. When buyers outnumber sellers, support levels are created as buyers step in to purchase the asset, driving the price up. Conversely, when sellers surpass buyers, resistance levels form as sellers enter the market, pushing the price down.

Visualizing Support and Resistance Levels

To better understand support and resistance levels, let’s imagine a price chart. Picture the support level as a sturdy floor that prevents the price from falling through, while the resistance level acts as a solid ceiling that prevents the price from breaking through. These levels represent areas of interest where traders pay close attention to potential price reactions.

By comprehending the formation of support and resistance levels and their relationship with supply and demand, you’ll be equipped with a foundational understanding to navigate the dynamic world of trading more effectively.

Stay tuned for the next section where we explore the immense power support and resistance levels hold in trading strategies!

The Power of Support and Resistance in Trading

Leveraging Support and Resistance Levels for Trading Success

Support and resistance levels are not mere lines on a price chart; they possess immense power that can significantly impact your trading success. Understanding and utilizing these levels can provide you with a competitive edge and boost your trading profits. Let’s explore how support and resistance levels exert their influence in trading.

Acting as Entry and Exit Points

One of the key advantages of support and resistance levels is their ability to act as points of entry and exit in trades. When the price approaches a support level, it may indicate a favorable buying opportunity as the asset is likely to bounce back from that level. Conversely, when the price nears a resistance level, it may suggest a potential selling opportunity as the asset may struggle to break through that level.

Improved Risk Management and Trade Timing

Support and resistance levels also play a vital role in risk management. By identifying these levels, traders can determine appropriate stop-loss levels, limiting potential losses if the price breaks through support or resistance. Additionally, support and resistance levels aid in trade timing by providing traders with insights into potential price reversals or continuations.

Realizing Profit Potential

By aligning your trading strategies with support and resistance levels, you can capitalize on price movements that occur around these areas of interest. When the price bounces off a support level, you can target potential profit by riding the upward momentum. Similarly, when the price stalls near a resistance level, you may consider taking profits or adjusting your positions accordingly.

Case Studies and Success Stories

Numerous traders have attributed their success to the effective utilization of support and resistance levels. Stories of traders accurately identifying crucial support and resistance zones and making profitable trades abound. These case studies serve as inspiration and highlight the real-world impact of incorporating support and resistance into trading strategies.

Understanding the power of support and resistance levels can give you a significant advantage in your trading journey. In the next section, we’ll delve into various techniques for identifying support and resistance levels, equipping you with practical tools to harness their potential.

Stay tuned to unleash the full power of support and resistance in your trading endeavors!

Techniques for Identifying Support and Resistance Levels

Mastering the Art of Spotting Support and Resistance

Identifying accurate support and resistance levels is a crucial skill for any trader. These levels act as significant turning points in price action and provide valuable insights for making informed trading decisions. Let’s explore some effective techniques for identifying support and resistance levels in the market.

1. Horizontal Price Levels

One of the simplest and most commonly used techniques is to look for horizontal price levels that have previously acted as support or resistance. These levels are formed when the price repeatedly bounces off a particular price point, creating a clear horizontal line on the chart.

2. Trendlines

Trendlines are another valuable tool for identifying support and resistance levels. An upward sloping trendline can act as support, while a downward sloping trendline can act as resistance. By connecting consecutive swing lows in an uptrend or swing highs in a downtrend, you can draw trendlines that help identify potential support or resistance areas.

3. Moving Averages

Moving averages can also be used to identify dynamic support and resistance levels. The 50-day or 200-day moving averages are commonly used by traders to determine areas where the price may find support or encounter resistance. When the price approaches or touches these moving averages, it can serve as a potential trading signal.

4. Fibonacci Retracement Levels

Fibonacci retracement levels are based on the Fibonacci sequence and are popular among traders for identifying potential support and resistance levels. By plotting these levels on a price chart, traders can identify areas where the price is likely to reverse or consolidate based on the Fibonacci ratios.

5. Pivot Points

Pivot points are technical indicators that help identify support and resistance levels based on the previous day’s high, low, and close prices. These levels can act as strong reference points for traders, as they are widely watched and utilized by many market participants.

By combining multiple techniques and tools, traders can increase the accuracy of identifying support and resistance levels in the market. Remember, it’s crucial to confirm these levels using additional indicators or price action analysis to validate their significance.

