Short Version

Cumulative Volume Delta (CVD) is a technical indicator used in market analysis to measure the difference between buying and selling pressure in a financial market. It quantifies the net volume at each price level and accumulates it over a specified period, providing insights into the dynamics between volume and price movements. By analyzing CVD, traders can gain valuable information about market sentiment, institutional activity, trend reversals, and areas of accumulation or distribution. Incorporating CVD into trading strategies can enhance decision-making and provide a competitive edge in the financial markets.

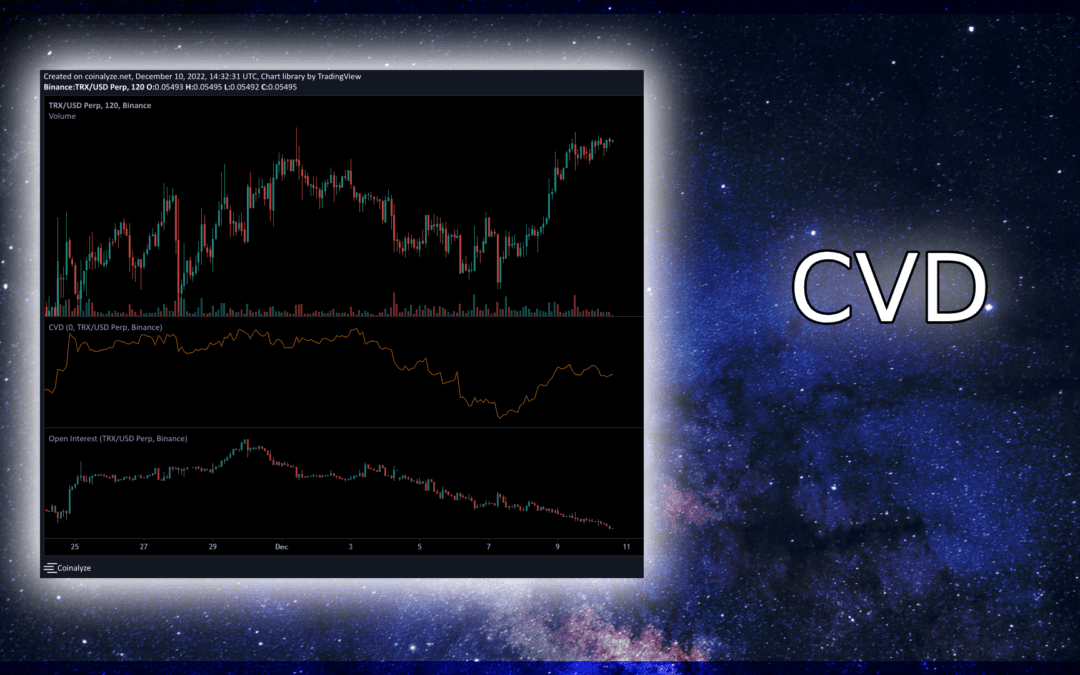

Examples of CVD

You can find more examples of CVD in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

https://tradingcenter.org/index.php/learn/technical-analysis/350-cvd-volume-based-indicator

https://phemex.com/academy/what-is-cumulative-delta-cvd-indicator

https://coinalyze.net/blog/cumulative-volume-delta-cvd-indicator-analyzing-buyer-and-seller-activities/

https://tabtrader.com/academy/articles/what-is-cumulative-delta-cvd-indicator

Long Version

Introduction

Market analysis is a crucial aspect of successful trading. Understanding the dynamics of price movements, identifying trends, and gauging market sentiment are all essential for making informed decisions. However, with the ever-evolving landscape of the financial markets, traders need powerful tools that can provide accurate insights.

That’s where Cumulative Volume Delta (CVD) comes into play. CVD is a game-changer, a revolutionary indicator that can help traders navigate the complex world of market analysis with confidence. In this ultimate guide, we’ll delve into the concept of Cumulative Volume Delta (CVD), explore its significance, and discover how it can elevate your trading strategy to new heights.

Why Market Analysis Matters

Before we dive into the details of CVD, let’s take a moment to recognize the importance of market analysis for traders. Market analysis involves studying various factors, such as price movements, volume, and market psychology, to make informed predictions about future market behavior. It helps traders identify potential opportunities, manage risks, and optimize their trading strategies.

Accurate market analysis is the cornerstone of successful trading, and staying ahead of the curve is key. By incorporating innovative tools like Cumulative Volume Delta (CVD), traders can gain a competitive edge and make smarter trading decisions.

Now, let’s explore what Cumulative Volume Delta (CVD) is and how it can revolutionize your approach to market analysis.

What is Cumulative Volume Delta (CVD)?

