Short Version

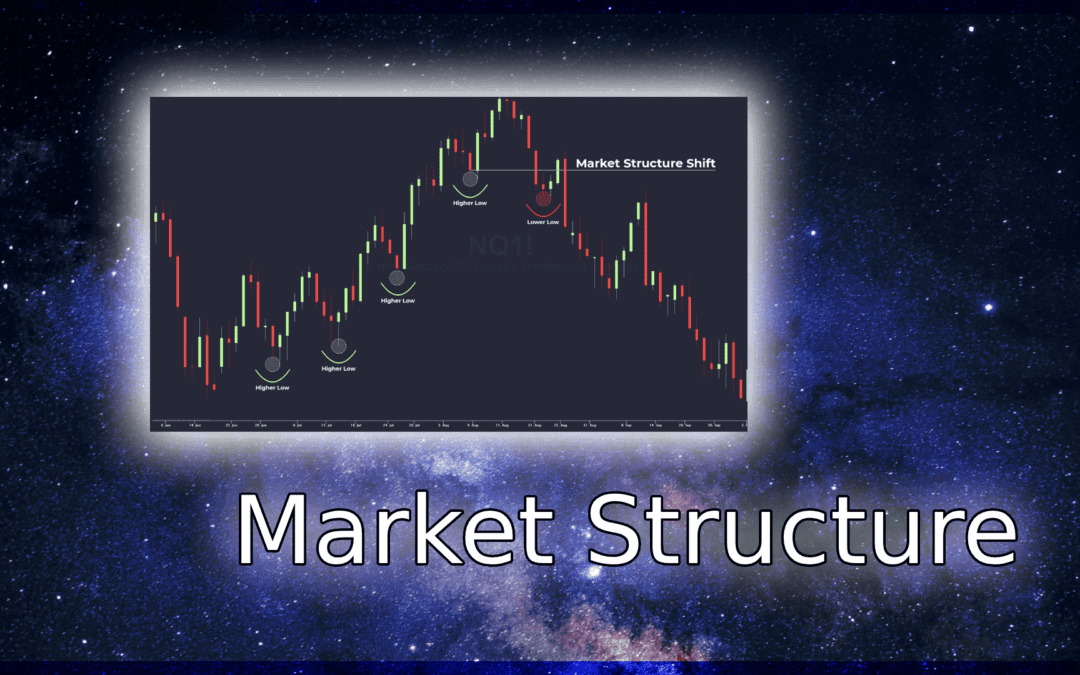

Market structure refers to the organizational characteristics and dynamics of a particular market or financial instrument. It involves analyzing the behavior of market participants, the degree of competition, the availability of information, and the overall framework within which buying and selling activities occur.

Understanding market structure is crucial for traders as it provides insights into price movements, trends, support and resistance levels, and the overall sentiment of the market. By studying market structure, traders can identify potential trading opportunities, develop effective trading strategies, and manage risks more efficiently. Market structure analysis involves techniques such as chart patterns, technical indicators, volume analysis, and market breadth analysis.

In essence, market structure analysis helps traders make more informed decisions by examining the framework and dynamics of the market they are trading in, allowing them to adapt their strategies to prevailing market conditions and increase their chances of success

Examples of Market Structure

You can find more examples of Market Structure in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

Long Version

Introduction

In the fast-paced world of trading, the ability to decipher market dynamics is the key to unlocking profitable opportunities. One fundamental aspect that traders must grasp is market structure. By comprehending the intricacies of market structure, traders can gain valuable insights into price movements, trends, and potential entry and exit points.

In this blog post, we’ll delve into the concept of market structure and explore its significance in the trading arena. Whether you’re an experienced trader or just starting, understanding market structure will equip you with a solid foundation for making informed trading decisions.

Throughout this article, we’ll cover the following topics:

- Defining Market Structure: What exactly is market structure, and why is it crucial for traders?

- Components of Market Structure: Explore the key elements that comprise market structure and their impact on trading.

- Analyzing Market Structure: Learn about effective methods and tools to analyze market structure and make informed trading decisions.

- Market Structure and Trading Strategies: Discover how market structure influences the selection and implementation of various trading strategies.

