Short Version

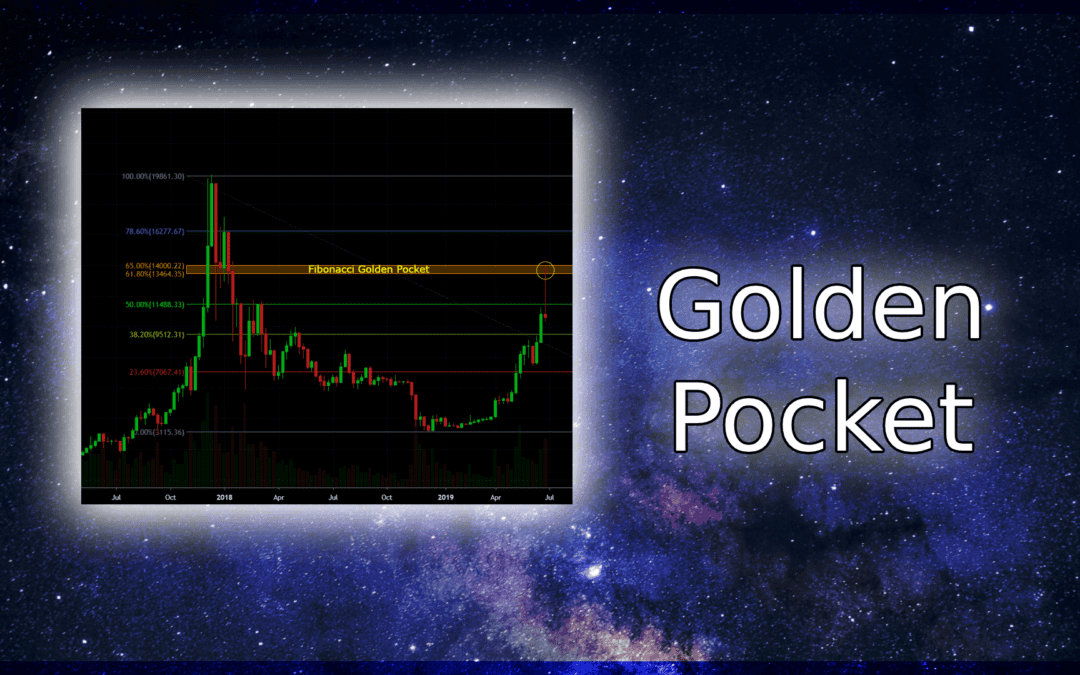

The Fibonacci Golden Pocket refers to a specific zone on a price chart that is derived from the Fibonacci retracement levels of 61.8% and 50%. This zone is considered significant in trading because it often serves as a point of support or resistance for price movements. Traders use the Fibonacci Golden Pocket to identify potential entry and exit points in the market. It is a powerful tool that helps traders make more informed decisions and increase the likelihood of successful trades

Examples of Golden Pocket

You can find more examples of Golden Zone in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

Long Version

Introduction

In the fast-paced world of trading, understanding the right tools and strategies can make all the difference between success and failure. One such powerful tool that has gained significant attention is the Fibonacci Golden Pocket. By incorporating this unique concept into your trading arsenal, you can unlock the secret to maximizing your profits and making informed trading decisions.

The Power of the Fibonacci Golden Pocket

The Fibonacci Golden Pocket derives its strength from the famous Fibonacci sequence, a mathematical pattern that appears throughout nature and the financial markets. Traders have discovered that specific ratios within this sequence hold crucial importance when it comes to identifying potential turning points and trend reversals.

The Fibonacci Golden Pocket is a specific retracement level derived from the Fibonacci sequence. It represents a zone on a price chart where the market is likely to experience a significant bounce or continuation in the prevailing trend. By understanding and harnessing the power of the Fibonacci Golden Pocket, traders gain a unique advantage in predicting future price movements.

In the following sections, we will delve deeper into the intricacies of the Fibonacci Golden Pocket and explore how you can master its application in your trading endeavors. We will cover its calculation, its relevance in the trading world, practical steps to implement it, and advanced strategies that can help you take your trading to the next level.

So, let’s embark on this exciting journey into the realm of the Fibonacci Golden Pocket and unlock its potential to revolutionize your trading success.

Understanding the Fibonacci Golden Pocket

To effectively incorporate the Fibonacci Golden Pocket into your trading strategy, it’s crucial to grasp its underlying principles and how it relates to the broader concept of Fibonacci retracement levels.

