Short Version

Trading halts refer to temporary suspensions of trading activity for specific securities or the entire market. These halts are typically implemented by exchanges or regulatory bodies in response to certain events or circumstances. Trading halts can be triggered by factors such as significant price fluctuations, news announcements, regulatory concerns, or technical glitches.

The purpose of trading halts is to ensure fair and orderly markets by providing a pause in trading activity. During a trading halt, investors are unable to buy or sell the halted security or securities. This pause allows market participants to digest important information, reassess their positions, and prevent panic selling or irrational trading decisions.

Trading halts also provide regulators and exchange operators an opportunity to investigate and address any issues or concerns that may have triggered the halt. Once the reasons for the halt have been resolved or addressed, trading typically resumes.

Trading halts are an essential tool in maintaining market integrity, protecting investors, and promoting a stable trading environment during times of volatility or unexpected events.

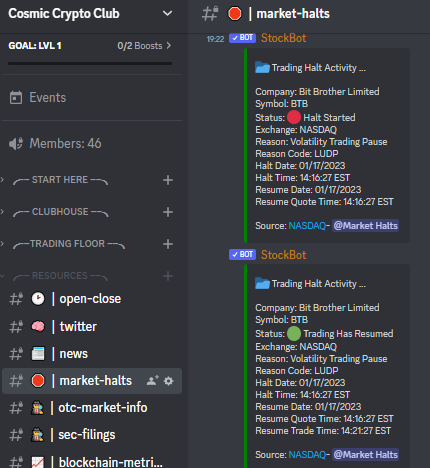

You can view a live list of trading halts on the Nasdaq website and view a list of all Halt Codes

These alerts are fed into the 🛑|market-halts Discord channel which you can get to here

If you want to be alerted be sure to set your role

Videos

Additional Resources

Long Version

Introduction

The stock market is like a roller coaster ride, filled with twists, turns, and unexpected drops. One moment, prices are soaring, and the next, they’re plummeting. It’s an environment of constant change, and as an investor, it’s essential to stay prepared.

Understanding the Significance of Trading Halts

In the midst of market volatility, trading halts emerge as valuable tools to navigate the stormy seas of investing. Trading halts are temporary pauses in trading activity that serve as a circuit breaker, allowing investors to catch their breath and reassess their strategies.

Guiding Investors Through Choppy Waters

In this blog post, we will delve into the world of trading halts and explore how they help investors navigate market volatility with confidence. From understanding the basics of trading halts to discovering their benefits, we’ll equip you with the knowledge you need to stay afloat in turbulent market conditions.

Why Trading Halts Matter

Before we dive into the details, let’s first clarify what trading halts are and why they play a crucial role in the stock market. By understanding their purpose and function, you’ll gain a better grasp of how trading halts can help you navigate market volatility effectively.

What Are Trading Halts

In the world of stock trading, trading halts serve as critical mechanisms to maintain order and stability in the market. Let’s explore what trading halts are and why they hold such significance.

Definition of Trading Halts

Trading halts are temporary suspensions of trading activity on a specific stock or across the entire market. They are typically initiated by stock exchanges or regulatory bodies to manage sudden and extreme fluctuations in stock prices.

Reasons for Trading Halts

Trading halts can occur for various reasons, and understanding these reasons is vital for investors. Here are some common triggers for trading halts:

1. Market-wide Events

During significant market events, such as economic crises, geopolitical turmoil, or natural disasters, trading halts may be implemented. These halts allow time for market participants to absorb the news, assess the impact, and prevent panic-driven reactions.

2. News Announcements

When a company releases significant news that could significantly impact its stock price, a trading halt may be put in place. This provides investors with an opportunity to review and evaluate the news before making any trading decisions.

3. Technical Issues

Sometimes, technical glitches or system malfunctions can disrupt the smooth functioning of the stock market. In such cases, trading halts may be initiated to address and rectify these issues, ensuring fair and orderly trading.

The Role of Regulatory Bodies

Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, play a crucial role in overseeing and implementing trading halts. They establish rules and regulations to safeguard investors’ interests and maintain the integrity of the financial markets.

By understanding the definition of trading halts and the reasons behind their implementation, investors can better navigate the complexities of market volatility.

Types of Trading Halts

Trading halts come in various forms, each serving a specific purpose in managing market volatility. Understanding the different types of trading halts is crucial for investors to adapt their strategies accordingly.

Circuit Breakers

One common type of trading halt is known as circuit breakers. These halts are automatic and are triggered by predefined thresholds based on market indices, such as the S&P 500. Circuit breakers aim to stabilize the market during times of extreme volatility and prevent massive sell-offs or panic-driven trading.

Trigger Levels and Duration

Circuit breakers are typically divided into three levels:

-

Level 1: If the market declines by a certain percentage within a specified timeframe, trading is paused for a brief period, usually 15 minutes. This pause allows investors to reassess their positions and helps dampen excessive market movements.

