Short Version

Auction Market Theory (AMT) is a framework used by traders to analyze market dynamics and make informed trading decisions. It is based on the concept that markets behave like auctions, with buyers and sellers interacting to determine prices. AMT focuses on understanding the interplay between supply and demand, depth and liquidity analysis, price action patterns, and market sentiment indicators. By studying these elements, traders aim to identify areas of interest, such as support and resistance levels, and anticipate potential price movements. AMT provides valuable insights into market behavior and can help traders gain a competitive edge in their trading strategies.

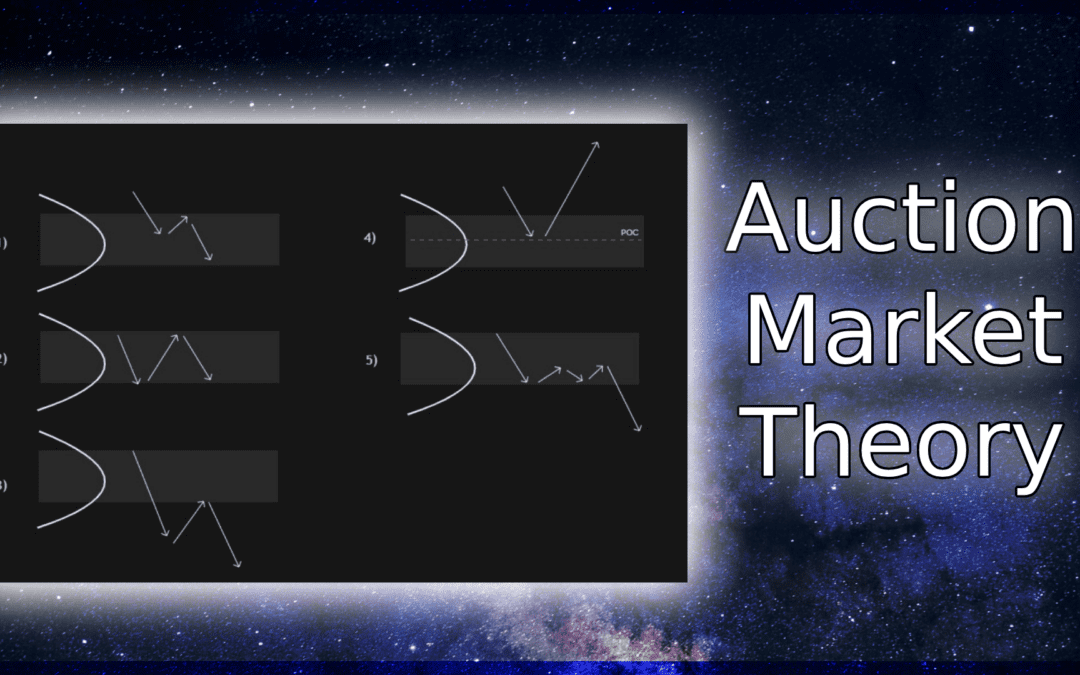

Examples of AMT

You can find more examples of AMT in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

Long Version

Introduction

The Importance of Effective Trading Strategies

In the fast-paced world of trading, having a solid strategy is crucial for success. Whether you’re a seasoned trader or just starting out, understanding the intricacies of the market and having a competitive edge can make all the difference. That’s where Auction Market Theory (AMT) comes into play. AMT is a powerful tool that can unlock a deeper understanding of market dynamics and help traders make informed decisions.

Unveiling Auction Market Theory (AMT)

At its core, Auction Market Theory is a framework that analyzes market behavior through the lens of auctions. Just like in a traditional auction where buyers and sellers compete to determine the price of an item, the financial markets also operate as auction-like environments. AMT provides traders with insights into how the market behaves, revealing the ebb and flow of supply and demand, and the resulting price action.

Why Understanding AMT Matters

Having a solid grasp of Auction Market Theory can be a game-changer for traders. By understanding the principles and components of AMT, traders can make more informed decisions, identify market trends, and better time their entries and exits. It provides a holistic view of market dynamics, helping traders navigate the complexities of supply and demand, and enabling them to anticipate market movements with greater accuracy.