In the next section, we’ll explore practical strategies for leveraging support and resistance levels to boost your trading profits. Stay tuned for insightful tips and techniques!

Boosting Your Trading Profits with Support and Resistance

Strategies for Maximizing Gains Using Support and Resistance Levels

Support and resistance levels are powerful tools that can significantly enhance your trading profits. Once you’ve identified these key levels, it’s time to leverage them strategically in your trading strategies. Let’s explore practical tips and techniques for maximizing gains with support and resistance.

1. Support and Resistance as Entry and Exit Points

One of the primary ways to boost your trading profits is by using support and resistance levels as entry and exit points. When the price approaches a support level, it may present an excellent buying opportunity. Traders can enter a trade, setting their stop-loss orders just below the support level for risk management. Conversely, when the price nears a resistance level, it may be an ideal time to consider taking profits or even initiating a short position.

2. Confluence with Other Indicators

To increase the accuracy of your trades, look for confluence between support or resistance levels and other technical indicators. For instance, if a support level coincides with a trendline or a Fibonacci retracement level, it strengthens the potential support and makes it a more compelling trading opportunity. Combining multiple indicators can help you validate your analysis and increase the probability of a successful trade.

3. Breakouts and Pullbacks

Support and resistance levels can also be used to identify breakout and pullback trading opportunities. When the price breaks through a strong resistance level, it may indicate a bullish breakout, offering a chance to enter a trade in the direction of the breakout. On the other hand, when the price pulls back to a previously broken resistance level, which now acts as support, it presents an opportunity to enter a trade in the direction of the overall trend.

4. Scaling Out of Positions

Another strategy to optimize your trading profits is by scaling out of positions at different support or resistance levels. Instead of closing your entire position at once, consider taking partial profits as the price reaches certain predetermined levels. This allows you to lock in profits along the way while still allowing the remaining portion of your position to potentially benefit from further price movement.

5. Practice Effective Risk Management

While support and resistance levels can be powerful tools, it’s crucial to incorporate effective risk management practices. Set appropriate stop-loss orders to limit potential losses if the price breaks through a support or resistance level. Adjust your position size according to your risk tolerance and always follow your trading plan to maintain discipline and protect your capital.

By applying these strategies and techniques, you can optimize your trading profits by effectively utilizing support and resistance levels. Remember, practice and experience are key to mastering the art of trading with support and resistance.

In the next section, we’ll conclude our exploration of support and resistance and summarize the key takeaways from this blog post. Stay tuned for the final insights!

Conclusion

Unleashing the Power of Support and Resistance in Your Trading Journey

Congratulations! You’ve now gained a comprehensive understanding of support and resistance levels and how they can significantly impact your trading success. By incorporating these powerful concepts into your trading strategies, you can boost your profits and gain a competitive edge in the market.

Throughout this article, we’ve explored the fundamentals of support and resistance, delving into their formation, role in supply and demand dynamics, and visual representation on price charts. We’ve also discussed the immense power that support and resistance levels hold, acting as entry and exit points, improving risk management, and unlocking profit potential.

Moreover, we’ve provided you with practical techniques for identifying support and resistance levels, including horizontal price levels, trendlines, moving averages, Fibonacci retracement levels, and pivot points. By mastering these techniques, you’ll be able to identify key levels with greater accuracy and precision.

Additionally, we’ve shared strategies for maximizing your trading profits using support and resistance. From using these levels as entry and exit points to leveraging confluence with other indicators, breakout and pullback trading, scaling out of positions, and practicing effective risk management, these strategies empower you to make informed trading decisions and optimize your returns.

Remember, mastering the art of trading with support and resistance takes time and practice. Continuously refine your skills, observe price action, and analyze historical data to strengthen your understanding of these levels and their impact on the market.

So, go forth and unleash the power of support and resistance in your trading journey. Apply the knowledge and techniques you’ve acquired to make better-informed trading decisions, manage your risk effectively, and seize profitable opportunities.

Thank you for joining us on this insightful exploration of support and resistance. We hope this article has equipped you with valuable insights and strategies to take your trading to new heights.

Happy trading, and may your support and resistance levels always guide you to success!