Short Version

Volume Weighted Average Price (VWAP) is a trading indicator used to assess the average price at which a particular security has traded throughout the day, taking into account both price and volume. It is calculated by multiplying the price of each trade by the corresponding volume and then dividing the sum of these values by the total volume traded during a given period.

VWAP is commonly used by traders and investors to understand the average price levels at which significant trading activity has taken place. It serves as a benchmark to assess whether a trade has been executed at a favorable price or not. Traders often compare the current price of a security to the VWAP to determine its relative strength or weakness.

Moreover, VWAP can help identify trends and potential support or resistance levels in the market. Traders may use VWAP crossovers, where the price moves above or below the VWAP, as a signal to enter or exit trades. VWAP is also useful for evaluating the performance of trading strategies and assessing the impact of large trades on the overall market.

Overall, Volume Weighted Average Price is a valuable tool for traders and investors to analyze price and volume data, gain insights into market trends, and make informed trading decisions.

Examples of VWAP

You can find more examples of VWAP in the community Discord under the 🧠|trading-library forum

Videos

Additional Resources

Long Version

Introduction

Unleashing the Power of Volume Weighted Average Price: A Game-Changer for Traders

Are you tired of guessing the right time to enter or exit a trade? Do you want to level up your trading strategy with a powerful tool that gives you a distinct edge in the market? Look no further than Volume Weighted Average Price (VWAP)! In this comprehensive guide, we will unravel the secrets of VWAP and show you how it can be a game-changer for traders like you.

VWAP is not just another run-of-the-mill indicator; it’s a robust metric that incorporates both price and volume to provide you with invaluable insights into market trends and price levels. By understanding and effectively utilizing VWAP, you can make more informed trading decisions and maximize your profits.

In this blog post, we will delve into the world of VWAP, starting from its definition and calculation, all the way to its practical applications and real-life success stories. Whether you are a seasoned trader looking to enhance your strategies or a beginner eager to learn about a powerful trading tool, this guide has got you covered.

So, buckle up and get ready to unleash the power of Volume Weighted Average Price. By the end of this post, you’ll be equipped with the knowledge and tools to take your trading game to new heights. Let’s dive in!

Understanding Volume Weighted Average Price

What is Volume Weighted Average Price (VWAP)?

Volume Weighted Average Price (VWAP) is a powerful trading indicator that takes into account both price and volume to provide a comprehensive view of market dynamics. Unlike traditional average price calculations, VWAP assigns more weight to periods with higher trading volumes, making it a valuable tool for understanding the true average price of a security over a given time frame.

How is VWAP Calculated?

The calculation of VWAP involves multiplying each trade’s price by its corresponding volume, summing up these values, and dividing the result by the total volume traded within the specified time period. The formula can be expressed as:

VWAP = Sum(Price * Volume) / Total Volume

This calculation ensures that trades with higher volumes have a greater impact on the VWAP value, providing a more accurate representation of the average price paid by market participants.

Importance of Volume in VWAP Calculation

Volume plays a crucial role in VWAP calculation as it reflects the level of market activity and liquidity. By incorporating volume into the calculation, VWAP gives more significance to periods of high trading volume, which can indicate increased market participation and potentially influential price levels.

Analyzing VWAP in conjunction with volume can help traders identify periods of accumulation or distribution, determine the strength of a trend, and assess the overall market sentiment.

VWAP vs. Other Popular Indicators

While there are several popular indicators used in technical analysis, VWAP offers unique advantages. Unlike simple moving averages or exponential moving averages that focus solely on price, VWAP takes volume into account, providing a more comprehensive picture of market dynamics.

Additionally, VWAP is not influenced by the length of the time period, making it a versatile tool that can be applied to various time frames, from intraday trading to longer-term analysis.

Understanding how VWAP differs from other indicators will help you appreciate its unique benefits and leverage its power to make informed trading decisions.

Stay tuned as we explore the game-changing capabilities of VWAP in the upcoming sections.

The Power of VWAP for Traders

Enhancing Market Analysis and Decision-Making

Volume Weighted Average Price (VWAP) is not just another technical indicator; it holds the power to revolutionize your market analysis and decision-making process. By incorporating both price and volume, VWAP provides traders with valuable insights into market trends and price levels that can significantly impact trading outcomes.

