Short Version

Fibonacci refers to a sequence of numbers in which each number is the sum of the two preceding numbers. It starts with 0 and 1, and the sequence continues indefinitely. The Fibonacci sequence begins as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and so on.

The Fibonacci sequence has intriguing mathematical properties and is found in various natural phenomena, including the growth patterns of plants, the spiral arrangement of shells, and the proportions of the human body.

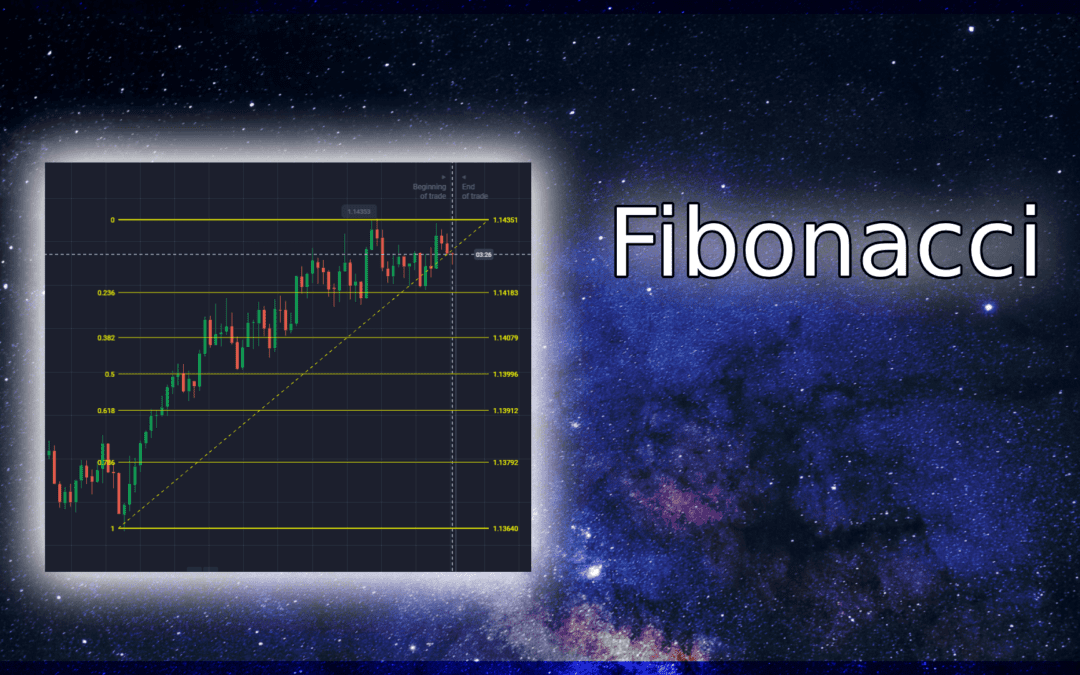

In the context of trading and technical analysis, Fibonacci ratios and levels derived from the Fibonacci sequence are used to identify potential support and resistance levels, determine price retracements, extensions, and time zones. Traders often apply Fibonacci analysis to financial charts to find patterns and make informed trading decisions based on these mathematical relationships.

By utilizing Fibonacci analysis, traders aim to identify key levels, predict potential price movements, and improve the precision of their trading strategies. It serves as a tool to analyze market trends and assist in making decisions regarding entry, exit, and risk management.

Examples of Fibonacci

You can find more examples of Fibonacci in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

Long Version

Introduction

Unleashing the Power of Fibonacci in Trading

Are you ready to unlock the hidden secrets of trading success? Look no further than the fascinating world of Fibonacci. With its unique mathematical properties, Fibonacci can revolutionize your trading strategy and pave the way to profitable outcomes. In this blog post, we will delve into the power of Fibonacci and how it can transform the way you approach trading.

At its core, Fibonacci is a sequence of numbers where each number is the sum of the two preceding ones: 0, 1, 1, 2, 3, 5, 8, 13, and so on. But what makes Fibonacci truly remarkable is its close connection to the Golden Ratio, a mathematical proportion found throughout nature and even in financial markets. By harnessing the power of Fibonacci, traders can gain insights into market trends, identify key levels, and make informed trading decisions.

