Short Version

Funding Rate is a term commonly used in trading, particularly in the context of perpetual futures contracts and margin trading. It represents the fee or interest rate exchanged between traders who hold long and short positions. The Funding Rate is calculated based on the difference between the contract price and the underlying asset’s spot price, as well as the funding interval.

In margin trading, when the Funding Rate is positive, long position holders pay funding fees to short position holders. Conversely, when the Funding Rate is negative, short position holders pay funding fees to long position holders. This mechanism helps balance the market and encourages traders to take positions against the dominant market sentiment.

Understanding and monitoring Funding Rate trends can provide valuable insights into market dynamics, assist with timing trades, and optimize trading strategies for enhanced profitability. By utilizing Funding Rate effectively, traders can maximize their trading gains and manage risks more efficiently.

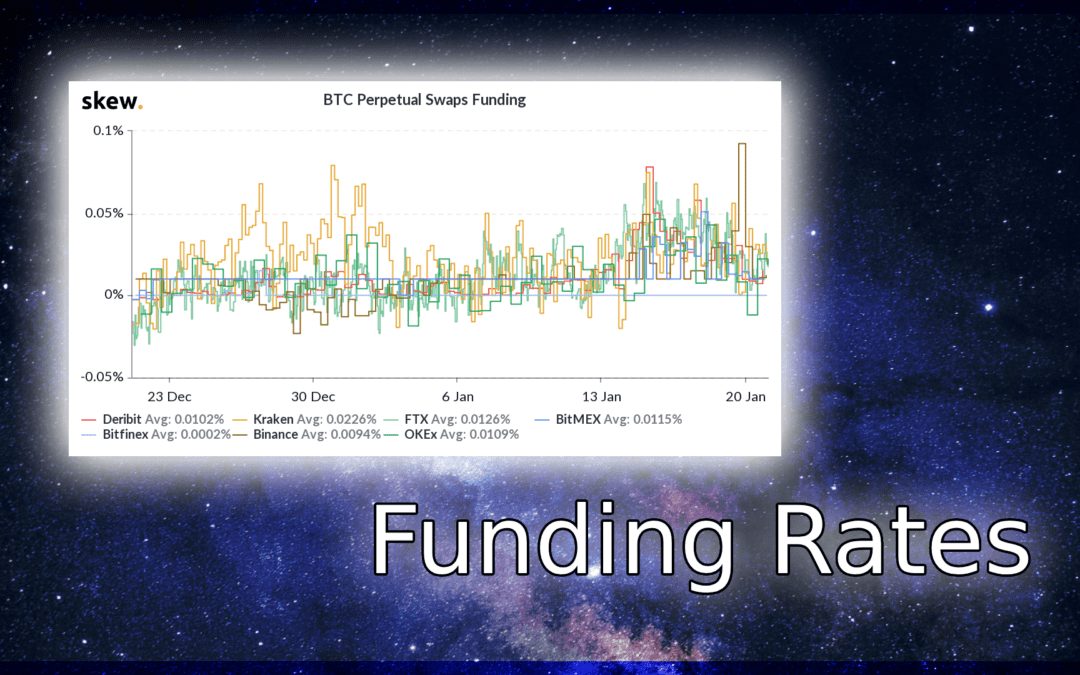

Examples of Funding Rates

You can find more examples of Funding Rates in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

Long Version

Introduction

Unleash the Power of Funding Rate and Turbocharge Your Trading Gains!

Are you looking to maximize your trading gains and take your portfolio to new heights? Look no further! In this blog post, we will delve into the ultimate strategy of leveraging Funding Rate to optimize your trading results. Whether you’re a seasoned trader or just starting out, understanding and harnessing the potential of Funding Rate can make a significant difference in your profitability.

What is Funding Rate?