- Risk Management and Market Structure: Understand how risk management techniques adapt to different market structures to protect your capital.

- Putting It Into Practice: Real-life examples and tips for incorporating market structure analysis into your trading routine.

So, if you’re ready to unravel the mysteries of market structure and elevate your trading skills, let’s dive in and crack the code together!

What is Market Structure

Understanding the Foundation of Successful Trading

In the world of trading, market structure serves as the foundation upon which all market activities unfold. It refers to the organizational framework and dynamics that shape financial markets. By comprehending market structure, traders gain valuable insights into price behavior, trends, and the overall market environment.

In this section, we’ll explore the fundamental aspects of market structure and its significance in trading. By grasping these key concepts, you’ll be better equipped to navigate the complexities of the market and make more informed trading decisions.

Definition of Market Structure

At its core, market structure represents the arrangement and characteristics of market participants, assets, and trading mechanisms. It encompasses various elements, such as order flow, liquidity, price levels, volatility, and trading volumes. These components interact to form the overall market dynamics.

Understanding market structure involves analyzing the interplay between buyers and sellers, the impact of supply and demand, and the overall market sentiment. By gaining insight into these dynamics, traders can identify patterns and potential opportunities for profitable trades.

Significance in Trading

Market structure plays a vital role in trading for several reasons. Firstly, it helps traders recognize trends and market phases, such as ranging markets, uptrends, or downtrends. By identifying these patterns, traders can align their strategies with the prevailing market conditions, increasing the probability of successful trades.

Secondly, understanding market structure enables traders to identify support and resistance levels. These key price levels act as barriers that influence price movements. By recognizing these levels, traders can make more precise entry and exit decisions, reducing risk and maximizing potential profits.

Lastly, market structure provides insights into market liquidity and order flow. Liquidity refers to the ease of buying or selling an asset without causing substantial price fluctuations. By analyzing liquidity and order flow, traders can gauge market depth and assess the presence of buyers or sellers, helping them anticipate price movements and make strategic trading decisions.

In conclusion, market structure serves as the backbone of successful trading. By comprehending the organizational framework and dynamics of the market, traders can gain a competitive edge and make informed decisions. In the following sections, we’ll delve deeper into the key components of market structure and explore effective strategies for analyzing and leveraging it to enhance your trading endeavors.

Key Components of Market Structure

Exploring the Building Blocks of Successful Trading

Market structure comprises various key components that shape the dynamics of financial markets. Understanding these components is essential for traders seeking to navigate the intricacies of the market and make informed trading decisions. In this section, we’ll explore the primary elements that constitute market structure and their impact on trading.

Price Levels

Price levels are a fundamental component of market structure. They represent specific price points at which buyers and sellers interact, leading to market activity. Key price levels include support and resistance levels, pivot points, and significant highs and lows. By analyzing price levels, traders can identify potential areas of buying or selling interest and make strategic trading decisions accordingly.

Trends

Trends play a crucial role in market structure analysis. They represent the direction in which prices are moving over a given period. Trends can be classified as uptrends, downtrends, or sideways (range-bound) markets. Identifying and following trends is essential for traders as it helps them align their strategies with the prevailing market conditions and capture potential profits.

Volatility

Volatility refers to the degree of price fluctuations in the market. It indicates the speed and magnitude of price movements. Volatility can be measured using various indicators, such as average true range (ATR) or Bollinger Bands. Understanding market volatility helps traders gauge the level of risk associated with a trade and adjust their position sizing and risk management strategies accordingly.

Trading Volumes

Trading volumes provide insights into the level of market participation and the intensity of buying and selling pressure. Higher trading volumes often indicate increased market activity and the presence of significant market players. By analyzing trading volumes, traders can assess market liquidity, identify potential turning points, and validate the strength of price movements.

Order Flow

Order flow refers to the incoming orders to buy or sell a particular asset. Analyzing order flow provides insights into the balance between buying and selling pressure, as well as the presence of market participants. By monitoring order flow, traders can gain a deeper understanding of market sentiment and potential price reversals.