Fibonacci Retracement Levels: A Brief Overview

Fibonacci retracement levels are horizontal lines drawn on a price chart that indicate potential areas of support or resistance during a price correction. These levels are derived from the Fibonacci sequence, a series of numbers in which each number is the sum of the two preceding numbers (e.g., 0, 1, 1, 2, 3, 5, 8, and so on).

The most commonly used Fibonacci retracement levels are 38.2%, 50%, and 61.8%, although other ratios like 23.6% and 78.6% are also considered significant. These levels act as psychological and technical support or resistance zones, where price often reacts or reverses.

Introducing the Fibonacci Golden Pocket

The Fibonacci Golden Pocket takes the concept of Fibonacci retracement levels a step further. It is a narrower range within the retracement levels that traders have identified as a critical zone for potential trend reversals or significant bounces.

The Fibonacci Golden Pocket is defined by two key Fibonacci retracement levels—61.8% and 50%. This pocket represents the sweet spot where price is more likely to find support or resistance before continuing its previous trend. It is considered a highly reliable level for identifying entry or exit points, as well as for managing risk and reward in trades.

Understanding the significance of the Fibonacci Golden Pocket can help you make informed trading decisions and improve your overall success rate in the markets.

In the next section, we will delve deeper into why the Fibonacci Golden Pocket holds such importance in the world of trading and how it can enhance your trading performance.

Why the Fibonacci Golden Pocket Matters in Trading

The Fibonacci Golden Pocket holds significant importance in the world of trading due to its ability to provide valuable insights into potential entry and exit points, as well as overall market trends. Understanding why it matters can help you harness its power to enhance your trading performance.

Identifying Potential Entry and Exit Points

One of the key reasons the Fibonacci Golden Pocket matters in trading is its ability to identify potential entry and exit points with a high degree of accuracy. As price approaches the Fibonacci Golden Pocket, it often acts as a strong support or resistance level, providing traders with opportunities to enter trades or secure profits.

By using the Fibonacci Golden Pocket in conjunction with other technical indicators or chart patterns, traders can develop a well-rounded trading strategy that increases the likelihood of capturing profitable trades while managing risk effectively.

Gauging Market Reversals and Continuations

The Fibonacci Golden Pocket also serves as a powerful tool for gauging market reversals and continuations. When price retraces to the Fibonacci Golden Pocket and finds support or resistance, it often indicates a potential reversal in the prevailing trend. Traders can capitalize on this information to enter trades in the direction of the anticipated reversal, maximizing their profit potential.

Furthermore, when price successfully breaks through the Fibonacci Golden Pocket, it suggests a continuation of the existing trend. Traders can use this signal to stay in trades and ride the trend for extended profit opportunities.

Managing Risk and Reward

Effective risk management is paramount in trading, and the Fibonacci Golden Pocket can assist in this aspect as well. By identifying the Fibonacci Golden Pocket as a potential support or resistance level, traders can place stop-loss orders strategically below or above this zone to limit potential losses.

Simultaneously, the Fibonacci Golden Pocket helps determine profit targets by highlighting potential areas where price may encounter significant resistance or support. Traders can adjust their take-profit levels accordingly, optimizing their risk-to-reward ratio and maximizing potential gains.

In the next section, we will explore practical steps to implement the Fibonacci Golden Pocket in your trading strategy, allowing you to leverage its benefits and enhance your trading success.

Practical Steps to Implement the Fibonacci Golden Pocket

Implementing the Fibonacci Golden Pocket into your trading strategy can significantly enhance your ability to identify optimal entry and exit points. By following these practical steps, you can effectively integrate the Fibonacci Golden Pocket into your trading routine.

Step 1: Identify the Trend and Select a Suitable Timeframe

Before applying the Fibonacci Golden Pocket, it’s essential to identify the prevailing trend in the market. Determine whether the trend is bullish or bearish, as this will guide your trading decisions.

Additionally, select a suitable timeframe that aligns with your trading goals and preferences. Shorter timeframes may be ideal for day trading, while longer timeframes provide a broader perspective for swing or position trading.

Step 2: Identify the Swing High and Swing Low Points

Identify the swing high and swing low points within the selected timeframe. The swing high represents a peak in price, while the swing low represents a trough. These points will serve as the foundation for calculating the Fibonacci retracement levels and, subsequently, the Fibonacci Golden Pocket.