In the following sections, we will delve deeper into the intricacies of Auction Market Theory, explore its key elements, and uncover how you can implement AMT in your trading strategy to enhance your chances of success.

What is Auction Market Theory?

Understanding the Foundation of Auction Market Theory (AMT)

Auction Market Theory (AMT) is a powerful concept that provides traders with valuable insights into market dynamics. At its core, AMT analyzes the behavior of financial markets through the lens of auctions. Just as buyers and sellers interact in a traditional auction setting to determine the price of an item, the financial markets function as auction-like environments where participants compete to buy and sell assets.

The Evolution of Auction Market Theory

The roots of Auction Market Theory can be traced back to the pioneering work of market analysts and traders who sought to understand the mechanics behind market movements. Over time, AMT has evolved into a comprehensive framework that helps traders make sense of the complex interactions between buyers, sellers, and market forces. It has become a fundamental tool for analyzing market behavior and developing trading strategies.

Key Principles of Auction Market Theory

Auction Market Theory revolves around several key principles that provide a deeper understanding of market dynamics. These principles include:

1. Market as an Auction: Viewing the market as a continuous series of auctions where participants compete to buy and sell assets.

2. Supply and Demand: Recognizing that the interaction between supply and demand determines price movement and market trends.

3. Market Profile: Utilizing market profile charts to visualize the distribution of trading activity and identify areas of interest.

4. Price Action Analysis: Studying price patterns and the behavior of market participants to gain insights into future price movements.

By embracing these principles, traders can gain a comprehensive perspective on market behavior and make more informed trading decisions.

In the upcoming sections, we will explore the power of Auction Market Theory in trading and delve deeper into the key elements that constitute AMT.

The Power of Auction Market Theory in Trading

Gaining Deeper Insights with Auction Market Theory (AMT)

Auction Market Theory (AMT) is a game-changer for traders, providing them with powerful insights into market dynamics. By analyzing market behavior through the lens of auctions, AMT offers a unique perspective on supply and demand, price action, and market sentiment. This deeper understanding enables traders to make more informed decisions and gain a competitive edge in the market.

Advantages of Using Auction Market Theory (AMT)

Utilizing Auction Market Theory in trading strategies offers several advantages:

1. Improved Decision Making: AMT helps traders make better decisions by providing a comprehensive view of market dynamics. By understanding supply and demand, traders can identify key price levels, anticipate market movements, and time their trades more effectively.

2. Enhanced Risk Management: AMT allows traders to assess market sentiment and gauge the balance between buyers and sellers. This information enables them to manage risk more effectively, adjust position sizes, and set appropriate stop-loss levels.

3. Trading with Market Trends: By analyzing market profile charts and price action, AMT helps traders identify trends and market biases. This allows them to align their trading strategies with the prevailing market direction, increasing the probability of successful trades.

4. Increased Profit Potential: The insights gained from AMT can lead to better trading opportunities. By identifying areas of high liquidity or significant imbalances between supply and demand, traders can capitalize on price movements and potentially increase their profitability.

Real-Life Success Stories

Numerous traders have experienced remarkable success by incorporating Auction Market Theory into their trading. By utilizing AMT to analyze market behavior, these traders have been able to make well-timed entries, identify high-probability trading setups, and stay ahead of market trends. Their success stories serve as a testament to the power of AMT in unlocking trading opportunities.

In the following sections, we will explore the key elements of Auction Market Theory and delve deeper into how you can implement AMT in your own trading strategies to harness its full potential.

Key Elements of Auction Market Theory

Understanding Depth and Liquidity in the Auction Process

In Auction Market Theory (AMT), depth and liquidity play a crucial role in understanding market dynamics. Depth refers to the volume of orders available at different price levels, indicating the market’s ability to absorb buying or selling pressure. Liquidity, on the other hand, reflects the ease with which assets can be bought or sold without causing significant price movements. By analyzing depth and liquidity, traders can gain insights into market strength, potential supply and demand imbalances, and key support or resistance levels.

Unraveling Supply and Demand Dynamics

Supply and demand are fundamental drivers of market movements, and Auction Market Theory provides a framework for understanding their interplay. By analyzing the interaction between buyers and sellers, traders can identify areas of price equilibrium or imbalance. Understanding the shifts in supply and demand allows traders to anticipate price movements, identify potential reversals or breakouts, and make informed trading decisions.