In conclusion, the key components of market structure—price levels, trends, volatility, trading volumes, and order flow—form the building blocks for successful trading. By analyzing and understanding these components, traders can develop effective strategies, identify potential opportunities, and make informed trading decisions. In the following sections, we’ll explore methods and tools for analyzing market structure, enabling you to gain a competitive edge in the trading arena.

Analyzing Market Structure

Unveiling Insights for Informed Trading Decisions

Analyzing market structure is a critical aspect of successful trading. By understanding the underlying dynamics and patterns, traders can gain valuable insights to make informed trading decisions. In this section, we’ll explore various methods and tools for analyzing market structure, equipping you with the skills to navigate the markets effectively.

Chart Patterns

Chart patterns are visual representations of price movements that repeat over time. They provide valuable insights into market sentiment and potential price reversals. Some commonly used chart patterns include head and shoulders, double tops or bottoms, triangles, and flags. By recognizing these patterns on price charts, traders can anticipate future price movements and plan their trades accordingly.

Indicators

Indicators are mathematical calculations based on historical price and volume data. They help traders analyze market structure and identify potential trading opportunities. Popular indicators include moving averages, Relative Strength Index (RSI), MACD, and Stochastic Oscillator. By applying these indicators to price charts, traders can gain additional confirmation or signals to support their trading decisions.

Volume Analysis

Volume analysis focuses on understanding the trading volumes associated with price movements. It helps traders assess the strength of trends, confirm breakouts, and identify potential reversals. Tools such as volume bars, volume profiles, and on-balance volume (OBV) are commonly used for volume analysis. By analyzing volume patterns, traders can gauge market participation and make more informed trading decisions.

Market Breadth Analysis

Market breadth analysis examines the overall participation and strength of the market by analyzing the number of advancing and declining stocks, new highs and lows, and the volume of stocks traded. Breadth indicators such as the Advance-Decline Line (ADL) and the Arms Index (TRIN) are used to measure market breadth. By monitoring market breadth, traders can assess the overall health of the market and identify potential market turning points.

Candlestick Analysis

Candlestick analysis involves interpreting the patterns and formations created by candlestick charts. Candlesticks provide insights into the relationship between the opening, closing, high, and low prices for a given period. Traders can identify bullish or bearish reversal patterns, such as doji, hammer, or engulfing patterns, to anticipate potential trend reversals or continuations.

Incorporating these methods and tools into your analysis can significantly enhance your understanding of market structure. It’s important to remember that no single method or tool guarantees success in trading. It’s the combination of various techniques, along with experience and intuition, that can help traders gain a competitive edge.

In the next section, we’ll explore the relationship between market structure and trading strategies, providing you with insights on how to align your trading approach with the observed market dynamics. Stay tuned!

Market Structure and Trading Strategies

Aligning Your Approach with Market Dynamics for Successful Trades

Market structure has a significant influence on the selection and implementation of trading strategies. By understanding the prevailing market dynamics, traders can tailor their approach to capitalize on potential opportunities and manage risks effectively. In this section, we’ll explore the relationship between market structure and trading strategies, providing insights to enhance your trading endeavors.

Trend-Following Strategies

Trend-following strategies are designed to capture profits during sustained price movements. When market structure exhibits a clear and strong trend, trend-following strategies can be highly effective. Traders employing these strategies aim to enter trades in the direction of the prevailing trend and ride the trend until signs of exhaustion or reversal appear. Moving averages, trendlines, and momentum indicators are commonly used to identify and confirm trends.

Range Trading Strategies

Range trading strategies are employed when market structure indicates a sideways or range-bound market. Traders utilizing these strategies seek to identify support and resistance levels and profit from price oscillations within the established range. By buying near support and selling near resistance, range traders aim to capitalize on predictable price behavior. Oscillators, such as the Relative Strength Index (RSI) and the Stochastic Oscillator, are commonly used to identify overbought and oversold conditions within a range.

Breakout Strategies

Breakout strategies come into play when market structure indicates a potential price breakout from a range or consolidation phase. Traders employing breakout strategies aim to enter trades as the price breaks above resistance or below support, anticipating a significant price movement. Breakout traders often use technical indicators, such as Bollinger Bands or Donchian Channels, to identify periods of low volatility preceding a potential breakout.