Step 3: Plot the Fibonacci Retracement Levels

Using charting software or tools, plot the Fibonacci retracement levels from the swing high to the swing low. The most crucial levels to include are 61.8% and 50%, representing the Fibonacci Golden Pocket.

Step 4: Assess Price Reaction at the Fibonacci Golden Pocket

Observe how price reacts as it approaches the Fibonacci Golden Pocket. Look for signs of support or resistance, such as price stalling, bouncing, or breaking through the levels. These reactions can provide valuable insights into potential entry or exit points.

Step 5: Confirm with Other Technical Indicators

While the Fibonacci Golden Pocket is a powerful tool on its own, it’s always beneficial to confirm signals with other technical indicators or chart patterns. Consider incorporating moving averages, trendlines, or oscillators to validate the potential trade setup before executing your trades.

Step 6: Set Stop-Loss and Take-Profit Levels

Based on the Fibonacci Golden Pocket analysis and your risk management strategy, set appropriate stop-loss and take-profit levels. Place your stop-loss orders below or above the Fibonacci Golden Pocket to limit potential losses, and set your take-profit levels at areas of significant support or resistance identified by the Fibonacci Golden Pocket.

By following these practical steps, you can effectively implement the Fibonacci Golden Pocket into your trading strategy and take advantage of its predictive power.

In the next section, we will explore common mistakes to avoid when using the Fibonacci Golden Pocket, ensuring that you make informed trading decisions and maximize your trading success.

Common Mistakes to Avoid

While the Fibonacci Golden Pocket can be a valuable tool in your trading arsenal, it’s important to be aware of common mistakes that traders often make when utilizing this technique. By avoiding these pitfalls, you can ensure that you make informed trading decisions and maximize the effectiveness of the Fibonacci Golden Pocket.

Mistake 1: Overlooking Confluence Factors

One common mistake is solely relying on the Fibonacci Golden Pocket without considering other confluence factors. Confluence refers to the convergence of multiple technical indicators or chart patterns that support a particular trading setup. It’s crucial to assess additional factors such as trendlines, moving averages, or candlestick patterns to validate the signals generated by the Fibonacci Golden Pocket.

Mistake 2: Neglecting Risk Management

Effective risk management is paramount in trading. Neglecting risk management principles, such as setting appropriate stop-loss orders and position sizing, can lead to significant losses. Ensure that you establish a risk management plan that aligns with your trading strategy and adhere to it consistently.

Mistake 3: Misinterpreting Support and Resistance Levels

Traders often misinterpret support and resistance levels when using the Fibonacci Golden Pocket. It’s essential to remember that these levels are zones rather than exact price points. Price may fluctuate within these zones, so it’s crucial to consider other factors, such as candlestick patterns or price action, to validate potential trade entries or exits.

Mistake 4: Failing to Adapt to Changing Market Conditions

Market conditions can change rapidly, and failing to adapt can lead to missed opportunities or losses. It’s important to recognize that the effectiveness of the Fibonacci Golden Pocket may vary in different market environments. Continuously monitor market conditions and be flexible in your approach, adjusting your trading strategy accordingly.

Mistake 5: Allowing Emotions to Influence Decision-Making

Emotions can cloud judgment and lead to impulsive trading decisions. It’s vital to remain disciplined and stick to your trading plan when using the Fibonacci Golden Pocket. Avoid making emotional decisions based on short-term price fluctuations and instead focus on the overall trend and signals generated by the Fibonacci Golden Pocket.

By being aware of these common mistakes and taking proactive steps to avoid them, you can effectively harness the power of the Fibonacci Golden Pocket and enhance your trading success.

In the next section, we will explore advanced techniques and strategies that can further amplify the effectiveness of the Fibonacci Golden Pocket, allowing you to take your trading to the next level.

Advanced Techniques and Strategies

To further amplify the effectiveness of the Fibonacci Golden Pocket and elevate your trading performance, consider incorporating advanced techniques and strategies. These advanced approaches can provide valuable insights and enhance your ability to identify optimal entry and exit points.

Fibonacci Extensions and Projections

While the Fibonacci Golden Pocket focuses on retracement levels, Fibonacci extensions and projections can expand your analysis beyond the retracement zone. Fibonacci extensions help identify potential profit targets by projecting price levels beyond the previous swing high or low. Fibonacci projections, on the other hand, utilize the Fibonacci ratios to project future price levels based on the length of a previous price move.