In the following sections, we will explore the various aspects of Fibonacci in trading, from understanding the sequence and ratios to applying Fibonacci tools in real-world scenarios. So fasten your seatbelts and get ready to embark on a journey that will transform the way you view and approach trading. Let’s dive in and discover the untapped potential of Fibonacci in the financial markets.

Stay tuned for the upcoming sections, where we will explore:

- Understanding Fibonacci in Trading

- Fibonacci Tools for Precision Trading

- Applying Fibonacci in Real-World Trading Scenarios

- Tips and Best Practices for Effective Fibonacci Trading

- Case Studies: Success Stories with Fibonacci

Let’s begin this exciting adventure and unlock the power of Fibonacci in trading!

Understanding Fibonacci in Trading

Decoding the Fibonacci Sequence and the Golden Ratio

In the world of trading, understanding the fundamentals of Fibonacci is essential. The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding ones: 0, 1, 1, 2, 3, 5, 8, 13, and so on. While this sequence may seem like a mathematical curiosity, its significance lies in its connection to the Golden Ratio.

The Golden Ratio, approximately 1.618, is a mathematical proportion found in various natural phenomena and even financial markets. This ratio is derived by dividing a number in the Fibonacci sequence by its preceding number. As the sequence progresses, the ratio converges towards the Golden Ratio, resulting in a unique pattern that holds intriguing insights for traders.

Unveiling the Connection between Fibonacci and Market Trends

One of the key applications of Fibonacci in trading is its ability to identify potential market trends. Traders often observe that price movements tend to retrace or extend by specific percentages derived from the Fibonacci sequence. These percentages, known as Fibonacci retracement levels, act as crucial support and resistance zones in the market.

Fibonacci retracement levels, such as 38.2%, 50%, and 61.8%, are widely used by traders to determine possible entry and exit points. These levels indicate areas where price corrections may occur before the prevailing trend resumes. By incorporating Fibonacci retracement levels into their analysis, traders gain a better understanding of the market structure and can make more informed trading decisions.

Unleashing the Potential of Fibonacci Retracement Levels

Fibonacci retracement levels can be a valuable tool in a trader’s arsenal. When a market experiences a significant price movement, traders can apply Fibonacci retracement levels to identify potential levels of support or resistance where price might reverse or consolidate. By combining these levels with other technical indicators and chart patterns, traders can enhance the accuracy of their predictions and increase the probability of successful trades.

Additionally, Fibonacci extensions come into play when traders aim to project potential price targets beyond the initial price movement. These extensions, derived from the Fibonacci ratios, provide traders with additional levels to consider for taking profits or setting future price targets.

Understanding and effectively using Fibonacci retracement and extension levels can significantly improve the precision of your trading strategy.

Stay tuned for the next section, where we will explore in-depth the Fibonacci tools available for precision trading. Get ready to take your trading to the next level with Fibonacci!

Fibonacci Tools for Precision Trading

Exploring Fibonacci Retracement: Identifying Key Entry and Exit Points

When it comes to precision trading, Fibonacci retracement is a powerful tool in a trader’s arsenal. By applying Fibonacci retracement levels to a price chart, traders can identify potential areas of support and resistance. These levels, derived from the Fibonacci sequence and ratios, act as crucial decision points for entering or exiting trades.

Fibonacci retracement levels, such as 38.2%, 50%, and 61.8%, are commonly used by traders to determine the extent of a price correction during a trend. When a market experiences a pullback or a rally, these levels indicate the zones where price is likely to find support or encounter resistance before resuming its previous direction.

By incorporating Fibonacci retracement levels into their analysis, traders gain insights into the market’s structure and can make informed decisions. Combining Fibonacci retracement levels with other technical indicators or chart patterns enhances the accuracy of trade setups and improves the overall precision of trading strategies.

Projecting Price Targets with Fibonacci Extensions

While Fibonacci retracement levels help identify entry and exit points, Fibonacci extensions take precision trading a step further by providing potential price targets beyond the initial price movement. By projecting these extension levels, traders can gauge where price might reach during an extended trend or breakout.

Fibonacci extension levels are derived from the Fibonacci ratios beyond 100%. Common extension levels include 161.8%, 261.8%, and 423.6%. When price surpasses the previous swing high or low, these extension levels act as potential targets for taking profits or setting future price objectives.