Understanding the fundamentals of Cumulative Volume Delta (CVD) is essential for unlocking its potential as a powerful market analysis tool. Let’s delve into what CVD is and how it captures the intricate relationship between volume and price movements.

Definition of Cumulative Volume Delta (CVD)

Cumulative Volume Delta (CVD) is a technical indicator that quantifies the difference between the buying and selling pressure in a financial market. It measures the net volume at each price level and accumulates it over a specified period, providing valuable insights into market dynamics.

The Role of CVD in Analyzing Volume and Price Movements

CVD serves as a bridge between volume and price movements, shedding light on the interplay between buyers and sellers. By analyzing CVD, traders can discern patterns and trends, enabling them to make more informed trading decisions.

How CVD Helps Identify Market Sentiment and Institutional Activity

One of the key advantages of CVD is its ability to provide insights into market sentiment and institutional activity. Large institutional players often leave a significant footprint in the market, and CVD helps traders spot these footprints by analyzing volume imbalances and divergence from price movements.

The Power of CVD in Enhanced Decision-Making

By incorporating CVD into your market analysis toolkit, you can gain a clearer picture of market dynamics and make enhanced trading decisions. CVD enables traders to identify buying or selling pressure at specific price levels, potential trend reversals, and areas of accumulation or distribution, offering a competitive advantage in the financial markets.

Now that we understand the fundamentals of Cumulative Volume Delta (CVD), let’s explore the benefits of incorporating CVD into your trading strategy.

The Benefits of Using Cumulative Volume Delta (CVD)

Incorporating Cumulative Volume Delta (CVD) into your trading strategy can provide a range of benefits. Let’s explore how utilizing CVD as a market analysis tool can give you a competitive edge in the financial markets.

1. Enhanced Market Sentiment Analysis

CVD allows you to gauge market sentiment more accurately by analyzing volume imbalances. By identifying periods of high buying or selling pressure, CVD helps you understand the dominant player’s sentiment, whether it’s bullish or bearish. This insight empowers you to align your trades with the prevailing market sentiment, increasing the probability of successful trades.

2. Spotting Institutional Activity

Large institutional players can significantly influence market dynamics. CVD helps you detect institutional activity by analyzing volume divergence from price movements. By identifying areas where institutional investors are accumulating or distributing shares, you can align your trades with these strategic moves, increasing the likelihood of profitable trades.

3. Identifying Trend Reversals

CVD can serve as an early warning system for potential trend reversals. By analyzing shifts in buying or selling pressure through CVD, you can spot divergences between volume and price movements. These divergences often precede trend reversals, allowing you to enter or exit positions at opportune moments and capitalize on market reversals.

4. Fine-Tuning Entry and Exit Points

Utilizing CVD as part of your market analysis toolkit can help you refine your entry and exit points. By analyzing CVD patterns, such as spikes or shifts in volume delta, you can identify optimal entry points to initiate trades. Additionally, CVD can assist in determining exit points by detecting signs of weakening buying or selling pressure, indicating potential exhaustion or trend continuation.

5. Increasing Trading Confidence

The comprehensive insights provided by CVD can enhance your trading confidence. By incorporating CVD into your analysis, you gain a deeper understanding of market dynamics and make more informed trading decisions. This increased confidence can lead to more disciplined and successful trading, empowering you to navigate the financial markets with conviction.

By leveraging the benefits of Cumulative Volume Delta (CVD) in your market analysis, you can gain a competitive edge and improve your trading performance. Now, let’s delve into how to interpret and utilize CVD effectively.

How to Interpret and Utilize Cumulative Volume Delta (CVD)

To fully harness the power of Cumulative Volume Delta (CVD), it’s crucial to understand how to interpret and utilize this market analysis tool effectively. Let’s explore a step-by-step guide on reading and understanding CVD charts and how to apply the insights derived from CVD to your trading strategy.

1. Reading and Understanding CVD Charts

CVD charts typically display a line or histogram that represents the cumulative volume delta over a specified period. The chart may have positive and negative values, indicating buying and selling pressure, respectively. Understanding how to read CVD charts is key to extracting valuable insights.

2. Analyzing CVD Patterns

Identifying patterns in CVD charts can provide valuable clues for trading decisions. Look for significant spikes or divergences in the CVD line or histogram, indicating shifts in buying or selling pressure. These patterns can signify potential trend reversals, areas of accumulation or distribution, and opportunities for entering or exiting trades.

3. Integrating CVD with Other Indicators

To enhance the effectiveness of CVD analysis, consider integrating it with other technical indicators. Combining CVD with indicators such as moving averages, trend lines, or support and resistance levels can provide a more comprehensive view of market conditions and strengthen your trading signals.