Integrating Fibonacci extensions and projections with the Fibonacci Golden Pocket can help you determine potential areas of price extension or reversal, enhancing your ability to set accurate profit targets and identify trend continuation or reversal points.

Combining with Other Indicators and Oscillators

To further validate signals generated by the Fibonacci Golden Pocket, consider combining it with other technical indicators and oscillators. For example, you can use moving averages to confirm trend direction or momentum oscillators like the Relative Strength Index (RSI) to identify overbought or oversold conditions.

By incorporating multiple indicators and oscillators, you can strengthen your trading signals and increase the probability of successful trades.

Harmonic Pattern Analysis

Harmonic patterns, such as the Gartley, Butterfly, or Bat patterns, are geometric price patterns that incorporate Fibonacci ratios. These patterns offer additional insights into potential reversal or continuation points in the market. By combining harmonic pattern analysis with the Fibonacci Golden Pocket, you can identify high-probability trade setups that align with the underlying market structure.

Multiple Timeframe Analysis

Expanding your analysis to multiple timeframes can provide a comprehensive view of the market and enhance your trading decisions. While the Fibonacci Golden Pocket on a specific timeframe may present a potential trade setup, observing higher timeframes can confirm the overall trend direction and provide additional context.

Performing multiple timeframe analysis allows you to align your trades with the broader market structure, increasing the likelihood of successful trades.

Backtesting and Practice

To solidify your understanding and refine your skills with the Fibonacci Golden Pocket, it’s crucial to backtest your trading strategy and practice in a simulated trading environment. Backtesting involves applying your strategy to historical price data to assess its performance and identify potential strengths or weaknesses.

By practicing your trading strategy and analyzing past performance, you can gain confidence in using the Fibonacci Golden Pocket and fine-tune your approach for real-time trading.

Incorporating these advanced techniques and strategies can help you unlock the full potential of the Fibonacci Golden Pocket and take your trading to the next level. Experiment with different approaches and find the combination that best suits your trading style and objectives.

In the concluding section, we will recap the key points discussed and encourage you to leverage the power of the Fibonacci Golden Pocket to maximize your trading success.

Conclusion

The Fibonacci Golden Pocket is a powerful tool that holds immense potential for traders seeking to improve their trading performance. By understanding the principles behind the Fibonacci Golden Pocket and implementing it strategically in your trading strategy, you can gain a unique advantage in identifying optimal entry and exit points, managing risk effectively, and maximizing your profits.

Unleashing the Power of the Fibonacci Golden Pocket

Through our exploration, we have learned that the Fibonacci Golden Pocket, derived from the Fibonacci retracement levels of 61.8% and 50%, represents a critical zone on a price chart where the market is likely to experience significant support or resistance. This pocket serves as a guide to traders in identifying potential trend reversals, entry and exit points, and managing risk and reward in their trades.

By following practical steps to implement the Fibonacci Golden Pocket, such as identifying the trend, plotting the retracement levels, and assessing price reactions, you can harness the predictive power of this tool and make informed trading decisions.

We have also highlighted common mistakes to avoid, such as overlooking confluence factors, neglecting risk management, and misinterpreting support and resistance levels. By being aware of these pitfalls, you can navigate the markets with greater precision and avoid unnecessary losses.

Moreover, we explored advanced techniques and strategies that can amplify the effectiveness of the Fibonacci Golden Pocket. By incorporating Fibonacci extensions and projections, combining with other indicators, utilizing harmonic pattern analysis, and performing multiple timeframe analysis, you can enhance the accuracy of your trading signals and elevate your trading performance.

Embrace the Fibonacci Golden Pocket and Excel in Trading

In conclusion, the Fibonacci Golden Pocket is a powerful and versatile tool that can revolutionize your trading success. By mastering its application, you can unlock the potential to identify optimal entry and exit points, manage risk effectively, and make well-informed trading decisions.

Remember to continually practice and refine your trading strategy, conduct thorough analysis, and adapt to changing market conditions. By doing so, you can leverage the full potential of the Fibonacci Golden Pocket and achieve consistent profitability in your trading endeavors.

So, embrace the Fibonacci Golden Pocket, immerse yourself in the world of trading, and embark on a journey of increased profitability and trading success!

If you have any further questions or need assistance, feel free to reach out. Happy trading!