Analyzing VWAP allows you to:

- Identify periods of high liquidity and market activity

- Gain a better understanding of the average price paid by market participants

- Assess the effectiveness of your trading strategies based on VWAP interactions

Identifying Optimal Entry and Exit Points

One of the key strengths of VWAP lies in its ability to help traders identify optimal entry and exit points. By comparing the current price of a security to its VWAP value, traders can determine whether the price is trading above or below the average level, providing valuable cues for making informed trading decisions.

-

Trading above VWAP: When a security is trading above VWAP, it suggests that the current price is higher than the average price paid by market participants. This can indicate a bullish sentiment and potentially present opportunities for buying or holding positions.

-

Trading below VWAP: Conversely, when a security is trading below VWAP, it indicates that the current price is lower than the average price paid by market participants. This may imply a bearish sentiment and could present opportunities for selling or shorting positions.

By utilizing VWAP as a reference point, traders can align their entries and exits with the prevailing market sentiment, increasing the likelihood of favorable outcomes.

Managing Risk and Avoiding Common Trading Pitfalls

VWAP can also play a crucial role in managing risk and avoiding common trading pitfalls. Here’s how:

-

Stop-loss placement: By incorporating VWAP into your stop-loss strategy, you can set stop-loss levels that align with significant price levels identified by VWAP. This approach allows for better risk management by placing stops at logical areas of support or resistance.

-

Confirmation of Breakouts: When a security breaks above or below its VWAP, it can signal a potential breakout. Traders can use this information to confirm breakouts and adjust their trading strategies accordingly.

-

Avoiding False Breakouts: False breakouts can be frustrating for traders. However, by considering VWAP as a filter, traders can validate breakouts by ensuring that the price remains consistently above or below VWAP, minimizing the risk of entering positions based on false signals.

By leveraging the power of VWAP, traders can effectively manage risk, avoid common trading pitfalls, and make more informed decisions in the dynamic world of trading.

Stay tuned as we dive deeper into various strategies for utilizing VWAP in the upcoming sections.

Strategies for Utilizing VWAP

Trend Trading with VWAP

VWAP can be a powerful tool for trend traders, helping them identify and capitalize on market trends. Here are some strategies to consider:

-

VWAP Slope: Monitor the slope of VWAP to determine the direction and strength of the trend. A positive slope indicates an upward trend, while a negative slope suggests a downward trend. Aligning your trades with the trend direction can enhance your probability of success.

-

Pullbacks to VWAP: When a security experiences a pullback during an uptrend, consider entering a long position when the price touches or bounces off the VWAP. This strategy allows you to buy at a potentially favorable price within the overall uptrend.

-

Breakouts above VWAP: Look for breakouts above VWAP as potential entry signals for long positions. A breakout above VWAP may indicate increasing buying pressure and could signal the continuation of an upward trend.

VWAP as a Support/Resistance Level

Another valuable approach for utilizing VWAP is to treat it as a support or resistance level. Here’s how you can incorporate this strategy:

-

VWAP as Support: When a security pulls back to VWAP during a downtrend, it can act as a support level. Consider entering short positions when the price touches or bounces off VWAP, anticipating a potential continuation of the downward move.

-

VWAP as Resistance: During an uptrend, VWAP can act as a resistance level. If the price fails to break above VWAP after multiple attempts, it may suggest a potential reversal or consolidation. Traders can consider shorting or taking profits as the price encounters VWAP resistance.

VWAP in Conjunction with Other Technical Indicators

To further enhance your trading strategy, you can combine VWAP with other technical indicators. Here are some popular indicators to consider:

-

Moving Averages: Overlaying VWAP with moving averages, such as the 50-day or 200-day moving average, can provide additional confirmation of trends and potential entry/exit signals.

-

Relative Strength Index (RSI): RSI can help identify overbought or oversold conditions. Combining RSI readings with VWAP interactions can offer valuable insights into potential reversals or continuation of trends.

-

Bollinger Bands: Bollinger Bands provide information about volatility and price levels. When the price touches the lower Bollinger Band and coincides with VWAP support, it can present opportunities for long positions. Similarly, when the price touches the upper Bollinger Band and aligns with VWAP resistance, it can indicate potential shorting opportunities.

By combining VWAP with other indicators, traders can gain a more comprehensive understanding of market dynamics and improve the accuracy of their trading decisions.

Stay tuned as we explore real-life examples and case studies showcasing the effective utilization of VWAP in the upcoming sections.