By combining Fibonacci retracement and extension levels, traders can develop a comprehensive trading strategy that covers both entry and exit points. This multi-dimensional approach helps increase the precision of trade setups and allows traders to better manage risk while aiming for profitable outcomes.

Timing Market Reversals with Fibonacci Time Zones

In addition to retracement and extension levels, Fibonacci can also assist traders in timing market reversals and trend continuations using Fibonacci time zones. While price levels help determine where price may reverse or extend, time zones focus on when these market movements are likely to occur.

Fibonacci time zones are derived by dividing the length of a significant price movement into key Fibonacci ratios, such as 0.382, 0.50, 0.618, and so on. These time zones help traders anticipate potential turning points in the market, where price may exhibit a reversal or continuation pattern.

By combining Fibonacci time zones with other time-based indicators or chart patterns, traders can increase their ability to identify market reversals and capitalize on trend continuations. This precise timing can lead to improved trade entries and exits, enhancing overall profitability.

Stay tuned for the next section, where we will explore practical applications of Fibonacci tools in real-world trading scenarios. Get ready to witness the power of Fibonacci in action!

Applying Fibonacci in Real-World Trading Scenarios

Unlocking the Power of Fibonacci in Stock Market Trends

The application of Fibonacci in real-world trading scenarios is a game-changer for traders seeking precision and accuracy. Let’s explore how Fibonacci can be effectively applied in different markets, starting with the stock market.

When analyzing stock market trends, Fibonacci retracement levels play a vital role. By identifying significant price swings, traders can draw Fibonacci retracement levels to pinpoint potential support and resistance zones. These levels act as areas where price may retrace before continuing its overall trend.

For example, if a stock has experienced a strong uptrend, traders can draw Fibonacci retracement levels from the low point to the high point. The resulting retracement levels, such as 38.2%, 50%, and 61.8%, offer potential entry points for traders looking to join the uptrend or add to their existing positions. Conversely, if a stock is in a downtrend, Fibonacci retracement levels can help identify potential areas to short or exit long positions.

By combining Fibonacci retracement levels with other technical indicators, such as moving averages or trendlines, traders gain a comprehensive view of the stock’s price action. This integration of Fibonacci analysis with other tools empowers traders to make well-informed trading decisions in the dynamic stock market environment.

Fibonacci in Forex Trading: Unveiling Opportunities and Challenges

The foreign exchange (Forex) market presents exciting opportunities for traders, and Fibonacci analysis can be a valuable tool in navigating this vast market.

In Forex trading, Fibonacci retracement levels are widely used to identify potential support and resistance levels during currency price movements. Traders draw Fibonacci retracement levels from significant swing highs to swing lows or vice versa to determine possible reversal zones.

For instance, if a currency pair has experienced a strong upward trend, traders can draw Fibonacci retracement levels to identify potential levels where price may retrace before resuming its upward movement. These retracement levels act as potential entry points for traders who missed the initial uptrend or are looking to add to their positions.

Fibonacci extensions also find relevance in Forex trading, as they help project potential price targets during trend extensions. Traders can use Fibonacci extension levels to set profit targets or identify areas where price might encounter resistance or support during a trend continuation.

It’s important to note that while Fibonacci analysis can provide valuable insights, it is not a foolproof strategy. Traders should consider other technical indicators, fundamental analysis, and risk management techniques to make well-rounded trading decisions in the Forex market.

Navigating Cryptocurrency Trading with Fibonacci

Cryptocurrency trading presents unique challenges and opportunities, and Fibonacci analysis can assist traders in navigating this volatile market.

Similar to other financial markets, Fibonacci retracement levels can be applied to cryptocurrency price charts to identify potential support and resistance levels. These levels can be used to identify entry and exit points or to set stop-loss orders.

Cryptocurrency markets often exhibit strong trends, making Fibonacci extensions particularly useful. Traders can project potential price targets or areas of interest using Fibonacci extension levels, especially during breakout movements or strong upward trends.

However, it’s important to exercise caution when applying Fibonacci analysis to cryptocurrencies due to their inherent volatility. Cryptocurrency markets can experience rapid price fluctuations, and combining Fibonacci analysis with other indicators and risk management strategies is crucial for successful trading in this space.