Funding Rate is a crucial concept in the world of trading. It refers to the fee exchanged between traders in perpetual futures contracts, based on the difference between the contract price and the underlying asset’s spot price. By studying and effectively utilizing Funding Rate, traders can gain insights into market dynamics, timing their trades more strategically.

At its core, Funding Rate acts as a mechanism to balance long and short positions, ensuring equilibrium in the market. It incentivizes traders to take the opposite side of dominant positions, thus encouraging market stability.

Why is Funding Rate Important?

Understanding and leveraging Funding Rate can offer traders several advantages. By incorporating Funding Rate into your trading strategy, you can:

- Maximize Profits: By timing your trades based on Funding Rate trends, you can optimize your entry and exit points, resulting in higher potential profits.

- Mitigate Risks: Funding Rate can provide insights into market sentiment and potential price movements, allowing you to better manage risks and protect your investments.

- Identify Market Trends: Tracking Funding Rate fluctuations can serve as an indicator for market trends, helping you make informed decisions and capitalize on opportunities.

In the following sections, we will explore various strategies and techniques to maximize your trading gains using Funding Rate. So, fasten your seatbelt and get ready to take your trading to the next level!

Understanding Funding Rate

What is Funding Rate?

In the world of trading, Funding Rate plays a pivotal role in determining the fees exchanged between traders in perpetual futures contracts. It represents the difference between the contract price and the underlying asset’s spot price. By comprehending the intricacies of Funding Rate, traders can gain valuable insights into market dynamics and optimize their trading strategies.

How is Funding Rate Calculated?

Funding Rate is typically calculated based on a predetermined formula that takes into account variables such as the contract price, funding interval, and the difference between the contract price and the underlying asset’s spot price. This calculation ensures a fair distribution of fees among traders, promoting market stability.

The Significance of Funding Rate in Margin Trading

Funding Rate holds particular importance in margin trading. Margin trading allows traders to amplify their positions by borrowing additional funds. The Funding Rate serves as an essential component in calculating the interest or funding fees that traders pay or receive based on their positions.

In margin trading, when the Funding Rate is positive, long position holders pay funding fees to short position holders. Conversely, when the Funding Rate is negative, short position holders pay funding fees to long position holders. This mechanism helps balance the market and incentivizes traders to take positions against the dominant market sentiment.

Funding Rate and Trading Positions

Funding Rate can have a direct impact on trading positions. Traders need to be aware of the Funding Rate associated with their open positions, as it can affect their overall profitability.

For example, if you have a long position and the Funding Rate is positive, you may incur funding fees. On the other hand, if you hold a short position and the Funding Rate is negative, you may receive funding fees. Understanding these dynamics enables traders to make informed decisions about their positions, taking Funding Rate into account.

The Role of Funding Rate in Market Stability

Funding Rate plays a crucial role in maintaining market stability. By encouraging traders to take positions against the prevailing market sentiment, Funding Rate helps balance long and short positions. This balancing act prevents extreme price movements and promotes a more orderly and efficient market environment.

By comprehending the significance of Funding Rate in trading and its impact on margin positions, traders can effectively utilize this information to their advantage. In the next section, we will explore the benefits of leveraging Funding Rate for maximizing trading gains and managing risks effectively.

The Benefits of Utilizing Funding Rate for Profitable Trades

Leveraging Leverage with Funding Rate

One of the key benefits of incorporating Funding Rate into your trading strategy is the ability to leverage your positions through margin trading. Margin trading allows you to trade with borrowed funds, amplifying your trading power. By considering Funding Rate trends, you can strategically time your trades and take advantage of favorable conditions to maximize your potential profits.

Leveraging Funding Rate enables you to magnify your gains without needing to allocate a significant amount of your own capital. However, it’s crucial to approach leverage with caution and conduct proper risk management to mitigate potential losses.

Effective Risk Management and Hedging

Another advantage of understanding Funding Rate is its role in risk management. By monitoring Funding Rate fluctuations, traders can gauge market sentiment and potential price movements. This information allows you to adjust your positions, implement stop-loss orders, or hedge against potential risks.