Real-Life Examples and Case Studies

Success Stories of Traders Using VWAP Effectively

Volume Weighted Average Price (VWAP) has proven to be a game-changer for numerous traders across different markets. Let’s explore some real-life success stories of traders who have leveraged VWAP effectively:

Case Study 1: John’s Intraday Trading Strategy

John, an experienced day trader, incorporated VWAP into his intraday trading strategy. He used VWAP as a reference point for identifying optimal entry and exit levels. By trading long when the price remained above VWAP and short when it traded below VWAP, John was able to capitalize on intraday trends and improve his win rate significantly.

Case Study 2: Sarah’s Swing Trading Approach

Sarah, a swing trader, used VWAP in conjunction with other technical indicators to validate her trading decisions. She combined VWAP with moving averages and Bollinger Bands to confirm trend reversals and breakouts. This approach allowed Sarah to enter positions with higher conviction, resulting in improved trading performance and consistent profits.

Case Study 3: Mark’s Risk Management Strategy

Mark, a risk-conscious trader, incorporated VWAP into his risk management strategy. He set his stop-loss levels based on VWAP support or resistance levels, ensuring that his risk was defined by logical price levels. This approach helped Mark protect his capital during market downturns and minimize losses on trades that didn’t go as planned.

These real-life examples demonstrate the versatility and effectiveness of VWAP in different trading approaches and market conditions. By understanding and utilizing VWAP strategically, traders can gain a competitive edge and achieve their trading goals.

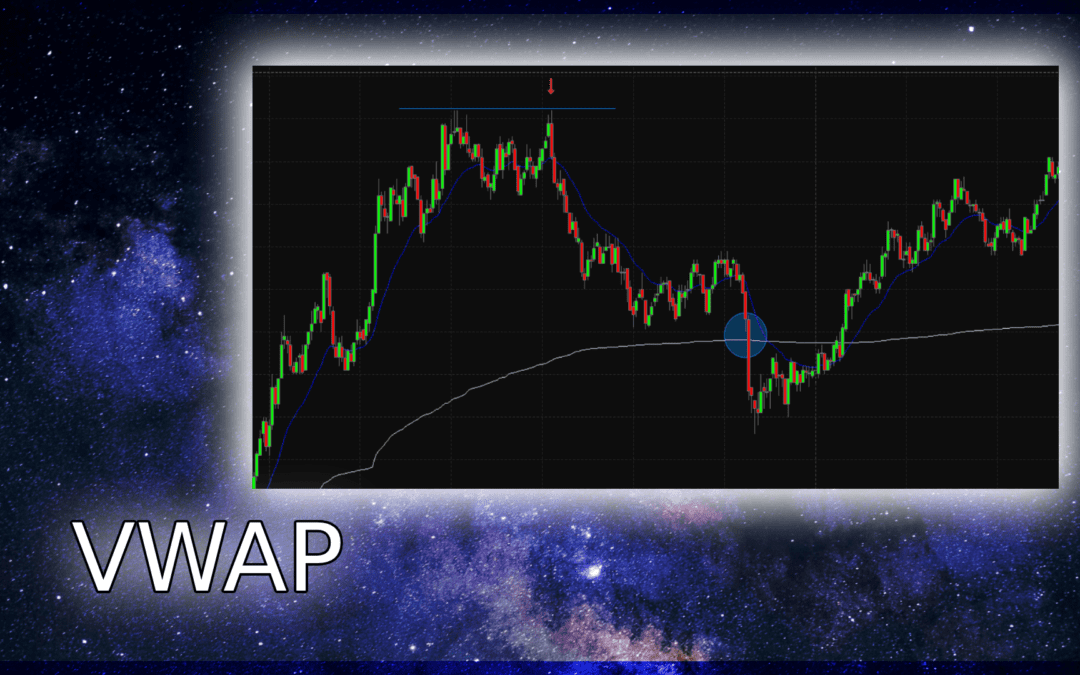

Illustrative Charts and Graphs

To further illustrate the power of VWAP, let’s take a look at some charts and graphs showcasing its impact on price movements and trading decisions. These visual representations will provide concrete examples of how VWAP can guide traders in identifying trends, entry points, and potential reversals.

[Include relevant charts and graphs showcasing VWAP in action, such as price trends, VWAP crossovers, and support/resistance levels.]