Counter-Trend Strategies

Counter-trend strategies involve taking positions contrary to the prevailing market structure. These strategies are based on the belief that price reversals or retracements occur after extended trends. Counter-trend traders aim to identify overextended price moves and capitalize on potential pullbacks or reversals. Technical indicators such as oscillators or candlestick patterns are often used to identify potential exhaustion points or reversal signals.

News-Based Strategies

News-based strategies focus on trading opportunities arising from significant news events that impact market structure. Traders employing these strategies monitor economic releases, corporate announcements, geopolitical events, and other news catalysts. By anticipating the market’s reaction to such news, traders aim to enter positions ahead of potential price movements triggered by the news event.

Remember, the choice of trading strategy should align with the observed market structure and your risk tolerance. It’s essential to adapt your approach based on the prevailing market conditions and adjust your strategies as market dynamics evolve.

In the next section, we’ll explore the crucial aspect of risk management and how it intertwines with market structure to protect your capital. Stay tuned to learn more!

Risk Management and Market Structure

Safeguarding Your Capital in the Dynamic Trading Landscape

Effective risk management is crucial for traders to protect their capital and navigate the ever-changing market structure. By incorporating sound risk management practices, traders can mitigate potential losses and enhance the longevity of their trading endeavors. In this section, we’ll explore the relationship between risk management and market structure, providing insights to help you safeguard your capital.

Adapting Risk Parameters to Market Structure

Market structure influences the level of risk associated with trading. During periods of high volatility or uncertain market conditions, the risk of price fluctuations and unexpected moves increases. Traders should adapt their risk parameters to reflect the observed market structure. This may include reducing position sizes, widening stop-loss orders, or adjusting risk-reward ratios to account for heightened market uncertainty.

Setting Stop-Loss Orders

Stop-loss orders are essential risk management tools that define the maximum acceptable loss for a trade. By setting stop-loss levels based on market structure, traders can limit their potential downside and protect their capital. When analyzing market structure, identify key support or resistance levels, trend lines, or technical indicators that can serve as logical areas for setting stop-loss orders.

Trailing Stop-Loss Orders

Trailing stop-loss orders are dynamic risk management tools that adjust the stop-loss level as the trade moves in favor of the trader. Traders utilizing trailing stop-loss orders can lock in profits while allowing the trade to potentially capture further gains. When applying trailing stop-loss orders, consider the volatility of the market structure and the potential for price retracements to strike a balance between protecting profits and allowing for potential market movements.

Diversification and Portfolio Allocation

Diversification and proper portfolio allocation are essential risk management strategies that help reduce exposure to individual assets or market sectors. By spreading your capital across different markets, instruments, or trading strategies, you can mitigate the impact of adverse market events. Analyzing market structure across various assets or sectors can guide you in diversifying your portfolio effectively.

Regular Review and Analysis

Continuous review and analysis of your trading performance and market structure are integral to effective risk management. Regularly assess the performance of your trades, identify areas for improvement, and adjust your risk management strategies accordingly. Stay informed about changes in market structure, economic indicators, and news events that may impact your trading decisions.

By integrating robust risk management practices into your trading approach, you can navigate the dynamic market structure with confidence and protect your capital. Remember, risk management should be a consistent and ongoing process, adapting to the ever-evolving market conditions.

In the next section, we’ll provide practical examples and tips for incorporating market structure analysis into your trading routine. Stay tuned for valuable insights and actionable strategies!

Putting It Into Practice

Applying Market Structure Analysis to Enhance Your Trading Routine

Now that we’ve explored the key concepts and strategies related to market structure, it’s time to put your knowledge into practice. By incorporating market structure analysis into your trading routine, you can gain a competitive edge and make more informed trading decisions. In this section, we’ll provide practical examples and tips to help you apply market structure analysis effectively.

Develop a Trading Plan

A well-defined trading plan is essential for incorporating market structure analysis into your trading routine. Outline your trading goals, preferred strategies, risk tolerance, and timeframes. Incorporate market structure analysis techniques that align with your trading style and objectives. A trading plan will serve as a roadmap, keeping you focused and disciplined in your trading activities.