For example, if Funding Rate suggests a bearish sentiment, you may consider reducing your exposure to long positions or implementing protective measures. Conversely, if Funding Rate indicates a bullish sentiment, you might adjust your positions to capitalize on potential upward price movements.

By utilizing Funding Rate as a risk management tool, you can protect your investments and minimize potential losses, ensuring a more secure trading experience.

Opportunities for Arbitrage

Funding Rate disparities across different exchanges present opportunities for arbitrage. Arbitrage involves exploiting price discrepancies to profit from the simultaneous purchase and sale of assets in different markets.

When Funding Rates vary significantly between exchanges, astute traders can capitalize on these differences by strategically opening positions on one exchange and simultaneously hedging or closing positions on another. This can result in profitable arbitrage opportunities.

However, it’s important to note that arbitrage opportunities may be short-lived, as markets tend to quickly adjust to eliminate discrepancies. Therefore, quick and decisive action is necessary to take advantage of these fleeting opportunities.

By keeping an eye on Funding Rate disparities and actively seeking arbitrage possibilities, traders can potentially enhance their profitability and gain an edge in the market.

In the next section, we will explore practical strategies for maximizing trading gains using Funding Rate. Stay tuned!

Strategies for Maximizing Trading Gains with Funding Rate

Timing Your Trades with Funding Rate

Timing plays a critical role in trading, and understanding Funding Rate can help you optimize your entry and exit points. By monitoring Funding Rate trends, you can identify periods of high or low funding fees and strategically time your trades accordingly.

For example, during periods of low Funding Rate or even negative rates, it may be advantageous to enter long positions, as you may receive funding fees from short position holders. Conversely, during periods of high Funding Rate, you may consider adjusting your positions or even exiting trades to avoid excessive funding fees.

By aligning your trades with Funding Rate fluctuations, you can enhance your trading gains and increase your profitability.

Utilizing Funding Rate as a Signal

Funding Rate can serve as an additional signal for market sentiment and trend analysis. By incorporating Funding Rate data into your analysis, you can gain insights into the overall market dynamics and make more informed trading decisions.

For instance, a consistently positive Funding Rate might indicate a dominant long sentiment, potentially signaling a bullish market. On the other hand, a consistently negative Funding Rate could imply a dominant short sentiment and a bearish market outlook.

By considering Funding Rate as a supplementary indicator alongside other technical analysis tools, you can strengthen your trading strategy and improve your chances of successful trades.

Pairing Funding Rate with Technical Analysis

Combining Funding Rate data with technical analysis can provide a comprehensive approach to trading. Technical analysis involves studying historical price patterns, chart patterns, and various indicators to make predictions about future price movements.

By integrating Funding Rate data into your technical analysis, you can gain deeper insights into potential price trends. For example, if you identify a bullish chart pattern or indicator signal, and the Funding Rate is also positive or increasing, it can provide further confirmation for entering a long position.

Conversely, if technical analysis suggests a bearish trend, and the Funding Rate is negative or decreasing, it can strengthen your decision to consider short positions or exit existing trades.

The synergy between Funding Rate and technical analysis empowers you to make well-informed trading decisions based on a combination of fundamental factors and market sentiment.

In the upcoming sections, we will explore real-world examples of successful trading strategies that leverage Funding Rate. Stay tuned for valuable insights and practical tips to enhance your trading performance!

Real-World Examples of Successful Trading with Funding Rate

Case Study 1: Trader A’s Profitable Funding Rate Strategy

Trader A, a seasoned trader, consistently monitors Funding Rate in their trading strategy. They observed a pattern where Funding Rate tended to be positive during certain hours of the day, indicating a dominant long sentiment. Utilizing this information, Trader A strategically entered long positions during those periods, capitalizing on the funding fees received from short position holders.