-

Level 2: If the decline continues after the Level 1 halt is lifted, a Level 2 halt is triggered. Trading is halted again for an extended period, usually 30 minutes, to provide a longer cooling-off period and evaluate the situation.

-

Level 3: In the event of a severe market decline, a Level 3 circuit breaker is triggered. This leads to a market-wide trading halt for the remainder of the trading day. The aim is to prevent further damage and give investors time to digest the information before resuming trading on the following day.

Regulatory Halts

Regulatory halts are initiated by regulatory bodies, such as the SEC, to protect investors’ interests and maintain market integrity. These halts can be imposed on individual stocks to investigate potential violations or irregularities, ensuring fair trading practices.

Reasons for Regulatory Halts

Regulatory halts may be implemented for various reasons, including:

- Significant news announcements affecting the company’s operations, financials, or corporate structure.

- Unusual or suspicious trading activity that may indicate market manipulation.

- Pending release of important information that could significantly impact the stock’s value.

Specific Stock Halts

Specific stock halts, also known as trading pauses or trading suspensions, occur when a particular stock experiences abnormal price movements or significant news. These halts allow investors to evaluate and digest the new information before making further trading decisions.

Duration and Impact

Specific stock halts can last for a few minutes to several hours, depending on the circumstances. They provide a temporary breather for investors to reassess their positions and prevent knee-jerk reactions that may result in unfavorable outcomes.

By understanding the different types of trading halts, investors can adapt their strategies and make informed decisions during periods of market volatility.

Benefits of Trading Halts

Trading halts serve several important benefits for investors during times of market volatility. Understanding these advantages can help you appreciate the role of trading halts in safeguarding your investments.

Creating a Cooling-Off Period

One significant benefit of trading halts is the creation of a cooling-off period. When market conditions become excessively volatile or chaotic, trading halts provide a pause in trading activity. This breather allows investors to step back, reassess their positions, and avoid making impulsive decisions driven by fear or panic.

Preventing Panic Selling

During periods of extreme market volatility, panic selling can trigger a vicious cycle of rapid stock price declines. Trading halts act as a circuit breaker by temporarily suspending trading and preventing panic selling from spiraling out of control. This pause gives investors time to regain composure, conduct proper analysis, and make informed decisions rather than succumbing to fear-induced actions.

Mitigating Excessive Market Fluctuations

By introducing trading halts, regulators aim to mitigate excessive market fluctuations. These fluctuations can be caused by sudden news announcements, extreme speculative activity, or technical glitches. Halting trading for a brief period provides an opportunity for the market to stabilize, reducing the magnitude of price swings and promoting a more orderly trading environment.

Facilitating Orderly Information Processing

Trading halts also allow investors to digest and process important information before making trading decisions. Whether it’s a company’s earnings report, regulatory news, or macroeconomic data, a temporary trading halt ensures that investors have adequate time to assess the impact of the news and adjust their positions accordingly. This promotes more thoughtful decision-making and potentially reduces knee-jerk reactions that could lead to unfavorable outcomes.

Restoring Investor Confidence

During periods of market turbulence, trading halts can restore investor confidence. By demonstrating that regulators are actively monitoring and intervening in the market when necessary, trading halts signal a commitment to maintaining fair and transparent trading conditions. This can help alleviate concerns and instill a sense of trust and stability among investors, ultimately benefiting market participants and the overall market ecosystem.

By recognizing the benefits of trading halts, investors can approach market volatility with more confidence and make more informed investment decisions.

Navigating Market Volatility with Confidence

Market volatility can be unsettling for investors, but with the right approach, it can also present opportunities. By understanding how to navigate market volatility with confidence, you can position yourself for success even in turbulent times.

Stay Informed and Conduct Thorough Research

Knowledge is power when it comes to navigating market volatility. Stay informed about market trends, economic indicators, and company-specific news. Subscribe to reputable financial news sources, follow expert opinions, and utilize research tools to gain insights into the market.

Conducting Thorough Research

- Dive deep into the fundamentals of companies you are interested in. Analyze their financial health, competitive positioning, and growth prospects.

- Evaluate market trends and sector performance to identify areas of potential strength or weakness.

- Consider historical data and patterns to gain insights into how certain assets perform during volatile periods.

Embrace a Long-Term Perspective

Market volatility often creates short-term fluctuations that can tempt investors to make impulsive decisions. Instead, adopt a long-term perspective and focus on your investment goals. Recognize that market fluctuations are part of the investing journey and that quality investments can withstand short-term volatility.

Diversify Your Portfolio

Diversification is a key strategy for navigating market volatility. Spread your investments across different asset classes, sectors, and geographies. This can help mitigate the impact of volatility on your portfolio, as different investments may react differently to market conditions.

Be Prepared for Trading Halts

As we’ve discussed earlier, trading halts play a crucial role in managing market volatility. Familiarize yourself with the types of trading halts and their triggers. Understand the potential impact of trading halts on your investment strategies and be prepared to adapt accordingly.