Price Action and Market Sentiment Analysis using AMT

Price action analysis is a critical component of Auction Market Theory. By studying price patterns, market profile charts, and the behavior of market participants, traders can gain insights into market sentiment and directional biases. This analysis helps identify areas of support and resistance, trend continuation or reversal patterns, and potential entry or exit points. By combining price action analysis with AMT principles, traders can enhance their understanding of market psychology and make more accurate predictions.

The Role of Time in Auction Market Theory

Time is an essential factor in Auction Market Theory analysis. By observing how price moves over different time frames, traders can identify the market’s pace and rhythm. Time-based analysis, such as market profile charts and time-sensitive indicators, provides valuable information about market trends, volatility, and trading opportunities. By incorporating time into their analysis, traders can gain a deeper understanding of the market’s structure and make better-informed decisions.

In the upcoming sections, we will explore practical ways to implement Auction Market Theory in your trading routine, leveraging these key elements to enhance your trading strategies.

Implementing Auction Market Theory in Your Trading

Step-by-Step Guide to Incorporating Auction Market Theory (AMT)

Auction Market Theory (AMT) can be a valuable tool in your trading arsenal. Here’s a step-by-step guide to help you implement AMT into your trading routine:

1. Educate Yourself: Start by learning the core concepts and principles of AMT. Familiarize yourself with depth and liquidity analysis, supply and demand dynamics, price action patterns, and market sentiment indicators. This foundation will help you understand how to interpret and apply AMT to your trading.

2. Analyze Market Profile: Utilize market profile charts to gain insights into the distribution of trading activity at different price levels. Pay attention to areas of high volume, low volume, and price acceptance. This analysis will help you identify areas of interest, such as value areas or potential support and resistance levels.

3. Monitor Depth and Liquidity: Keep an eye on the order book and observe the depth and liquidity at different price levels. Look for significant imbalances or areas of high liquidity that may influence price movements. Understanding depth and liquidity can help you identify potential areas of buying or selling pressure.

4. Incorporate Price Action Analysis: Study price patterns and market structure to identify key support and resistance levels, trend continuation or reversal patterns, and potential entry or exit points. Combine your AMT analysis with price action signals to make more informed trading decisions.

5. Stay Mindful of Market Sentiment: Monitor market sentiment indicators to gauge the overall mood of market participants. This can help you assess the balance between buyers and sellers and identify potential shifts in sentiment. Understanding market sentiment can provide valuable insights into future price movements.

6. Practice and Refine: Implementing AMT into your trading requires practice and refinement. Start by paper trading or using a demo account to test your strategies. Analyze your trades and learn from your successes and failures. Continuously refine your approach based on your observations and experiences.

Tools and Resources for Analyzing Auction Market Theory

Incorporating AMT into your trading is made easier with the help of various tools and resources. Here are some popular options:

– Market profile charting platforms: There are several software platforms that provide market profile charts, allowing you to visualize the distribution of trading activity and analyze value areas.

– Order book data: Utilize order book data provided by trading platforms to assess depth and liquidity at different price levels.

– Price action indicators: Use technical indicators that focus on price action, such as support and resistance indicators, trend indicators, and candlestick pattern recognition tools.

– Sentiment indicators: Explore sentiment indicators that measure the overall sentiment of market participants, such as the put-call ratio, the Volatility Index (VIX), or proprietary sentiment indicators.

By leveraging these tools and resources, you can enhance your AMT analysis and make more informed trading decisions.

In the following sections, we will delve deeper into practical tips and best practices for effectively implementing Auction Market Theory in your trading strategy.

Common Mistakes to Avoid when Using Auction Market Theory

The Pitfalls of Misinterpreting Depth and Liquidity Analysis

Depth and liquidity analysis is a crucial aspect of Auction Market Theory (AMT), but it can be prone to misinterpretation. Here are some common mistakes to avoid:

1. Focusing Solely on Price Levels: Relying only on price levels without considering the corresponding depth and liquidity can lead to inaccurate assessments. It’s essential to analyze the relationship between price levels and the orders available to gain a more comprehensive understanding of market dynamics.