By aligning their trades with Funding Rate trends, Trader A significantly enhanced their trading gains. Over time, their consistent application of this strategy resulted in consistent profits and an overall improvement in their trading performance.

Case Study 2: Arbitrage Opportunities Exploited by Trader B

Trader B, an experienced arbitrage trader, identified significant disparities in Funding Rates across different cryptocurrency exchanges. They quickly recognized the potential arbitrage opportunities presented by these discrepancies.

By simultaneously opening positions on one exchange with a lower Funding Rate and hedging or closing positions on another exchange with a higher Funding Rate, Trader B successfully exploited the price differences. This allowed them to profit from the simultaneous buying and selling of assets and capitalize on the Funding Rate disparities.

Through careful monitoring and swift execution, Trader B was able to maximize their trading gains and achieve consistent profitability through Funding Rate-based arbitrage strategies.

Case Study 3: Trader C’s Confirmation Tool with Funding Rate

Trader C, a technical analysis enthusiast, used Funding Rate as a confirmation tool in their trading strategy. They combined their analysis of chart patterns, indicators, and price action with the insights provided by Funding Rate.

Whenever Trader C identified a potential trade setup based on technical analysis, they would assess the corresponding Funding Rate. If the Funding Rate aligned with their analysis, indicating a supportive market sentiment, Trader C gained more confidence in their trade.

By incorporating Funding Rate as a confirmation tool, Trader C increased their trading success rate and achieved more consistent profits.

Learnings from Real-World Examples

These real-world examples highlight the diverse ways in which traders have successfully utilized Funding Rate in their trading strategies. From capitalizing on positive Funding Rates for long positions to exploiting arbitrage opportunities and using Funding Rate as a confirmation tool with technical analysis, each approach demonstrates the potential for maximizing trading gains with Funding Rate.

However, it’s important to note that individual trading strategies may vary, and there is no one-size-fits-all approach. It’s essential to conduct thorough research, practice risk management, and adapt strategies to personal trading goals and risk tolerance.

By studying these real-world examples and extracting valuable insights, you can develop your own unique trading approach incorporating Funding Rate, leading to improved profitability and trading success.

In the next section, we will conclude our discussion and provide some final thoughts on leveraging Funding Rate for trading gains.

Conclusion

Maximizing Trading Gains with Funding Rate: Unlock Your Profit Potential

In this blog post, we have explored the incredible potential of leveraging Funding Rate to maximize your trading gains. Understanding Funding Rate and incorporating it into your trading strategy can be a game-changer, offering numerous benefits and opportunities for profitability.

By leveraging Funding Rate, you can enhance your trading gains through strategies such as timing your trades, utilizing Funding Rate as a signal, and pairing it with technical analysis. These approaches enable you to make more informed trading decisions, optimize your entry and exit points, and manage risks effectively.

Real-world examples have illustrated how traders have achieved remarkable success by incorporating Funding Rate into their strategies. From capitalizing on positive Funding Rates, exploiting arbitrage opportunities, to using Funding Rate as a confirmation tool with technical analysis, these case studies demonstrate the versatility and profitability of Funding Rate-driven approaches.

It’s crucial to note that each trader’s journey is unique, and it’s essential to adapt strategies to personal trading goals and risk tolerance. Continual learning, research, and risk management remain critical aspects of successful trading.

As you embark on your trading journey, consider integrating Funding Rate analysis into your toolkit. Stay informed about Funding Rate trends, monitor market dynamics, and refine your strategies over time. By harnessing the power of Funding Rate, you can unlock your profit potential and elevate your trading performance.

Remember, trading involves risks, and past success does not guarantee future results. Always conduct thorough research, seek professional advice, and trade responsibly.

Now, armed with the knowledge and insights from this blog post, it’s time to take action and unleash your trading gains with Funding Rate. Embrace the opportunities, adapt to the ever-changing market conditions, and embark on a profitable trading journey.

Happy trading!