Stay tuned for the next section, where we will explore tips and best practices for effective Fibonacci trading. Discover how to optimize your trading strategy and unlock the full potential of Fibonacci!

Tips and Best Practices for Effective Fibonacci Trading

Setting Up Fibonacci Tools for Seamless Analysis

To make the most of Fibonacci analysis, it’s essential to set up the Fibonacci tools correctly on your preferred trading platform. Here are some tips to ensure a seamless analysis experience:

-

Choose a reliable trading platform: Select a platform that offers Fibonacci tools and allows you to draw retracement levels, extensions, and time zones easily.

-

Customize Fibonacci levels: Customize the Fibonacci levels based on your trading preferences. While the default levels are commonly used, you can adjust them to match your specific trading style and market conditions.

-

Combine Fibonacci with other indicators: Enhance the effectiveness of Fibonacci analysis by incorporating it with other technical indicators, such as moving averages, oscillators, or trendlines. This holistic approach provides a comprehensive view of the market dynamics.

Understanding the Limitations of Fibonacci Analysis

While Fibonacci analysis is a powerful tool, it’s important to recognize its limitations and use it as part of a broader trading strategy. Here are a few key considerations:

-

Use Fibonacci in conjunction with other tools: Avoid relying solely on Fibonacci analysis for making trading decisions. Combine it with other technical and fundamental analysis methods to validate your trading signals.

-

Consider market context: Remember that Fibonacci levels are not foolproof indicators. Market conditions, news events, and other factors can influence price movements, sometimes leading to deviations from Fibonacci patterns. Always consider the overall market context when applying Fibonacci analysis.

-

Apply risk management techniques: Implement proper risk management strategies, including setting stop-loss orders, calculating position sizes based on risk tolerance, and managing trade exits. Fibonacci analysis can assist in identifying potential entry points, but risk management is crucial for overall trading success.

Experiment and Adapt Fibonacci to Your Trading Style

Every trader has a unique trading style and risk appetite. Use Fibonacci analysis as a versatile tool that can be adapted to your specific needs. Here’s how you can personalize your Fibonacci trading approach:

-

Adjust Fibonacci levels: Experiment with different Fibonacci levels and ratios to find the ones that align with your trading strategy and preferences. Some traders may find additional Fibonacci levels beyond the traditional ones to be more suitable for their analysis.

-

Validate with price action: Combine Fibonacci levels with price action patterns, such as candlestick formations or chart patterns, to enhance the reliability of your trade signals. Look for confluence between Fibonacci levels and other technical factors to increase the probability of successful trades.

-

Keep a trading journal: Maintain a trading journal to record your Fibonacci analysis and the outcomes of your trades. This practice helps you track the effectiveness of your Fibonacci-based strategies over time and make necessary adjustments as needed.

By experimenting, adapting, and documenting your Fibonacci trading experiences, you can refine your skills and develop a personalized approach that aligns with your trading style.

Stay tuned for the next section, where we will explore case studies and success stories of traders who have achieved remarkable results using Fibonacci techniques. Get ready to be inspired by real-life examples of Fibonacci in action!

Case Studies: Success Stories with Fibonacci

Case Study 1: Fibonacci Retracement in Stock Trading

In this case study, we examine how a trader successfully applied Fibonacci retracement in stock trading to identify key levels for entry and exit.

The trader identified a strong uptrend in a popular tech stock and wanted to enter a long position. Using Fibonacci retracement, they drew the retracement levels from the swing low to the swing high of the recent price movement.

The trader observed that the stock retraced to the 61.8% Fibonacci level, which coincided with a previous support level and a rising trendline. Recognizing this confluence of factors, the trader entered a long position, anticipating the stock’s resumption of the uptrend.

As the trade progressed, the stock price reached the 161.8% Fibonacci extension level, where the trader decided to take profits. The trade resulted in a substantial gain, showcasing the effectiveness of Fibonacci retracement in identifying both entry and exit points.

Case Study 2: Fibonacci Extensions in Forex Trading

In this case study, we explore how Fibonacci extensions were utilized in Forex trading to identify potential price targets during a strong trend.

A Forex trader identified a significant upward trend in a currency pair and wanted to set profit targets for their long position. Using Fibonacci extensions, they projected potential price levels beyond the initial price movement.