Developing a Trading Halt Strategy

- Anticipate the possibility of trading halts during times of heightened volatility.

- Identify alternative investment options or strategies that can be utilized during trading halts.

- Set stop-loss orders or consider utilizing options to protect your investments during volatile periods.

Avoid Emotional Decision-Making

Emotions can cloud judgment during market volatility, leading to impulsive and irrational decisions. Avoid making investment decisions based on fear or greed. Instead, rely on your research, analysis, and investment strategy. Implementing a disciplined approach can help you navigate volatile markets with a level head.

Seek Professional Guidance if Needed

Navigating market volatility can be challenging, especially for inexperienced investors. If you feel overwhelmed or uncertain, don’t hesitate to seek professional guidance from financial advisors or investment experts. They can provide valuable insights, advice, and strategies tailored to your specific circumstances.

By staying informed, embracing a long-term perspective, being prepared for trading halts, avoiding emotional decision-making, and seeking guidance when needed, you can navigate market volatility with confidence and increase your chances of achieving investment success.

Case Studies

Examining real-life case studies can provide valuable insights into how trading halts have influenced market dynamics during periods of volatility. Let’s explore a few notable examples that demonstrate the impact of trading halts on investor behavior and market outcomes.

Case Study 1: Flash Crash of 2010

Background

In May 2010, the U.S. stock market experienced a sudden and severe decline, commonly known as the “Flash Crash.” During this event, the market indices plunged by a significant percentage within minutes, leaving investors bewildered and concerned.

Trading Halt Intervention

To stabilize the market, trading halts were automatically triggered through circuit breakers. The Level 1 halt lasted for 15 minutes, followed by the Level 2 halt, which extended the pause by an additional 15 minutes. These halts provided a crucial breathing space for investors to reassess their positions and prevent further panic selling.

Impact and Lessons Learned

The trading halts during the Flash Crash helped prevent a complete market meltdown and provided an opportunity for regulators and market participants to investigate the causes of the rapid decline. This event highlighted the importance of circuit breakers in managing extreme market volatility and led to subsequent enhancements in market surveillance systems and trading rules.

Case Study 2: Regulatory Halt on a Biotech Stock

Background

A biotech company announced groundbreaking clinical trial results for a potential life-saving drug. The news triggered a surge in investor interest and rapid buying activity, causing the stock price to skyrocket.

Regulatory Halt Intervention

To ensure fair trading practices and protect investors, regulators imposed a trading halt on the stock. This allowed time for regulators to review the news release and assess potential market manipulation or false information.

Impact and Lessons Learned

The regulatory halt on the biotech stock provided investors with an opportunity to analyze the news announcement more critically and avoid making hasty investment decisions. It demonstrated the role of regulatory bodies in maintaining market integrity and safeguarding investor interests.

Case Study 3: Trading Suspension Due to Technical Issues

Background

A major stock exchange experienced technical issues, leading to disruptions in trading operations. Order execution delays, incorrect pricing, and data discrepancies created a volatile and unpredictable trading environment.

Trading Suspension Intervention

To address the technical issues and restore orderliness to the market, the stock exchange decided to suspend trading temporarily. This halt allowed time for the technical glitches to be resolved, ensuring fair and transparent trading conditions.

Impact and Lessons Learned

The trading suspension during the technical issues helped protect investors from erroneous trades and potential losses resulting from system malfunctions. It underscored the importance of maintaining robust and reliable trading infrastructure and the need for prompt resolution of technical issues.

Analyzing these case studies provides valuable insights into the role and impact of trading halts during market volatility. By understanding how trading halts have influenced investor behavior and market outcomes in the past, investors can better prepare for and navigate similar situations in the future.

Conclusion

Navigating market volatility can be challenging, but understanding the role of trading halts can provide investors with a sense of confidence and stability. Trading halts serve as vital mechanisms to manage extreme market fluctuations, protect investor interests, and promote orderly trading conditions.

By recognizing the benefits of trading halts, such as creating cooling-off periods, preventing panic selling, and mitigating excessive market fluctuations, investors can approach market volatility with a level head and make more informed investment decisions.

Furthermore, understanding the different types of trading halts, such as circuit breakers, regulatory halts, and specific stock halts, allows investors to adapt their strategies and anticipate potential market disruptions.

To navigate market volatility with confidence, it is crucial to stay informed, conduct thorough research, embrace a long-term perspective, and be prepared for trading halts. Avoiding emotional decision-making and seeking professional guidance when needed can also contribute to a more successful investment journey.

Remember, market volatility presents both challenges and opportunities. By staying proactive, disciplined, and adaptable, investors can position themselves for long-term success, even in the face of market turbulence.

As you continue your investment journey, stay attuned to market conditions, learn from past experiences, and leverage the benefits of trading halts to navigate market volatility with confidence.