2. Neglecting Order Book Dynamics: The order book is constantly evolving, and liquidity levels can change rapidly. Failing to continuously monitor and update your analysis can result in outdated or inaccurate information. Stay vigilant and adapt your trading decisions based on real-time data.

3. Overemphasizing Short-Term Depth: While short-term depth analysis can provide valuable insights, it’s important to consider the broader context. Market dynamics are influenced by both short-term and long-term depth, so it’s crucial to analyze the overall depth profile to get a complete picture.

Misjudging Supply and Demand Dynamics

Supply and demand dynamics lie at the core of Auction Market Theory, but misjudging these dynamics can lead to erroneous trading decisions. Avoid the following pitfalls:

1. Ignoring Market Context: Assessing supply and demand without considering the broader market context can be misleading. Factors such as market sentiment, economic news, and overall market trends can significantly impact supply and demand dynamics. Incorporate these factors into your analysis for a more accurate assessment.

2. Relying Solely on Indicators: While indicators can provide valuable insights, relying solely on them to gauge supply and demand can be risky. It’s crucial to combine indicator analysis with other AMT principles, such as price action and market profile, to gain a more holistic view.

3. Neglecting Dynamic Shifts: Supply and demand are not static; they evolve over time. Failing to recognize dynamic shifts in supply and demand can result in missed trading opportunities or erroneous assessments. Continuously monitor market conditions and adjust your analysis accordingly.

Overlooking Price Action Signals and Market Sentiment

Price action signals and market sentiment analysis are integral to Auction Market Theory, but overlooking them can hinder your trading success. Avoid these common mistakes:

1. Disregarding Price Patterns: Price patterns offer valuable clues about market sentiment and potential future price movements. Ignoring price patterns can result in missed trading opportunities or entering trades at unfavorable times. Incorporate price action analysis into your AMT framework for a more comprehensive analysis.

2. Neglecting Market Sentiment Indicators: Market sentiment indicators provide insights into the overall mood of market participants. Disregarding these indicators can lead to a lack of awareness about potential shifts in sentiment and can hinder your ability to anticipate market movements. Include market sentiment analysis in your AMT toolkit.

3. Failing to Adapt to Changing Conditions: Market conditions are not static, and sentiment can shift quickly. Failing to adapt to changing conditions can lead to outdated analysis or trading decisions that are not aligned with the prevailing market sentiment. Stay flexible and adjust your strategies as market conditions evolve.

By avoiding these common mistakes, you can enhance the effectiveness of Auction Market Theory in your trading strategy. In the following sections, we will explore advanced techniques and practical tips to optimize your AMT analysis and improve your trading results.

Conclusion

Unlocking the Potential of Auction Market Theory (AMT) in Your Trading

In conclusion, Auction Market Theory (AMT) offers traders a powerful framework for analyzing market dynamics and making informed trading decisions. By understanding the key elements of AMT, such as depth and liquidity analysis, supply and demand dynamics, price action, and market sentiment, traders can gain a competitive edge in the market.

Throughout this blog post, we’ve explored the various aspects of AMT and how to effectively implement it into your trading strategy. We’ve discussed the importance of depth and liquidity analysis, the interplay between supply and demand, the significance of price action patterns, and the role of market sentiment in AMT analysis.

By avoiding common mistakes such as misinterpreting depth and liquidity, misjudging supply and demand dynamics, and overlooking price action signals and market sentiment, you can optimize your AMT analysis and improve your trading results.

Remember, incorporating AMT into your trading requires education, practice, and continuous refinement. Stay curious, keep learning, and adapt your strategies based on real-time market conditions. By leveraging the power of AMT and combining it with your trading expertise, you can unlock new opportunities and enhance your trading success.

So, go ahead and explore the world of Auction Market Theory. Dive deeper into its principles, experiment with different tools and resources, and refine your strategies. Embrace the potential of AMT to gain a deeper understanding of market dynamics and elevate your trading to new heights.

Thank you for joining us on this journey through Auction Market Theory. We hope this blog post has provided you with valuable insights and practical guidance for incorporating AMT into your trading routine. Happy trading!

For more trading tips and strategies, be sure to explore our blog and stay tuned for future updates and educational content.