Short Version

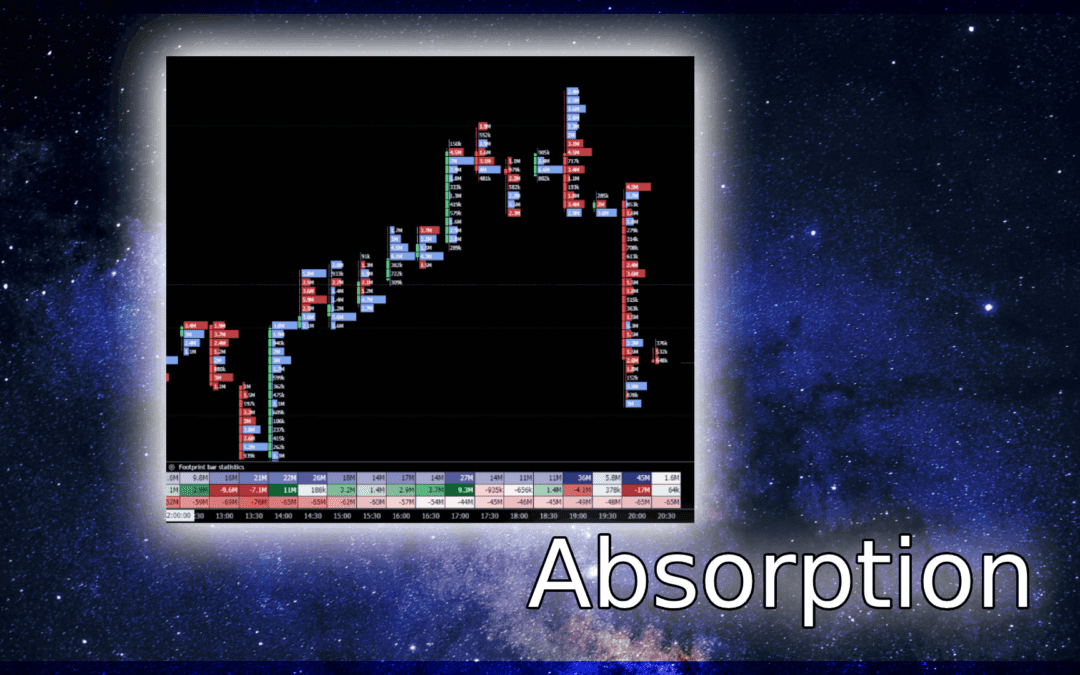

Absorption, in the context of trading, refers to the process of absorbing market liquidity at specific price levels. It involves identifying key zones where buying or selling pressure is concentrated. By understanding and utilizing absorption strategies, traders can gain valuable insights into market sentiment and make more informed trading decisions.

Absorption zones act as important levels of support or resistance, indicating areas where market participants are actively absorbing orders. These zones are characterized by increased buying or selling activity, often leading to price reversals or breakouts.

Traders who recognize absorption patterns and interpret them correctly can anticipate potential market movements and align their trading strategies accordingly. By leveraging absorption techniques, traders aim to stay ahead of the game and capitalize on trading opportunities.

Examples of Absorption

You can find more examples of Absorption in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

Long Version

Introduction

In the world of trading, staying ahead of the game is crucial for success. As a trader, you need to constantly evolve and adapt to ever-changing market conditions. One strategy that can give you a competitive edge is harnessing absorption techniques. In this blog post, we will dive deep into the concept of absorption in trading and explore how you can leverage absorption strategies to maximize your trading success.

Why Absorption Strategies Matter

In trading, absorption refers to the process of absorbing market liquidity at specific price levels. It involves identifying key zones where buying or selling pressure is concentrated. By understanding and utilizing absorption strategies, you can gain valuable insights into market sentiment and make more informed trading decisions.

As a trader, you know that timing is everything. Absorption strategies help you identify optimal entry and exit points, enabling you to capitalize on potential price reversals or breakouts. By recognizing absorption zones and patterns, you can ride the wave of market movements and potentially boost your trading returns.

But how exactly do absorption strategies work? In the following sections, we will explore some key techniques that can help you harness the power of absorption in your trading endeavors. So, let’s dive in and uncover the secrets of successful absorption strategies!

Understanding Absorption in Trading

As a trader, it’s essential to grasp the concept of absorption and its significance in the world of trading. Absorption plays a crucial role in analyzing market dynamics and identifying trading opportunities. In this section, we will delve into what absorption is and how it relates to your trading success.

What is Absorption?

Absorption in trading refers to the process of absorbing market liquidity at specific price levels. It occurs when buying or selling pressure is concentrated, resulting in price consolidation or temporary halts. By identifying absorption zones, traders can gain insights into the balance of supply and demand and anticipate potential market movements.

Absorption zones act as important levels of support or resistance, indicating areas where market participants are actively absorbing orders. These zones are characterized by increased buying or selling activity, often leading to price reversals or breakouts.

The Role of Absorption in Trading

Understanding absorption is crucial because it helps you gauge market sentiment and make informed trading decisions. By identifying absorption zones, you can assess the strength of buyers or sellers in the market.

When absorption occurs at support levels, it suggests that buyers are actively absorbing the available supply, indicating potential upward price movement. On the other hand, absorption at resistance levels suggests that sellers are absorbing the demand, indicating potential downward price movement.

By recognizing absorption patterns and interpreting them correctly, you can anticipate market reversals or breakouts and align your trading strategies accordingly. Absorption analysis can enhance your ability to time your trades effectively and increase the probability of favorable outcomes.