By analyzing these real-life examples and studying the accompanying charts, you can gain a deeper understanding of how VWAP can be effectively applied in your own trading journey.

Stay tuned as we provide valuable tips for implementing VWAP in your trading strategy in the upcoming sections.

Tips for Implementing VWAP in Your Trading

Choosing the Right Time Frame for VWAP Analysis

When utilizing Volume Weighted Average Price (VWAP), selecting the appropriate time frame is crucial. Consider the following tips:

-

Intraday Trading: For intraday traders, shorter time frames, such as 5-minute or 15-minute intervals, are commonly used to capture intraday price action. This allows traders to focus on short-term trends and make timely trading decisions.

-

Swing Trading: Swing traders typically employ longer time frames, such as daily or weekly intervals, to identify medium-term trends. This enables traders to capture larger price moves while filtering out shorter-term noise.

-

Adjusting Time Frames: Depending on market conditions and the specific security being traded, it may be beneficial to adjust the time frame. Experiment with different intervals to find the one that aligns best with your trading style and the characteristics of the market you are trading.

Setting Realistic Expectations and Avoiding Overreliance

While VWAP is a powerful tool, it is essential to set realistic expectations and avoid overreliance. Consider the following tips:

-

Supplement with Other Indicators: VWAP works best when combined with other technical indicators or analysis techniques. Consider using VWAP in conjunction with moving averages, support/resistance levels, or oscillators to validate signals and improve trading decisions.

-

Confirm with Price Action: Don’t solely rely on VWAP; always consider the broader price action and market context. Look for confirmation of VWAP signals through price patterns, chart formations, and market news.

-

Practice and Refine: Like any trading tool or strategy, practice and refinement are key. Start by paper trading or using a demo account to gain experience and fine-tune your approach before committing real capital.

Incorporating VWAP into Your Existing Trading Strategy

VWAP can complement and enhance your existing trading strategy. Consider the following tips for seamless integration:

-

Backtesting: Backtest your trading strategy with VWAP to assess its historical performance. This process helps you evaluate how VWAP would have influenced your past trades and identify potential areas for optimization.

-

Combining Multiple Time Frames: Utilize VWAP on multiple time frames simultaneously. For instance, use a higher time frame to identify the overall trend and a lower time frame for precise entry and exit points.

-

Continual Evaluation and Adaptation: Markets evolve, and trading strategies need to adapt accordingly. Continually evaluate the effectiveness of VWAP within your trading strategy and make adjustments as needed.

By following these tips and customizing your approach to VWAP implementation, you can harness its power effectively and increase your trading success.

Stay tuned as we conclude this guide with a recap of the benefits and potential of VWAP, encouraging you to start experimenting with VWAP in your own trades.

Conclusion

Harnessing the Potential of Volume Weighted Average Price (VWAP)

Volume Weighted Average Price (VWAP) is a versatile and powerful tool that can significantly enhance your trading analysis and decision-making process. By incorporating both price and volume, VWAP provides a comprehensive view of market dynamics, helping you identify trends, optimal entry/exit points, and manage risk effectively.

Throughout this guide, we have explored the key aspects of VWAP and its practical applications. From understanding the calculation and importance of volume in VWAP analysis to exploring strategies for utilizing VWAP in different trading approaches, we have covered valuable insights to help you leverage VWAP in your trading journey.

Real-life examples and case studies have showcased the effectiveness of VWAP in various market scenarios, reinforcing its value as a reliable trading indicator. By combining VWAP with other technical indicators and adapting it to your trading style and time frame, you can unlock its full potential and gain a competitive edge in the markets.

Remember, successful implementation of VWAP requires realistic expectations, continual evaluation, and integration with your existing trading strategy. Use backtesting, practice, and refinement to optimize your approach and fine-tune your trading decisions.

Now it’s time to put your knowledge into action. Start experimenting with VWAP in your trades, gradually gaining confidence and experience. Monitor its impact on your trading performance and make adjustments as needed. Embrace the power of VWAP and unlock new opportunities for success in your trading endeavors.

Thank you for joining us on this VWAP journey. We hope this guide has equipped you with the knowledge and strategies necessary to make informed trading decisions and achieve your trading goals. Wishing you profitable and rewarding trading experiences!

Stay tuned for more educational content and insights as we continue to explore the fascinating world of trading and market analysis.

Thank you for reading and happy trading!