The trader drew Fibonacci extension levels from the swing low to the swing high of the trend, focusing on the 161.8% and 261.8% extensions. These levels acted as potential areas where the price could reach during the continuation of the upward trend.

As the price advanced, it eventually reached the 161.8% Fibonacci extension level. The trader decided to take partial profits at this level, while keeping a portion of the position open to capture further potential gains.

The trade proved successful as the price continued to rise and reached the 261.8% Fibonacci extension level, where the trader exited the remaining position. This case study illustrates the value of Fibonacci extensions in setting profit targets during trend extensions.

Case Study 3: Fibonacci Time Zones in Cryptocurrency Trading

In this case study, we examine how Fibonacci time zones were utilized in cryptocurrency trading to anticipate potential market reversals.

A cryptocurrency trader identified a prolonged upward trend in a popular digital asset and wanted to time their exit from the market to maximize profits. They applied Fibonacci time zones by dividing the length of the significant price movement into key Fibonacci ratios.

The trader noticed that the price reached a critical Fibonacci time zone, indicating a potential reversal point. Additionally, the price action displayed bearish candlestick patterns and exhibited overbought conditions according to oscillators.

Combining the signals from Fibonacci time zones, candlestick patterns, and oscillators, the trader decided to exit their position. Soon after, the cryptocurrency experienced a substantial price correction, confirming the accuracy of the Fibonacci time zone analysis.

This case study highlights the effectiveness of Fibonacci time zones in conjunction with other technical indicators for timing market reversals in the cryptocurrency space.

Stay tuned for the conclusion of our blog series, where we will summarize the key takeaways from using Fibonacci in trading and provide additional resources for further exploration. Get ready to enhance your trading strategies with the power of Fibonacci!

Conclusion

Unlocking Trading Precision with Fibonacci: Key Takeaways

In this blog series, we delved into the world of Fibonacci analysis and its application in trading. Here are the key takeaways to remember:

-

Fibonacci Retracement for Entry and Exit Points: Fibonacci retracement levels act as crucial decision points for entering or exiting trades. By identifying potential areas of support and resistance, traders can make informed decisions based on price retracements during trends.

-

Fibonacci Extensions for Price Targets: Fibonacci extensions project potential price targets beyond the initial price movement. These levels assist traders in setting profit targets and identifying areas where price may encounter resistance or support during trend extensions.

-

Fibonacci Time Zones for Timing Market Reversals: Fibonacci time zones help traders anticipate potential turning points in the market, where price may exhibit a reversal or continuation pattern. By combining Fibonacci time zones with other time-based indicators or chart patterns, traders can increase their ability to identify market reversals and capitalize on trend continuations.

-

Setting Up Fibonacci Tools for Seamless Analysis: Choose a reliable trading platform that offers Fibonacci tools and customize the Fibonacci levels based on your trading preferences. Combining Fibonacci analysis with other technical indicators enhances its effectiveness and provides a comprehensive view of the market.

-

Understanding Limitations and Personalizing Fibonacci Analysis: While Fibonacci analysis is a powerful tool, it should be used as part of a broader trading strategy. Consider other indicators, market context, and risk management techniques to validate and enhance the accuracy of Fibonacci signals. Personalize your Fibonacci analysis by adjusting levels and validating them with price action patterns.

Enhance Your Trading Strategies with Fibonacci Techniques

Fibonacci analysis provides traders with a systematic and logical approach to analyzing financial markets. By incorporating Fibonacci retracement, extensions, and time zones into your trading strategies, you can unlock precision and improve your decision-making process.

Remember, mastering Fibonacci analysis requires practice, experimentation, and continuous learning. Stay updated with the latest market trends, study real-life examples, and refine your skills to harness the full potential of Fibonacci in your trading journey.

We hope this blog series has shed light on the power of Fibonacci and inspired you to explore its applications further. By combining the art of trading with the mathematical precision of Fibonacci, you can elevate your trading game and make more informed decisions.

For additional resources, tutorials, and tools related to Fibonacci analysis, check out our recommended links below. Join the community of Fibonacci traders, share your insights, and embark on a rewarding journey towards trading success.

Happy Fibonacci trading!