In the next section, we will explore some key absorption strategies that traders employ to harness the power of absorption in their trading activities. Stay tuned to uncover actionable techniques that can elevate your trading game!

Key Absorption Strategies for Trading Success

To leverage the power of absorption in trading, it’s essential to employ effective strategies that capitalize on absorption zones and patterns. In this section, we will explore some key absorption strategies that can help you achieve trading success.

Strategy 1: Recognizing Absorption Zones

Identifying absorption zones is a crucial step in utilizing absorption strategies. By recognizing these zones on price charts, you can gain insights into the strength of buying or selling pressure. Here are some tips to help you recognize absorption zones:

- Look for price consolidations or sideways movements within a defined range.

- Pay attention to increased volume or trading activity during these consolidations.

- Monitor the order flow and observe if market participants are actively absorbing orders at specific price levels.

Once you identify absorption zones, you can use them as potential entry or exit points in your trades. These zones act as important levels of support or resistance, and trading opportunities may arise when price breaks out of these absorption areas.

Strategy 2: Riding the Absorption Wave

Absorption patterns can provide valuable signals for potential price reversals or breakouts. By understanding and riding the absorption wave, you can enhance your trading success. Here’s how you can utilize this strategy:

- Learn to identify common absorption patterns such as absorption humps, absorption tails, or absorption wicks.

- Analyze the context in which these patterns occur, such as after a prolonged uptrend or downtrend.

- Enter trades when price breaks out of the absorption pattern, confirming a potential reversal or continuation.

Remember to combine this strategy with other technical indicators or analysis techniques to increase the probability of favorable outcomes.

Strategy 3: Capitalizing on Absorption Volume

Volume analysis is an important aspect of absorption strategies. Monitoring volume during absorption phases can provide additional confirmation for trading decisions. Here’s how you can incorporate absorption volume into your strategy:

- Pay attention to volume spikes or surges during absorption zones or pattern formations.

- Higher volume during absorption suggests increased participation and potential market interest.

- Confirm your trading decisions by aligning volume analysis with price action and other indicators.

By combining volume analysis with absorption patterns, you can gain a more comprehensive understanding of market dynamics and make more informed trading choices.

In the next section, we will provide practical tips for implementing these absorption strategies effectively. Stay tuned to elevate your trading game and maximize your success!

Tips for Implementing Absorption Strategies

Implementing absorption strategies effectively is key to maximizing their potential impact on your trading success. In this section, we will share practical tips to help you integrate absorption strategies into your trading routine.

Tip 1: Prioritize Risk Management

While absorption strategies can enhance your trading outcomes, it’s crucial to prioritize risk management. Set clear stop-loss levels to protect your capital in case the market moves against your trade. Consider position sizing based on your risk tolerance and ensure you have a well-defined risk-reward ratio for each trade.

Tip 2: Test and Validate Strategies

Before fully incorporating absorption strategies into your trading, it’s advisable to test and validate them. Backtest historical data, use paper trading accounts, or experiment with small positions to assess the effectiveness of your chosen strategies. Make adjustments as needed and gather sufficient evidence of their reliability before deploying them with larger positions.

Tip 3: Continuous Learning and Adaptation

The trading landscape is ever-evolving, and it’s essential to stay updated with new trends and market dynamics. Continuously invest in your education and keep refining your absorption strategies. Stay engaged with trading communities, follow industry experts, and attend webinars or seminars to stay ahead of the curve.

Tip 4: Embrace Technology and Tools

Leverage technology and trading tools to streamline your absorption strategy implementation. Utilize charting platforms with advanced features to identify absorption patterns, set alerts for specific price levels or volume surges, and automate trade executions when conditions are met. These tools can save time, improve efficiency, and increase the accuracy of your absorption strategy implementation.

Tip 5: Keep a Trading Journal

Maintaining a trading journal is invaluable for tracking your progress and learning from your experiences. Record your trades, including the rationale behind each trade, entry and exit points, and the outcomes. Review your journal regularly to identify patterns, strengths, and areas for improvement. A trading journal can help you refine your absorption strategies and enhance your overall trading approach.

By following these tips, you can implement absorption strategies with confidence and increase your chances of trading success. Remember, consistency, discipline, and continuous improvement are key to achieving your trading goals.

In the concluding section, we will summarize the key points discussed and leave you with a final thought to inspire your trading journey. Stay tuned for the grand finale!

Conclusion

Congratulations! You have now unlocked the secrets of absorption strategies and their potential to elevate your trading success. By harnessing absorption zones, recognizing patterns, and leveraging volume analysis, you can gain valuable insights into market dynamics and make informed trading decisions.

Remember, implementing absorption strategies requires a combination of skill, practice, and adaptability. Continuously refine your strategies, prioritize risk management, and stay updated with market trends. Embrace technology and tools to streamline your trading process, and keep a trading journal to track your progress and learn from your experiences.

Trading is a journey of constant learning and adaptation. As you navigate the ever-changing market landscape, be patient, disciplined, and focused on your goals. Absorption strategies can give you an edge, but success ultimately depends on your dedication and commitment to continuous improvement.

So, start implementing absorption strategies in your trading routine today. Stay ahead of the game, ride the absorption waves, and capitalize on market opportunities. Remember, trading success is within your reach if you embrace the power of absorption.

Thank you for joining us on this exploration of absorption strategies for trading success. We hope this blog post has provided you with valuable insights and actionable techniques. Now it’s time for you to take what you’ve learned and apply it in your trading journey.

Wishing you all the best in your trading endeavors. May your absorption strategies lead you to greater profits and financial freedom. Happy trading!

Keep learning, keep adapting, and keep trading like a pro!