4. Backtesting and Validating CVD Signals

Before fully incorporating CVD into your trading strategy, it’s crucial to backtest and validate the signals derived from CVD analysis. Historical testing allows you to assess the performance of CVD signals in different market conditions and refine your approach. Validating CVD signals in real-time trading further reinforces their reliability.

5. Practicing Risk Management

While CVD analysis can provide valuable insights, it’s essential to practice sound risk management principles in your trading strategy. Set appropriate stop-loss levels, manage position sizes, and adhere to your risk tolerance levels to protect your capital. CVD analysis should be used in conjunction with risk management techniques to maximize trading success.

By following these steps and continuously refining your understanding and application of CVD analysis, you can leverage this powerful tool to make more informed trading decisions. In the next section, we’ll explore tips and best practices for mastering Cumulative Volume Delta (CVD).

Tips and Best Practices for Mastering Cumulative Volume Delta (CVD)

To fully harness the power of Cumulative Volume Delta (CVD) and elevate your market analysis, it’s important to follow some key tips and best practices. Here are some actionable recommendations to help you master CVD and enhance your trading strategy.

1. Understand the Context of CVD Signals

When interpreting CVD signals, it’s essential to consider the broader market context. Analyze CVD patterns in conjunction with other technical analysis tools, such as price action, trend lines, and support/resistance levels. Understanding the overall market environment can provide valuable context for interpreting CVD signals accurately.

2. Validate CVD Signals with Multiple Timeframes

To strengthen the reliability of CVD signals, validate them across multiple timeframes. Look for alignment between CVD signals on shorter timeframes, such as intraday or hourly, and longer-term timeframes, such as daily or weekly. Consistency in CVD signals across different timeframes increases their validity and enhances the probability of successful trades.

3. Combine CVD with Volume Analysis

Incorporate volume analysis alongside CVD to gain deeper insights into market dynamics. Analyze volume patterns, such as volume spikes or divergences, in conjunction with CVD signals. Combining CVD with volume analysis can provide a more comprehensive understanding of market participants’ behavior and strengthen your trading decisions.

4. Continuously Educate Yourself

Market analysis techniques, including CVD, are constantly evolving. Stay updated with the latest research, books, and educational resources to expand your knowledge and refine your CVD analysis skills. Engage in online communities or forums to learn from other traders’ experiences and exchange ideas for using CVD effectively.

5. Practice Patience and Discipline

As with any trading strategy, patience and discipline are essential when utilizing CVD analysis. Wait for confirmation of CVD signals before entering or exiting trades. Avoid impulsive decisions based on isolated CVD patterns and exercise discipline in adhering to your trading plan. Consistent application of CVD analysis with patience and discipline can lead to long-term success.

By following these tips and best practices, you can enhance your mastery of Cumulative Volume Delta (CVD) and optimize its effectiveness in your trading strategy. In the final section, we’ll conclude our ultimate guide with a recap of the importance of CVD and a touch of humor.

Conclusion

Congratulations! You’ve reached the end of our ultimate guide to mastering Cumulative Volume Delta (CVD) for market analysis. Let’s recap the importance of CVD and its potential to revolutionize your trading strategy, with a touch of humor.

The Power of Cumulative Volume Delta (CVD)

Cumulative Volume Delta (CVD) is not just another technical indicator. It’s a powerful tool that unlocks a whole new dimension of market analysis. By understanding the relationship between volume and price movements, CVD empowers you to gauge market sentiment, spot institutional activity, identify trend reversals, and refine your entry and exit points. With CVD in your toolkit, you gain a competitive edge in the financial markets.

Embrace CVD and Trade with Confidence

Incorporating CVD into your trading strategy requires practice, patience, and continuous learning. As you master CVD analysis, remember to consider the broader market context, validate signals across multiple timeframes, combine CVD with volume analysis, and maintain discipline. By following these tips and best practices, you can maximize the effectiveness of CVD and trade with confidence.

CVD: Your Secret Weapon for Trading Success

Now armed with the knowledge of Cumulative Volume Delta (CVD), you’re ready to take on the markets with a newfound advantage. Let CVD be your secret weapon, guiding you through the complexities of market analysis. Remember, while CVD provides valuable insights, it’s essential to practice sound risk management and adapt to changing market conditions.

So, dive into the world of CVD, explore its patterns, spot those institutional footprints, and make informed trading decisions. Whether you’re a seasoned trader or just starting, CVD can elevate your trading game and set you on a path to success.

Happy trading, and may the CVD be ever in your favor!

Remember, trading involves risks, and it’s essential to conduct your own thorough research and seek professional advice before making any investment decisions.

Thank you for joining us in this ultimate guide to mastering Cumulative Volume Delta (CVD). May your trades be profitable and your journey in the financial markets be filled with success!