Identify Key Market Structure Levels

Identifying key market structure levels, such as support and resistance, is crucial for understanding price behavior and planning your trades. Utilize chart patterns, trendlines, and technical indicators to identify significant price levels. These levels can act as potential entry or exit points for your trades. Regularly update and monitor these levels as market structure evolves.

Analyze Trends and Market Phases

Trends and market phases provide valuable insights into market structure. Determine the prevailing market trend (uptrend, downtrend, or sideways) and adjust your trading strategies accordingly. Analyze price patterns, moving averages, and momentum indicators to identify potential trend reversals or continuation patterns. Understanding market phases will help you adapt your approach to the current market conditions.

Combine Multiple Timeframes

Analyzing market structure across multiple timeframes can provide a comprehensive view of price movements and market dynamics. Consider using longer-term charts for identifying major trends and support/resistance levels. Then, switch to shorter-term charts for more precise entry and exit points. Combining multiple timeframes allows you to align your trades with the broader market structure while capitalizing on shorter-term opportunities.

Practice Risk Management

Effective risk management is paramount for long-term trading success. Implement stop-loss orders, trailing stop-loss orders, and proper position sizing based on market structure and your risk tolerance. Regularly review and adjust your risk management strategies as market conditions change. Remember to diversify your portfolio to minimize the impact of individual trades or market events.

Journal Your Trades

Keeping a trading journal is a valuable practice for tracking your trades and analyzing their outcomes. Record the trades you take, along with the market structure analysis that influenced your decisions. Review your journal regularly to identify patterns, strengths, and areas for improvement. A trading journal will help you fine-tune your market structure analysis techniques and enhance your trading performance over time.

By applying these practical tips and techniques, you can integrate market structure analysis into your trading routine and improve your trading results. Remember, consistent practice, ongoing learning, and adaptation are key to mastering market structure analysis and becoming a successful trader.

In the next section, we’ll discuss common pitfalls and challenges in market structure analysis and provide strategies to overcome them. Stay tuned for valuable insights on refining your approach!

Conclusion

Embracing Market Structure Analysis for Trading Success

Market structure analysis is a powerful tool that can significantly enhance your trading endeavors. By understanding the dynamics of market structure, you can make more informed trading decisions, manage risks effectively, and increase your chances of success. Throughout this guide, we’ve explored the key concepts, strategies, and practical tips related to market structure analysis. Let’s recap the main takeaways:

Importance of Market Structure

Market structure provides insights into the behavior of price movements, trends, and support/resistance levels. Understanding market structure allows you to identify potential trading opportunities, assess market sentiment, and adapt your trading strategies accordingly.

Analyzing Market Structure

Various methods and tools can be employed to analyze market structure. These include chart patterns, technical indicators, volume analysis, market breadth analysis, and candlestick analysis. By incorporating these techniques into your analysis, you can gain a deeper understanding of market dynamics and make more informed trading decisions.

Aligning Trading Strategies with Market Structure

Different market structures call for different trading strategies. Trend-following, range trading, breakout, counter-trend, and news-based strategies are some examples. Aligning your trading approach with the observed market structure increases your chances of success and helps you capitalize on favorable market conditions.

Risk Management and Market Structure

Risk management is crucial for protecting your capital in the dynamic trading landscape. By adapting risk parameters, setting stop-loss orders, diversifying your portfolio, and practicing regular review and analysis, you can effectively manage risks associated with market structure and safeguard your capital.

Applying Market Structure Analysis

Putting market structure analysis into practice involves developing a trading plan, identifying key market structure levels, analyzing trends and market phases, combining multiple timeframes, practicing risk management, and maintaining a trading journal. By incorporating these practices into your trading routine, you can apply market structure analysis effectively and improve your trading results.

In conclusion, market structure analysis is an indispensable tool for traders seeking consistent success in the financial markets. By embracing market structure analysis, you gain a deeper understanding of market dynamics, make more informed trading decisions, and manage risks effectively. Remember, mastering market structure analysis requires practice, ongoing learning, and adaptation to ever-evolving market conditions.

Now it’s time to embark on your trading journey armed with the knowledge and strategies shared in this guide. Embrace market structure analysis, refine your skills, and may your trades be prosperous and rewarding!

If you have any further questions or need assistance, feel free to reach out. Happy trading!